Bonanza is said to be a fully automated EA that does not need any special skills from you. It was launched in the market on August 14, 2021. Since then, it has been updated severally, and currently, we have the 1.50 version. The goal of our review is to ascertain the workability of the strategy used and whether buying the robot is a good investment decision.

Is investing in Bonanza EA a good decision?

No, it is not. The EA is overpriced, and with no credible data, we highly suspect that it will not give you value for money. Furthermore, since the developer’s expertise is not known, it is unlikely that her product will help you to trade successfully.

Company profile

The developer of this robot is known as Elizaveta Erokhina. She is situated in Russia, and as you can see in the profile below, not much info has been disclosed about her. Her skills and trading experience in the Forex market are not highlighted. Without this data, it is hard to have confidence in her, and consequently, her invention.

Main features

The EA has several features, which are highlighted below:

- Supports the XAUUSD currency pair.

- Works on the 1-hour timeframe.

- Easy to set up.

- Not sensitive to broker conditions.

- Does not apply the grid, martingale, or other dangerous approaches.

- Applies hard stop loss and take profit for every position.

- The minimum recommended deposit is $300.

- Prefers to work with the ECN broker.

- Runs on the MT4 platform.

Bonanza EA’s strategy is based on filtering techniques. Even though the developer doesn’t say anything more about these techniques, what we know is that the strategy entails determining when to buy and sell orders based on percentage changes from previous prices. Filtering is mainly grounded on price momentum or the belief that increasing prices tend to rise progressively while decreasing prices continue to plummet. Notably, the vendor also mentions that the EA uses its own price action algorithms coupled with an indicator she created.

Price

Bonanza EA is currently retailing at $499. It can also be rented at $300 for a month. These costs are expensive. Furthermore, a money-back guarantee is not offered. For these reasons, we believe that the robot is not worth the money.

Trading results

Although the presentation features several backtest reports, none of them gives us useful information. The report we have chosen to focus on only indicates testing period (2005-2021). Factors such as the profitability rate, drawdown rate, profit factor, trading frequency, modeling quality, and win-rates for long and short trades are missing. This is fishy. It shows that the vendor is hiding something; probably, the inefficiency of the strategy in use.

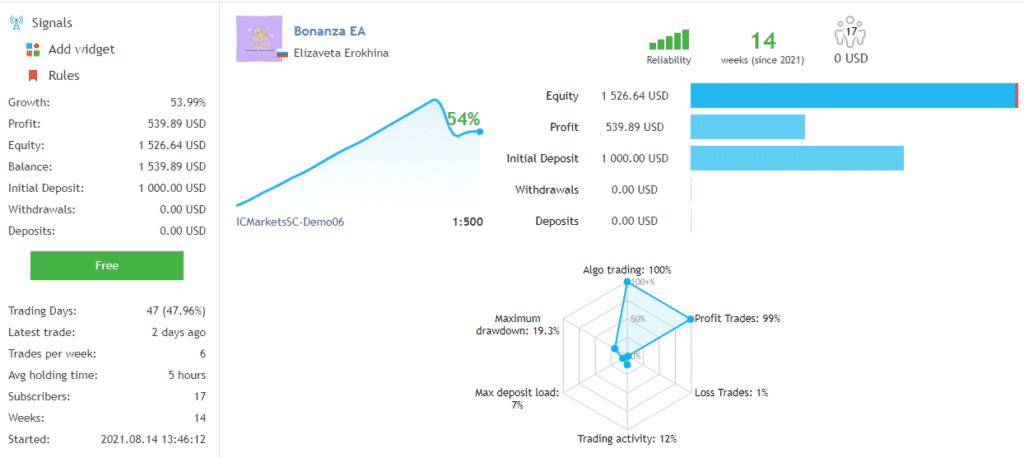

The vendor provides a link to the EA’s live trading results. There is a problem, though. The statistics have not been verified.

As you can see, we have been supplied with a demo account that is utilizing the IC Markets broker.

As per the data, the account was initially deposited at $1,000, and within 47 trading days, the EA has made a profit of $539.89. As a consequence, the value of the account has increased by 53.99%. The balance currently stands at $1539.89. We have a maximum drawdown of 19.3%.

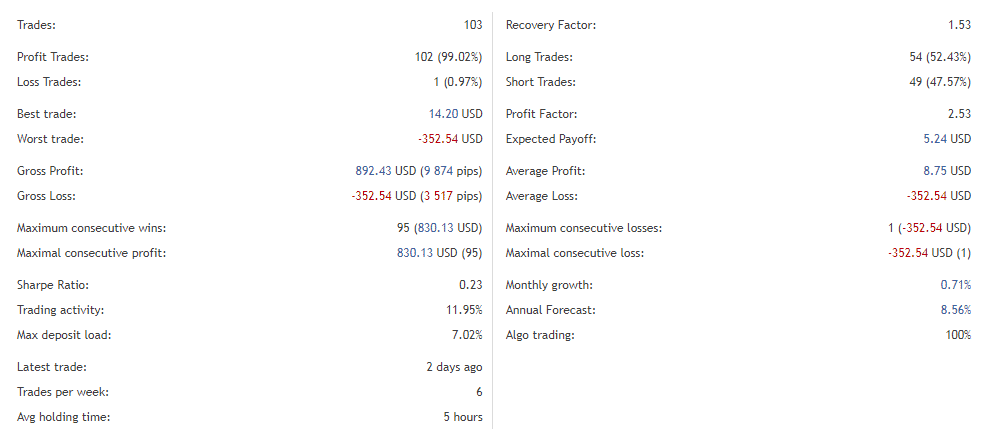

So far, the number of trades conducted since the account was opened on August 14, 2021, is 103. We are told that the long (52.43%) and short trades (47.57%) performed dismally. The profit factor is 2.53, and it indicates that the robot is capable of doubling the investment. However, we are concerned about the system’s high losing streak. This is evidenced by an average loss of -$352.54 that is very high compared to the average profit of $8.75.

Customer reviews

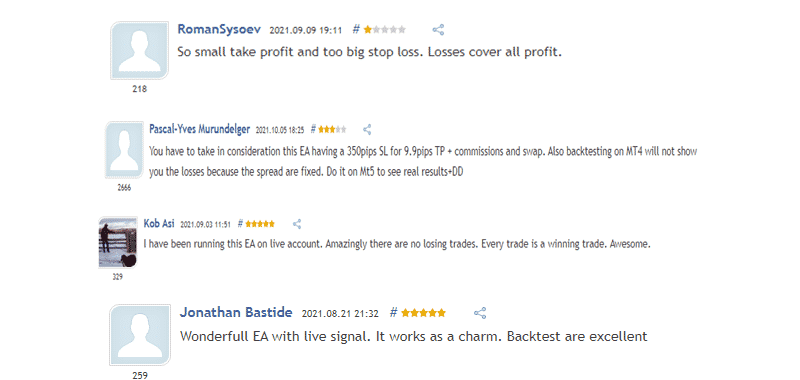

There are several mixed customer reviews on mql5. While some customers say that their experiences with the EA are good so far, others assert that the values used for the take profit and stop loss aren’t effective. Below is a sample size of the reviews:

Summing up

Purchasing Bonanza EA is not a good decision. Although the authenticity of the trading results has not been confirmed, the data intimates that the strategy in place is not effective. This is because it generates more losses than wins. In addition, the lack of a detailed backtest report hints at a vendor who doesn’t want the public to be aware of the probable poor long-term performance of the EA.