Why you need budgeting?

Individuals new to budgeting may find it overwhelming to figure out how to manage their own money on a monthly basis. Budgeting refers to the creation of a spending plan, allowing the individual to determine whether the person will have enough money to achieve the financial goals. Budgeting relies not only on organizing but also on making decisions that are difficult and related to spending. Here, simply relying on the experience of other individuals does not suffice as the expenditure and income habits of each individual are unique. Luckily, there’s a way one can make a spending plan without being a financial expert or having expert financial knowledge by learning about the 50-30-20 Rule.

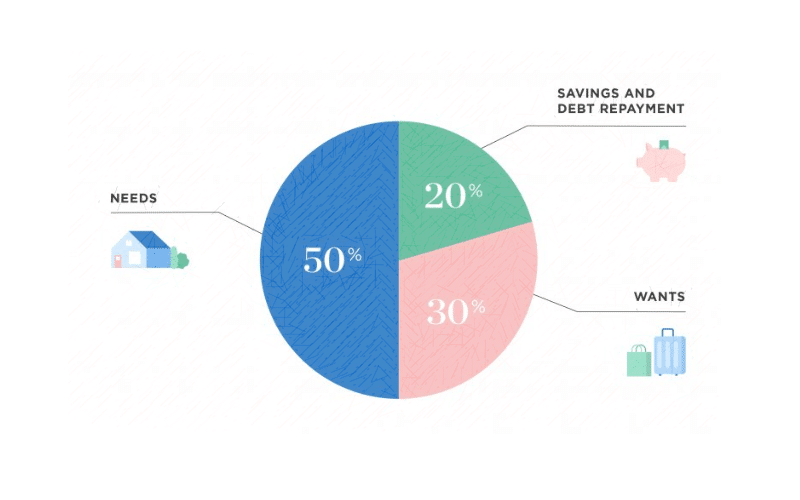

What is the 50/30/20 budgeting rule?

The “50-30-20” budget rule originated as a term popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan”. It’s a simple budgeting rule which divides an individual’s take-home income into three basic categories.

- 50% for need

- 30% for wants

- 20% for savings

To start budgeting according to the 50-30-20 rule, an individual needs to figure out what’s happening with his/her finances. This involves looking at their pay stubs to ascertain how much money one brings home every month, which is what they’ll base their 50-30-20 budget on. The spending of the individual should then be adjusted according to the 50-30-20 parameters to make this system work. So here is how it works:

Calculate Your Income

The first thing one needs to do is to calculate one’s monthly after-tax income. This is the income the gets after deducting taxes along with the cost of any payroll deductions for automatic savings programs such as 401(k)s or health insurance. Taxes can include income tax, local tax, state tax, Social Security, and Medicare tax. Individuals receiving a steady paycheck can easily figure out their after-tax income, just by examining their pay stubs. They should add back any deductions taken out earlier, such as retirement contributions or healthcare.

The after-tax income for self-employed individuals is calculated differently. For them, it is equal to their gross income, deducted by any business expenditure such as the cost of computers or laptops used, expenditure for airfare and travels as well as any amount allocated for taxes. Because they don’t have an employer, they remit their own quarterly tax payments to the government.

For self-employed individuals, the self-employment tax that they pay should also be included in these calculations. It is double the amount of what one pays for Social Security and Medicare taxes when employed.

Limit Your Needs to 50%

The individual needs to figure out the total expenditure incurred for monthly “needs”. “Needs” refer to those bills that an individual must pay for things that are necessary for survival. This can include car payments, payments for mortgages and rent, groceries, healthcare, utilities, and minimum debt payment. This category should not include extras, such as bills for dining out, Watching Netflix and HBO, going to Starbucks, etc.

An individual should allocate half of their after-tax income to cover needs and obligations. Anyone spending more than should take steps to decrease their wants such as by downsizing their lifestyle. It is essential for the individual to distinguish “needs” from “wants”. Any payment which one can forgo facing only minor inconveniences, such as back-to-school clothing, or cable bills, are a “want”. However, any payment, without which the quality of life of the individual can get impacted, such as prescription medicines, and electricity, is a “Need”.

Some payments such as minimum payments on a credit card that cannot be easily forgone and which can have a direct negative impact on the individual’s credit score may be considered a “need”. However, if the minimum payment of the credit card is $20 and the individual makes a monthly payment of $100 to keep a manageable balance, the excess 80$ isn’t considered a need.

Wants Are Less Than 30%

Wants include things individuals spend money on, which is not absolutely essential. This includes expenditures such as those on electronic gadgets, sporting events, vacations, expensive hi-speed internet, and more. All these expenses are optional when one examines them. This category can also include any upgrade decisions the individual makes, such as choosing an expensive Mercedes over a more economical option or ordering a costlier steak instead of an inexpensive hamburger.

The plan is to allocate 30% of one’s income towards these wants. This should not include extravagances but rather the niceties that make life more enjoyable. Individuals can limit wants in many ways, such as choosing the cheaper hamburger over the steak or choosing an antenna to watch television for free rather than paying cable bills.

Savings or Debt – 20%

Under this budgeting model, savings refer to any amount an individual stock away in preparation for the future. Savings should include a chunk of the individual’s income devoted to repaying any existing debt to create a future financial environment to avoid taking any further debt. To start saving, individuals should:

- Start an emergency fund and keep contributing to it.

- Getting a 401(k) or an individual retirement account to save for retirement

- Paying off debt starting from the most high-interest and toxic type of debt.

Individuals should spend a minimum of 20% of their after-tax income towards saving and repaying debts. For instance, in the credit card example above, the extra $80 paid by the individual should fall under this “20%” category.

Summary

The 50-30-20 rule is a great way for an individual to keep his/her personal finances in a simple and organized manner, allowing them to pay their bills, add to their savings and have the financial freedom to spend on what they want. It is especially helpful for budgeting novices as it provides clear financial objectives, offering a concrete path towards savings, investments, and meeting other financial goals.

The 50-30-20 Rule also offers flexibility, allowing individuals to bend it a bit by altering percentages that work better for them. The main objective of using the 50-30-20 rule is to help individuals consistently manage their money on a monthly basis, covering expenses, saving for the future, while not compromising on life’s enjoyment in the present. Once an individual is aware of his/her wealth outflows and inflows, they can start exerting more control over how they want to spend their money.