Overview

- In March last year, the pandemic fueled a sell-off in global stock markets, but more breathtaking was the sector’s recovery in the year. Major indexes have hit several record highs since then, though the momentum seems to be waning. This week, for example, the S&P 500 and the Nasdaq Composite closed in the red on the back of substantial losses posted by technology stocks.

- This year is not particularly great for tech stocks if you consider the record performance registered last year. There is a huge possibility that the volatility underway in the US government bond market weighs heavily on investor decisions. Investors might be tactically pulling back from tech stocks to cover their portfolio against excessive risks.

- Also, the sudden lack of interest in tech stocks could result from money managers doubling down because they think the valuation of tech stocks is too high. SQQQ could be the perfect answer for investors looking to hedge their tech portfolio as headwinds mount.

Is this the time to hedge tech stocks?

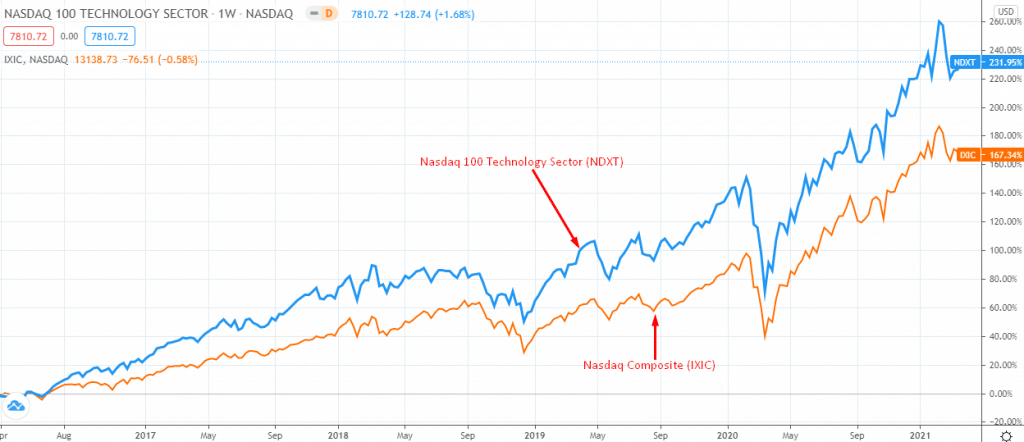

Over the past decade, tech stocks have become the behemoths that move the market. The Nasdaq 100 Technology Sector Index (NDXT), for example, has consistently performed better than the Nasdaq Composite Index (IXIC) over the last five years (as shown in the figure below – blue line for NDXT and brown line for IXIC).

Figure 1: NDXT vs. IXIC performance over the past five years

But it seems that the technology sector, especially the one represented by US-based tech giants, has run too far. The positive bias that led investors into the sector appears to have washed away. And in its place is a constant fear that tech stocks might slide due to a growing number of trigger cases. One notable trigger case is Facebook’s privacy-related scandals over the past several years that have undermined its stock’s value.

The last year has not been great for tech stocks. Yahoo Finance maintains an unofficial index that tracks 18 symbols that include tech companies traded in the US. Dubbed “The Only Tech Stocks That Matter” or “Tech Stocks That Move the Market,“ this unofficial index tracks the performance of the block of stocks regarding the performance of the companies on September 29, 2016.

Interestingly, the one-year return for the Tech Stocks That Move the Market market-capitalization-weighted index has been -3.07%. Meanwhile, the one-year return for the S&P 500 Index is 51.32%.

Investors who have clinched some substantial gains from the bull run that seems to be on the wane have to think of hedging as necessary. Various opportunities exist for hedging, but buying inverse ETFs such as ProShares UltraPro Short QQQ (SQQQ) is up there among smarter moves.

About ProShares UltraPro Short QQQ

SQQQ belongs to the ProShares fund family and is administered by ProShare. The fund tracks the Nasdaq 100 index but moves in the opposite direction. For instance, the fund trades downward when the Nasdaq 100 hits a bull market, and the opposite is true.

However, SQQQ does not move in the opposite direction of the index. For instance, a direct inverse ETF would move 1% opposite when an index climbs by the same amount. On the contrary, SQQQ is a 3x inverse fund, which means it goes opposite by 3% when the index climbs by 1%.

ProShares launched SQQQ in 2010, and the fund takes 95 basis points of users’ investment as annual fees. SQQQ had $1.6 billion assets under management at the time of writing. The fund has returned 6.09% over the past month instead of a 7.11% loss year-to-date.

SQQQ fundamentals are strong despite a battered share price

Last year’s strong performance across the entire US stock market applied immense pressure on SQQQ’s stock price. Over the past year, the ETF declined from a high of $109.75 and bottomed out at $11.96 early this year. Despite the tumble, SQQQ’s weekly volatility has remained stable over the period – at 10%.

SQQQ has suffered immensely from the recent craze by investors who snapped up big-name tech stocks. With plenty of money from government relief checks available to retail traders, it has been almost impossible to argue ‘valuation’ and ‘fundamentals’ in the market. Investors have been bidding up Amazon, Apple, and others, but we believe the conditions are not optimistic. The likelihood of the bull market collapsing under the weight of reality check is stronger than ever.

How is that? A huge amount of money has been coming in from the bond market after the treasuries’ rout in late February this year. However, this route seems declining, which means big money might begin retreating from overvalued tech stocks. A little trickle might become a mad dash, and fundamentals might start to matter. When this happens, SQQQ’s time to shine would have arrived.

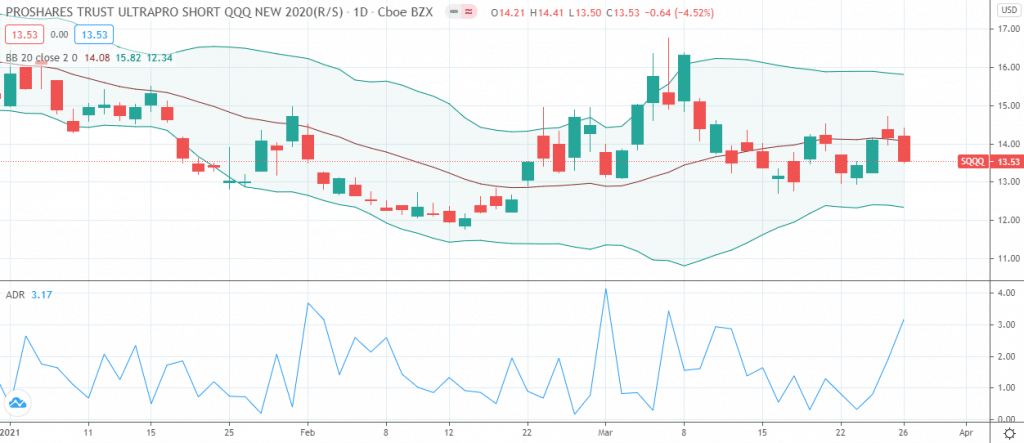

High volatility in SQQQ’s price action – an indication that investors are repositioning for an uptrend?

There has been substantial volatility in SQQQ’s price action, as shown by the Bollinger Bands in figure 2 below. Although the market appears to be ranging, the Advance/Decline Ratio shows buyers are taking the upside.

Figure 2: SQQQ price chart

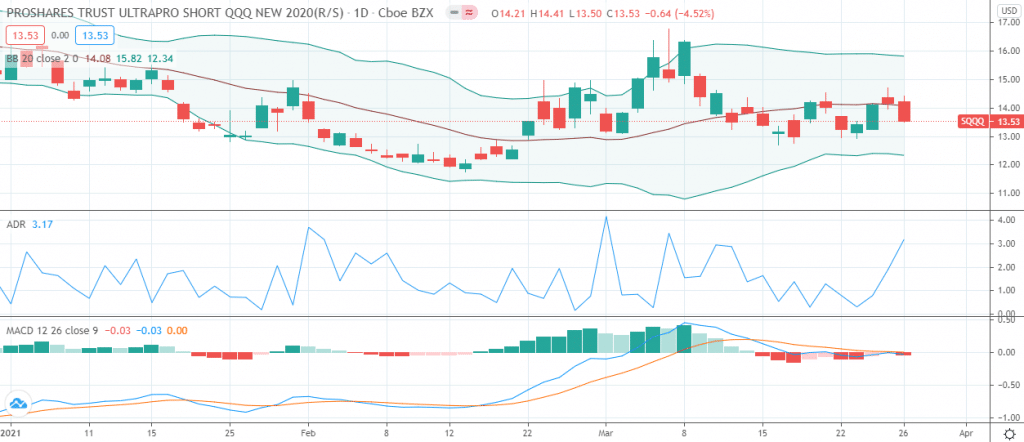

We get a clearer picture of what is happening with the addition of the MACD (as shown in figure 3). It seems the selling pressure is letting up, and the market is at an inflection point.

Figure 3: SQQQ price chart

Conclusion

Inverse ETFs often suffer in a bull market, and 2020 was one of those years that the suffering was beyond measure. However, the market – especially the tech stocks – seems to have run far enough. SQQQ’s technicals show that the investors could be repositioning for a direction change, and the fundamentals offer their kind support. In this light, we recommend that SQQQ is a BUY.