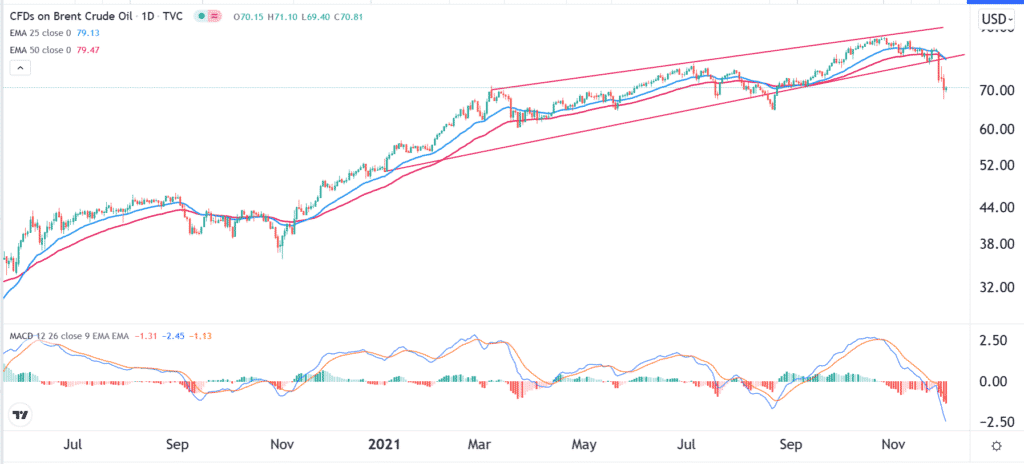

The crude oil price erased most of the gains it made in November as concerns about the Omicron variant and strategic releases rose. Brent, the international benchmark, is trading at around $70 per barrel. This was about 18% below the highest level in November. West Texas Intermediate (WTI), on the other hand, is trading at $67, which is about 21% below the year-to-date high.

Strategic Petroleum Reserves

There are two main reasons why the crude oil price has nosedived in the past few weeks. First, last week, the United States government announced a coordinated plan to release about 50 million barrels of oil from its strategic petroleum reserves (SPR). This release is being coordinated with other countries like the United Kingdom, Japan, China, and South Korea.

These countries reached this decision after the OPEC+ cartel remained adamant about more supplies. In its recent meetings, the cartel has stated that it will increase its oil production by about 400k barrels per month. Analysts believe that these increases are not enough, considering that the demand was rising at a faster pace.

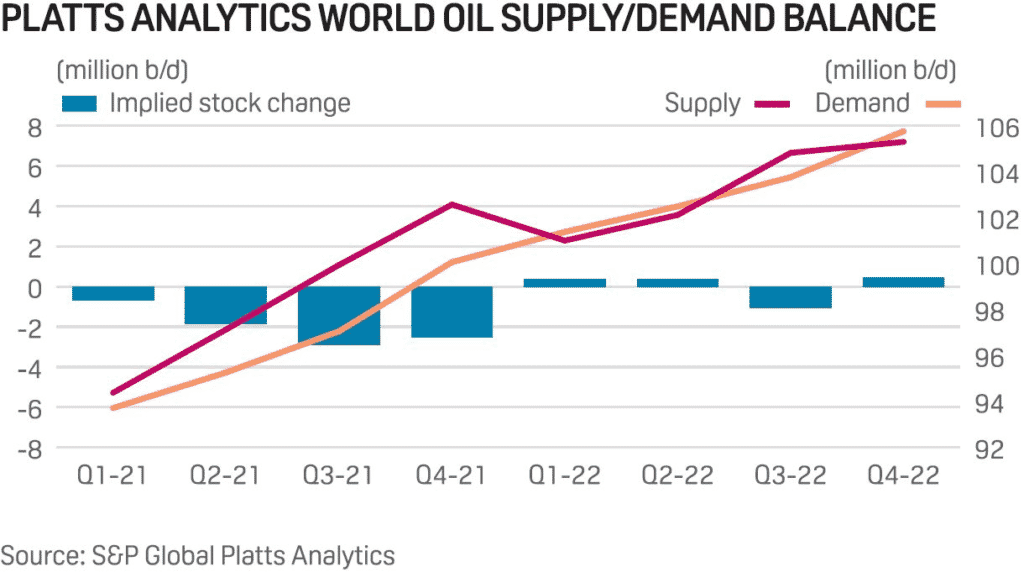

Indeed, recent reports by the Energy Information Administration (EIA) and the International Energy Agency (IEA) showed that global demand is surging. The two agencies and OPEC expect that demand will rise to more than 105 million barrels per day in 2022. A study by S&P estimates that demand will rise to more than 100 million barrels.

Therefore, the release of these reserves helped to stabilize prices in November. Joe Biden took the controversial decision after his poll numbers crashed as more Americans complained about inflation.

Omicron variant

Crude oil prices also tumbled sharply after the latest scare from South Africa. The country confirmed a new variant of the virus known as Omicron. Earlier data shows that the new strain of the virus is relatively more transmissible than Delta. The numbers also show that the variant is able to evade the current vaccines.

Indeed, in a statement on Tuesday, the CEO of Moderna said that it would take more months to develop a vaccine for this variant. As such, analysts expect that the new variant could lead to weaker demand for crude oil. Several countries like Japan and Morocco have already banned foreign travelers. Others like Austria have already announced new lockdowns.

OPEC+ meeting ahead

The crude oil price will next react to the latest OPEC+ meeting that will happen on Wednesday and Thursday. It is still unclear how the cartel will react formally to the SPR release and the Omicron variant.

Because of the animosity between Prince Mohammed and Joe Biden, there is a likelihood that the cartel will announce new supply cuts in a bid to push prices higher. Russia, a key ally of OPEC, also has the motivation to punish Joe Biden.

Therefore, signs that OPEC+ will be keen to limit their supplies will provide a near-term cushion for crude oil prices. Other key movers for the price will be the latest US inventories numbers.

Crude oil price forecast

The daily chart shows that the crude oil price has struggled in the past few weeks. Last Friday, the price managed to move below the lower side of the ascending channel that is shown in red. It has also dropped to the lowest level since September 7th.

At the same time, it has fallen below the 25-day and 50-day Moving Averages, while the MACD has crashed below the neutral level. Therefore, the price will likely retreat to about $65 soon.