The crude oil price has bounced back in the past few weeks as worries of the Omicron variant have subsided. Brent, the global benchmark, is trading at $78.65 while West Texas Intermediate (WTI) has risen to about $75. These prices are about 20% above the lowest level in December.

Omicron variant fears wane

The crude oil price tumbled sharply in November after South Africa announced about the Omicron variant. This announcement helped to push oil prices to the lowest level in a few months.

Recently, the number of Omicron cases has jumped around the world, pushing some governments to announce some restrictions.

For example, the Dutch government has launched a nationwide lockdown to curb the spread. Countries like Germany have announced restrictions for incoming visitors while the US is distributing millions of instant tests.

The US is reporting more than 200k daily Covid cases, while the UK is reporting about 80k per day. Worse, China, the biggest oil consumer in the world, is going through a Covid wave. This week, the country announced some restrictions in Xi’an as the government does contact tracing.

At the same time, the aviation industry, which is a major consumer of crude oil, is in trouble. During the Christmas weekend, more than 1,500 flights were canceled as many employees called in sick.

Still, the crude oil price has jumped because of the recent news about Omicron. Studies show that vaccines from companies like Pfizer and Moderna are offering some protection from the illness.

Other studies show that the symptoms of the Omicron variant are a bit mild. And in most cases, people with the disease don’t need any hospitalization.

On Monday, the Centers for Disease Control (CDC) also decided to cut the isolation period for infected people from 10 to 5 days. Therefore, analysts believe that the demand of oil will start rebounding in the coming weeks.

OPEC meeting eyed

The crude oil price has also risen because of the ongoing Santa Claus rally. In the past few days, the prices of key assets like stocks and commodities like natural gas and copper have all risen. The same is true among cryptocurrencies like Bitcoin and Ether.

Meanwhile, investors are now focusing on the upcoming meeting of the OPEC+ cartel that will happen on January 4th. In this meeting, the members will deliberate on the supply quota for February and set the Official Selling Prices (OSP).

This will be an important meeting because of the recent trends in oil prices. While they have bounced back, they remain about $11 below their highs this year. Still, analysts expect that the members will agree to continue adding production by about 400k barrels. The members have defied the American pleads to increase the amount of production.

Another key catalyst for oil prices is the ongoing weather conditions in the US. Analysts expect that the freezing cold environment in the country’s north will lead to more demand for natural gas. This too, could lead to higher oil prices because of the correlation that happens between the two.

Crude oil price forecast

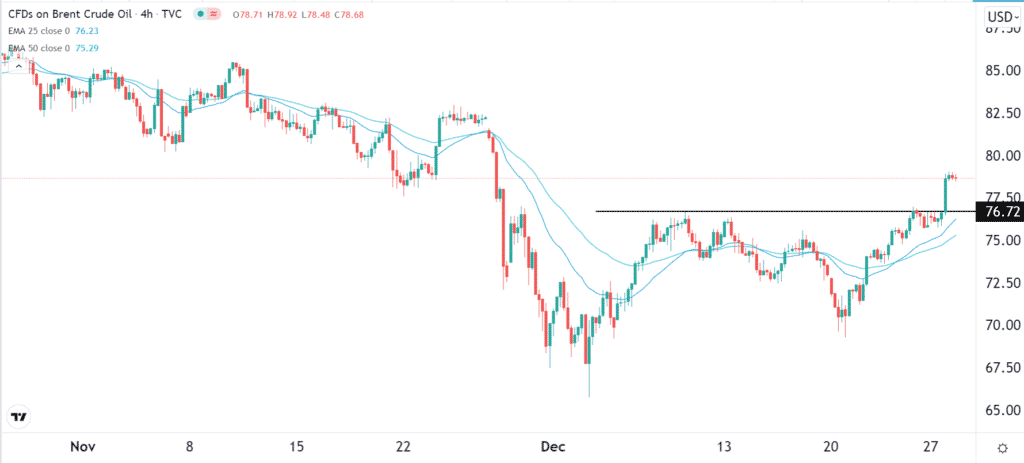

The four-hour chart shows that the crude oil price has been in a bullish trend in the past few weeks. Brent has moved from a low of $65 to about $78.68. It has also crossed the key resistance level at $76.62, which was the highest level on December 9. It has also moved above the 25-day and 50-day moving averages. It has also risen above the inverted head and shoulders (H&S) pattern. Therefore, there is a likelihood that the prices will keep rising as bulls target the key resistance at $80.