The US Dollar index (DXY) retreated slightly on Wednesday evening even after the relatively hawkish Federal Reserve interest rate decision. The index fell to $93.35, which was slightly below this week’s high of $93.52.

Fed decision

The Federal Reserve concluded its monthly meeting on Wednesday evening. As was widely expected, the central bank decided to leave interest rates unchanged between 0% and 0.25%. They have been in this range since the pandemic started in 2020.

The bank also decided to continue with its quantitative easing program for a while. In this QE program, the bank is buying assets worth $120 billion per month. $80 billion of these funds are going to treasuries while the rest are going to mortgage-backed securities (MBS).

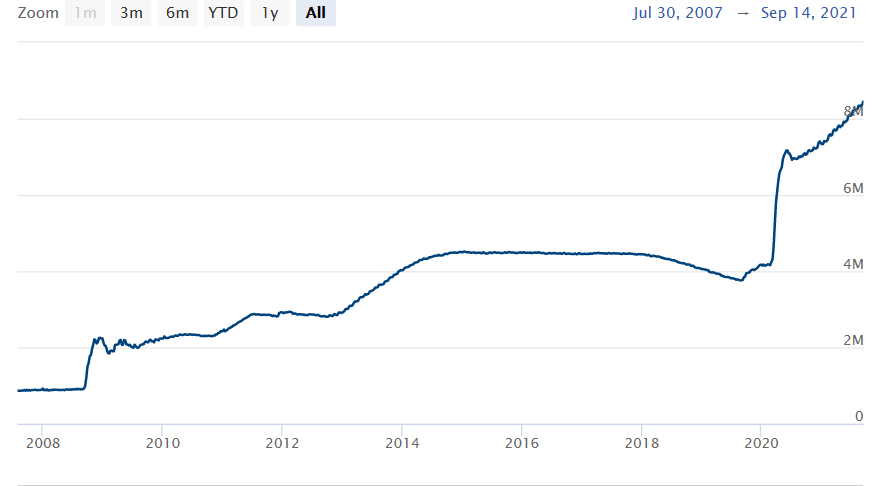

As a result, the asset purchases have pushed the Fed’s balance sheet to more than $8.4 trillion, as shown below. This is notable since the bank’s balance sheet was less than $1 trillion before the 2008 global financial crisis (GFC).

Fed balance sheet trend

While the Federal Reserve didn’t change its policy, the meeting was more hawkish than before. For one, the dot plot showed that more officials believe that the first interest rate hike will happen in 2022. In the previous meeting, most officials were expecting the rate hike to come in 2023.

The bank also hinted that it will start to deliberate on winding down the quantitative easing purchases in the coming meetings. Therefore, there is still a possibility that the bank will start slowing down its asset purchases in the fourth quarter of the year.

In theory, the US dollar index should climb after a hawkish Federal Reserve. However, the opposite happened mostly because the hawkish Fed tone was already priced in by market participants. Recent notes by Wall Street analysts like those from Morgan Stanley and JP Morgan were all pointing to a hawkish Fed.

Therefore, the DXY declined because of the so-called ‘buy the rumor, sell the news’ situation. Indeed, the index was rising throughout the week.

Strong US data

The Fed decision came at a time when the US economy is doing relatively well. Recent economic numbers show that the economy has been in a strong recovery. For example, the economy added more than 1.1 million jobs in July, followed by a dig dip in August. The number of job vacancies has risen to more than 10 million.

At the same time, inflation has remained stubbornly above the Fed’s target of 2.0%. The latest figures showed that the headline inflation declined in August because of airfares. Now, as traveling picks up again, there is a likelihood that prices will keep rising. In its statement on Wednesday, the bank said that inflation was higher than expected, but it sees the headline figure falling in the coming year.

The housing market is also relatively strong. Data published this week showed that the country’s building permits and housing starts remained steady in August.

US dollar index forecast

The DXY index retreated slightly after the FOMC decision. The index declined from a high of $93.52 to a low of $93.42. On the four-hour chart, it is slightly below the key resistance level at $93.72, which was the highest level on August 20. It remains slightly above the short and long-term moving averages while the MACD remains above the neutral line. Therefore, the index will likely keep rising as bulls target the psychological level of $94.