eToro is multi-regulated forex and CFDs broker famous among investors due to its sophisticated social trading platform. Moreover, it has a built-in web trading platform with many trading tools and $500,000 availability of assets.

It is an Israeli fintech company with multiple regulations to provide services in several countries. It is regulated under two tier-1 jurisdictions and one tier-2 jurisdiction making it a safe broker for FX and CFDs trading.

Can eToro be trusted?

Regulation

Regarding regulatory oversight, eToro is under the control of regulators in 3 different countries: USA, UK, Cyprus.

- eToro USA LLC is registered with FinCEN as a Money Services Business (“MSB”), and has regulatory licences from several states.

- eToro operates in the UK under eToro (UK) Ltd and is registered with the UK Financial Conduct Authority (FCA) under registration number FCA 583263. Since both regulators (CySEC and FCA) follow the Markets in Financial Instruments Directive (MiFID), eToro is MiFID compliant and eligible to conduct business in the Eurozone.

- The broker is licensed as a Cyprus Investment Firm (CIF) under 109/10. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC). eToro meets all of the very stringent regulatory requirements, including, for example, capitalization requirements and keeping customer funds in segregated accounts.

Foundation

eToro is a social trading broker established in 2007.

History

Broker eToro, founded initially under RetailFX in 2006, is a social platform for online transactions in stocks, currencies, indices, and commodities. The company was founded by two brothers Ronen and Yoni Assia, together with a partner named David Ring. The two brothers and their partner founded eToro intending to provide users with a financial online trading platform that is both friendly and fulfilling.

Location & Offices

eToro provides social trading services in the UK under its Financial Conduct Authority (FCA) regulation. Besides, it has a physical office in the US, the UK, EU, and Australia. eToro is not a listed company on any stock exchanges, and it does not disclose its financial information on the website.

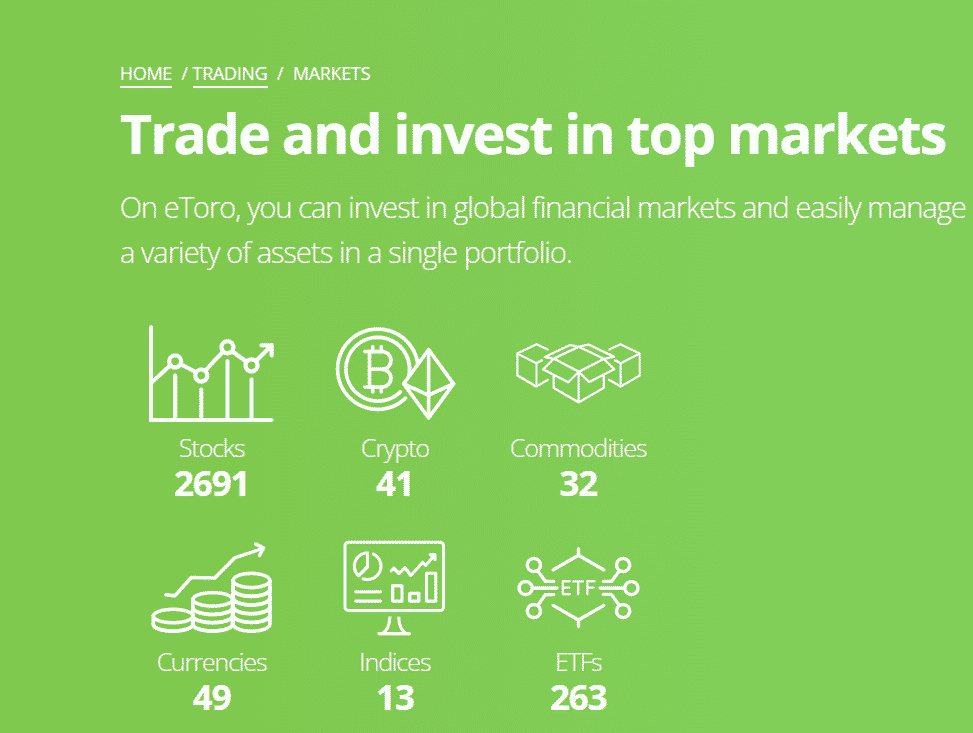

Markets overview

Let’s check the list of available markets on the eToro platform. In eToro, you can diversify your trading portfolio from forex, stocks, indices, commodities, and cryptocurrencies.

Available markets

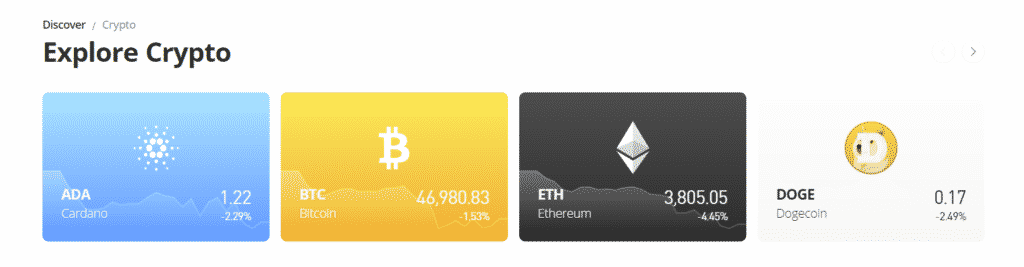

Cryptocurrencies

- 24/7 trading in cryptocurrencies

- Low trading cost in crypto trading: 0.75% for BTC

Forex

- The broker offers currency pairs trading with more than 50 pairs, including forex majors, minors, and exotics

- The broker provides the ability to trade personal accounts or take copy trading services from other traders through the eToro platform

Stocks

- Available stocks in nine categories

- Lots of stocks to trade from 17 different exchanges

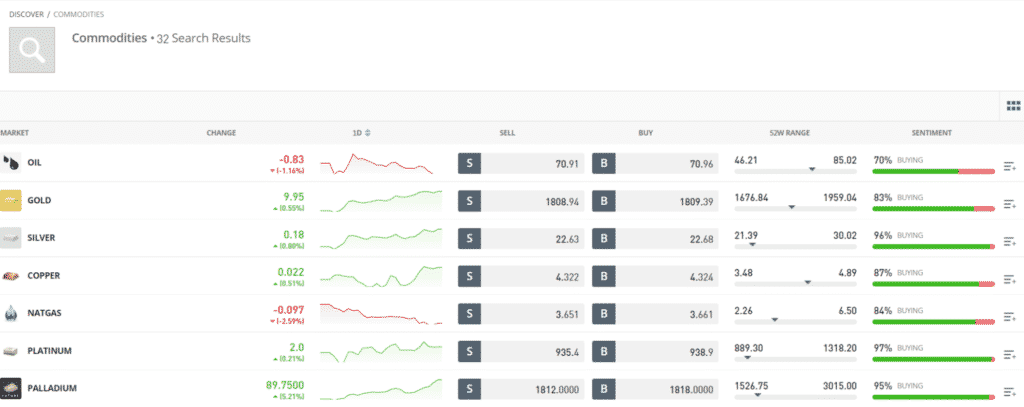

Commodities

- 31 available instruments in the commodity section, including gold, oil, copper, coffee, etc.

- Ability to perform or use social trading for commodity pairs

ETFs

The fund allows you to invest in a group of assets in a single trade. It could be dozens of stocks pegged to the FTSE 100 or a basket of tech stocks. eToro hosts over 260 ETFs from a wide variety of sectors.

It’s understandable why investors flock to ETFs when it comes to building and diversifying their portfolios. With the commission-free pass offered by eToro, this is a great way to invest in a wide variety of different assets in just one investment.

Comparison with other brokers

| eToro | Plus500 | FXTM | AvaTrade | RoboForex | Forex4you | InstaForex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Metals | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes | No | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | No | Yes | Yes | No | No |

| Options | Yes | Yes | No | Yes | No | No | Yes |

Platforms overview

There are currently three trading platforms on eToro:

- eToro Webtrader

- eToro Openbook

- eToro Mobile Trading

eToro Webtrader

Almost any FX broker has such a platform, but on eToro, it is distinguished by the presence of a chat. This tool allows traders to correspond in real-time. If a trader does not want to communicate with anyone, he can set the “invisible” status.

The interface of the Webtrader platform is straightforward. It includes only the most necessary information for making deals. Since this is a web-based platform, you can access it from anywhere in the world where there is an Internet connection.

eToro Openbook

eToro Openbook is a kind of Facebook Forex trading. You can see what other traders are doing in real-time on this platform. This way, you can find the most suitable strategy or try out new methods.

The similarity of the eToro Openbook platform with the social network allows, in particular, to learn how to trade much faster. Finally, traders trading with the eToro Openbook do not need to perform complex analysis and search for strategies on their own – financial market experts will do everything required for successful trading.

eToro Mobile

In the modern world, mobile technologies occupy their niche in all areas of activity, including Forex trading. Using smartphones and tablets, traders tend to follow the market anywhere, wherever they are.

With this in mind, the developers of the eToro platform have created unique mobile applications to access Webtrader and Openbook via mobile devices. With the help of such applications, you can always find a profitable opportunity in the market, even if you are very far from your computer.

Is eToro good for mobile trading?

In addition to eToro’s web-based trading platform, traders can also take advantage of their smartphones by downloading the eToro trading platform as an Android and iPhone app.

Mobile apps allow traders to see live feeds of other traders on the eToro social trading platform, just like the web-based version of the OpenBook platform.

In the mobile application, traders can check the prices of various financial instruments before starting transactions. They can also track the status of their trading account and interact with other traders on the traders’ social network.

eToro fees

Broker eToro guarantees that its traders will not suffer from slippage during transactions. eToro does not charge annual fees or commissions for joining the traders’ social network. Instead, it adds a spread to market quotes. Investing in stocks is also free of commission.

Non-trading commissions

- Deposit fee: free

- Withdrawal fee: $5

- Currency conversion fee: 50 pips

- Inactivity fee: $10 per month after 12 months of inactivity

- No clearing fees

Our findings show that spreads are higher in eToro than other brokers. However, it does not have any commission or overnight fees in regular trading accounts.

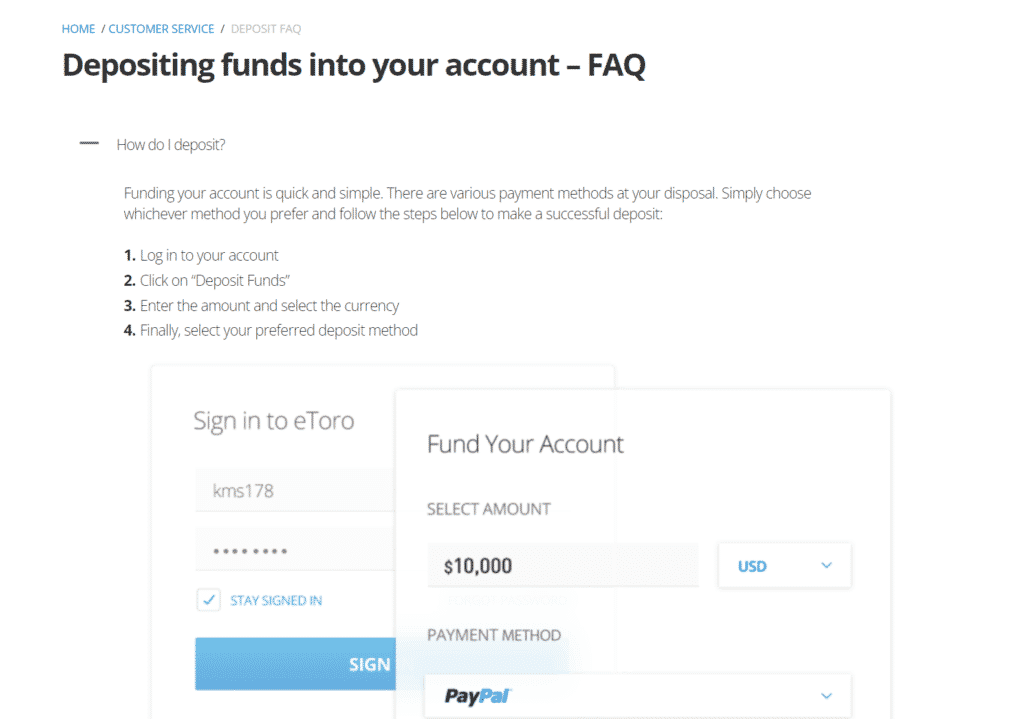

Deposit & Withdrawal

Funds deposit-withdrawal operations are possible by bank transfer, transfer from payment cards, using electronic payment systems (PayPal, Skrill, Neteller), using the Giropay payment system.

- The min. payment for bank transfers is $500

- For electronic payment systems $50

- The first min. deposit is at least $200

- For each withdrawal of funds, eToro charges a commission of $5; the client will also have to pay for conversion services if the withdrawal is not made in US dollars.

Payment methods

- Debit card

- Online banking

- Bank transfer

Withdrawal option

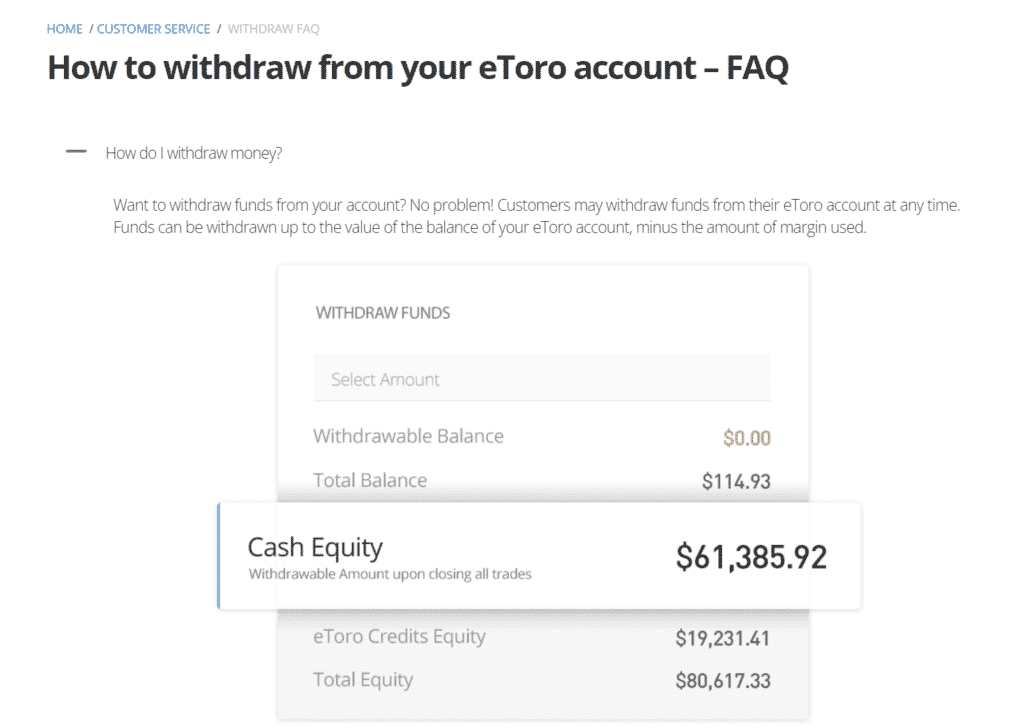

To make a withdraw, you have to follow some simple steps:

- Click on the withdraw funds tab in the left-hand menu

- Enter the amount to withdraw (in USD)

- Complete the electronic withdrawal form as required

- Click the Submit button

The min. withdrawal amount is $30, and you have to wait a min. of seven days to withdraw the invested amount.

Minimum deposit

$100

Base currencies

USD

Where does eToro excel?

- Trade CFDs without transaction fees and other recurring fees

- Ability to buy contracts for fractional shares

- The ability to connect to the auto-tracking of deals of the best managers

- There are strategies for copying trades that are managed by eToro experts with no management fees

- Acceptable spreads and large leverage

What are eToro disadvantages?

- Less variety in account types

- Takes withdrawal fee of $5

- Limited choice of ways to deposit methods

- You need to calculate and pay taxes by yourself

- Supplier quotes are not always market quotes; there are slippages

Why eToro is best for?

For traders primarily focused on independent trading, eToro is not the best option. Tight margin requirements, poor trading conditions, and restrictions make eToro unattractive for scalpers and high-frequency traders.

The company may be interesting for investors focused on copying managers’ transactions and the managers themselves.

But before connecting to copying, we advise you to study in detail the statistics of traders because copying transactions does not guarantee success.

Conclusion

With over 12 million users, it is clear why investors are using eToro to increase their trading capital. The platform is straightforward, so great for beginners. It is important to note that the notable lack of commissions and trading fees is also desirable to investors.

Besides the fact that there is an annual fee and a wide variety of payment options, eToro also attracts seasoned investors. eToro not only supports standard investing, but you can also short sell and even leverage.

Besides the fact that over 800 different stocks are available, everyone has something. This includes everything from commodities and bonds CFDs to forex, indices, and cryptocurrencies. Even if you’re still undecided, you won’t be short of options. eToro is a multi-asset platform that offers equity and cryptocurrency investments and CFD trading.

Please note that CFDs are complex instruments and have a high risk of losing money quickly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. It would help if you considered whether you understand how CFDs work and whether you can afford to risk losing your money.

Trade with this broker