Summary

ETX Capital is a London-based spread betting and CFDs broker. It debuted in the financial space back in 1965, specializing in mortgages and bonds. It falls under a legit regulatory framework led by the FCA and CySEC, and its asset classes support more than 5,000 tradable instruments. As a result, the liquidity provider boasts over 50 years of experience in the market, offering clients personal and tailor-made services fueled by award-winning technology and tight spreads.

The broker claims that users experience instant execution of trades and meager spreads starting from 0.6 pips. They access the markets through ETX Capital’s proprietary platform and the MetaTrader 4. Also, clients start trading with a minimum deposit of 100 euros. However, the amount increases for premium and professional traders.

Can ETX Capital be trusted?

Regulation

The broker serves clients from around the globe with offices based in Europe, Asia, and Russia. The head office is located in London, Great Britain, and operates under the FCA regulation. Generally, it is authorized and regulated by the following regulatory bodies.

- The Financial Conduct Authority (FCA) is regulated and authorized by license number 124721.

- Also holds license 50246 from the South African FSCA.

- It also abides by the Cyprus Securities and Exchange Commission (CySEC).

Foundation

The company is one of the earliest brokers in the trading industry. Its parent company, Monecor, pioneered in the trading space in 1965 as a mortgage and bonds services firm. Over time, it diversified its portfolio and introduced stocks and derivatives, giving it the force needed to enter the retail trading space.

History

As a result, Monecor launched a retail derivative arm called TradIndex in 2002. Its mission entailed rolling out simplified retail trading services of markets such as Forex and CFDs. The retail trading firm later rebranded into ETX Capital, a term derived from the broker’s business model, including electronic trading, telephone trading, and execution.

Currently, the liquidity provider claims to have expanded globally and operates in regions such as Europe, Asia, and Russia. It offers a wide range of markets that yield more than 5,000 tradable instruments. Traders speculate these products through spread betting and as CFDs. ETX Capital also notes to offer tailor-made services to each trader, making it a boutique company. Nonetheless, it holds multiple industrial awards in its trophy cabinet.

Location & offices

The broker is located in London, England, United Kingdom.

Markets overview

The broker allows clients to speculate in a wide range of markets through spread betting and CFDs. The broker claims that its markets support more than 5,000 tradable products. The asset classes include:

- Forex pairs

- Indices

- Shares

- Commodities

- Cryptocurrencies

These products trade with speedy executions, meager spreads are starting from 0.6 pips, leverage of up to 100:1 on most assets, or margin rates starting from 3.33%. However, the broker offers small leverage compared to other FCA-regulated brokers that offer a leverage of up to 500:1.

Forex

The foreign exchange market supports over 60 currency pairs. These products include majors, minors, and exotic currency pairs. Clients trade the assets 24/5 with instant executions, tight spreads starting from 0.6 pips, and competitive leverages. The instruments include assets such as EUR/USD, GBP/USD, GBP/EUR, and many others.

Indices

The broker’s clients access over 20 global indices from the UK, USA, and Asian markets. The products trade as CFDs with tight spreads starting from 1 pt and instant executions. Indices traders also benefit from real-time news and analysis provided by the broker.

Shares

The broker prides itself on offering a diverse share trading marketplace. The broker allows clients to trade numerous share CFDs with trade sizes as low as 0.1 of a share. Traders also benefit from zero commission on stock trading, market news and content, and an array of educational resources. Some of the company shares traded include Tesla, Apple, Rolls-Royce, and many more.

Commodities

The commodities market supports both hard and soft commodity products. The assets include metals, energies, and softs like cotton. They all trade with instant executions and competitive spreads as CFDs 24/5.

Cryptocurrencies

The cryptocurrency market fluctuates in real-time. The traders can go long or short and benefit even when the market dips. The broker allows its users to speculate on the movement of popular cryptocurrencies 24/7. Some of the crypto assets offered include Bitcoin, Ethereum, Ripple, and Litecoin.

Comparison with other brokers

| ETX Capital | PrimeXBT | RoboForex | Forex4you | InstaForex | Exness | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metals | Yes | No | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | No | Yes | Yes |

| ETFs | No | No | Yes | No | No | No |

| Options | No | No | No | No | Yes | No |

Platforms overview

The broker offers clients access to its award-winning trading platform dubbed ETX TraderPro, and the MetaTrader 4 platform. The platforms provide an effective trading environment tailored to each trader. They integrate with powerful trading tools such as:

- Price alerts

- Watchlists

- Interactive charts

- VPS

- Analysis tools

Also, the platforms operate on several terminals allowing clients to access the markets from anywhere.

Analysis of the platforms

ETX TraderPro

- Speculate more than 5,000 products

- Cutting-edge tools for research

- Benefit from several chart types

- Easy to use trade tickets, making it simple to set stops and limits

- Integrated with risk and profit calculators and profit calculators

- The charts are interactive

- Benefit from negative balance protection

ETX MetaTrader 4

- Lightening-fast executions

- Offers automated trading

- Experience one-click through trading

- Trade micro-lots

- Hedging allowed

- Integrated with VPS

- Leverage up to 100:1 on most assets and 400:1 on few other instruments

- Benefit from negative balance protection

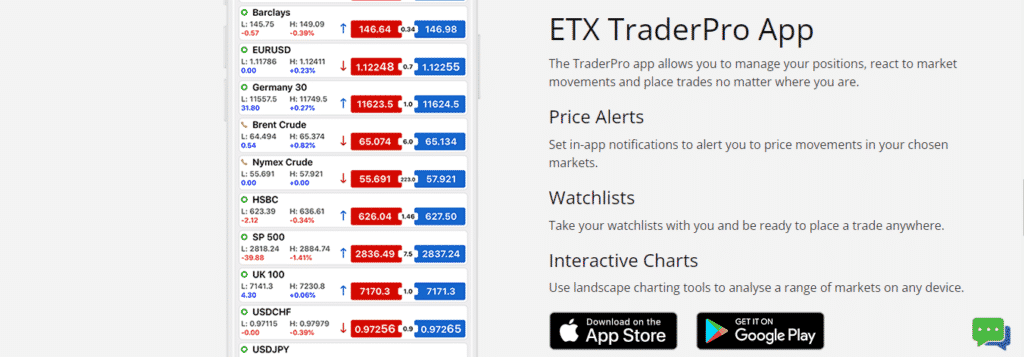

Is ETX Capital good for mobile trading?

The broker confirms to offer the MT4 on multiple terminals, including mobile, and a mobile version of its proprietary platform. The TraderPro App is strategically designed to serve mobile traders and comes with sophisticated features.

They include:

- Price Alerts

- Watchlists and

- Interactive charts

As a result, the broker proves good also in mobile trading.

ETX Capital fees

The broker operates as a market maker offering spreads starting from 0.6 pips. The minimum spread also depends on the asset being traded. As a result, ETX Capital adds fees to the market spread. However, it also notes that clients trade assets such as stocks with zero commissions and competitive margins.

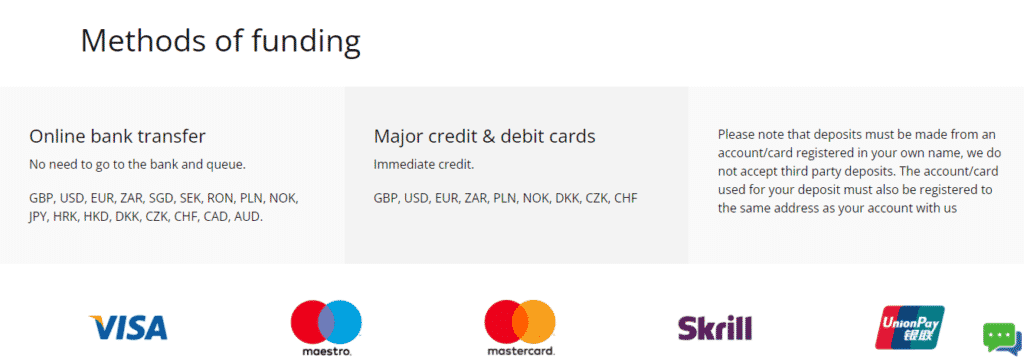

Other financial benefits may include segregation of funds and negative balance protection. It also assures to waive all fees on deposits and withdrawals, but some payment options may add fees separate from the broker’s charges.

Although, the broker charges ten euros for any withdrawal above 100 euros after five withdrawals of the same size within a month. It also charges high stock fees and an inactivity fee of $25 every month after six months of account dormancy. Clients may face overnight fees and swaps as well.

Deposit & withdrawal

The broker provides multiple deposit and withdrawal options to clients. The minimum deposit is capped at 100 euros or its equivalent, meaning the liquidity provider accepts 15+ base currencies for deposits.

Its funding methods include:

- Bank wire transfers

- Debit/credit cards like Visa and Maestro

- E-Wallets such as Skrill and

- China’s Union Pay

Where does ETX Capital excel?

- Offers instant execution of trades

- Negative balance protection is provided

- Dedicates to offering tailor-made services to clients

- Clients trade 5,000+ markets

- Provides tight spreads starting from 0.6 pips

- Waives fees on deposits and withdrawals

- Assures to hold clients’ funds in segregated accounts

- Regulated by the FCA, and other reputable agencies

- Access to award-winning trading technology and educational resources

- Cutting-edge trading tools

What are ETX Capital disadvantages?

- High fees on CFDs

- Not accepted in the USA and other regions of the same jurisdiction

- It does not offer social trading

- Charges an inactivity fee of $25 every month after six months of account dormancy

- Charges 10 euros after five consecutive withdrawals of 100 euros and above in a month

Who is ETX Capital best for?

With a track record of over 50 years in the trading space, award-winning educational service and trading technology, ability to offer tailor-made services to every client, ETX Capital proves best to all sorts of traders. However, the premium packages best suit veteran traders. Although, the furnished educational platform and ability to create a demo account help novice traders catch the wind of how to explore the broker’s markets.

It also holds a top-tier trading license from the FCA, making it a safe broker for all traders. However, the minimum deposit is capped slightly higher than other brokers. It also charges high fees on CFDs and a $25 inactivity fee after six months of inactive trading. As a result, some traders might find it challenging to cope with the charges.

Conclusion

ETX Capital is a spread betting and CFDs brokerage company based in London, Great Britain. It prides itself on over 50 years in the industry, offering clients tailor-made services. The clients trade over 5,000 products leveraging its award-winning technology with meager spreads, instant executions, and competitive leverage. Its clientele hovers around the globe, but the broker notes to have established its mark in Europe, Asia, and Russia.