- The euro may find strength from ECB intervention if the Eurozone inflation target is met.

- The US dollar has remained stable amid inflation.

- The new Covid-19 strain (Delta variant) has had little impact on EURUSD.

The Euro was down against the dollar today, continuing with its 7-day losing spree to lose 0.17% in 24 hours and trade at $1.17159 at 1355 GMT on Tuesday. The US dollar is still savoring the impetus created by the latest US jobs data and a high possibility of Fed tapering in September.

Eurozone inflation and US economy

The United States July inflation report (CPI) is set to be released this month, with high rates of inflation expected to be persistent. In July, the EUR/USD pair decreased by about 0.9%. Additional evidence indicates persisting high inflation would help propel United States Treasury yields higher.

For the Euro, their current decline against the USD is likely to continue in the short-term, as investors wait for action from the European Central Bank (ECB). According to Germany’s Jens Weidmann, Eurozone inflation may spike faster than expected, thereby necessitating the raising of interest rates soon.

Weidmann is also concerned that higher inflation could increase the cost of borrowing for member states, which would be detrimental to their economies.

EURUSD’s consistent decline in recent days is not only down to a strong US economy but also due to investor fever about the Eurozone economy. According to the Sentix Investor Confidence report released yesterday, the six-month economic confidence dropped to 22.2 in July from 29.8 in June.

Notably, the July figure also missed analysts’ forecast of 29.0. While the market seemed unmoved by the report, this could potentially bring more trouble for the EURUSD pair as the actual effects of reduced business confidence are felt by the economy.

In the meantime, the rise in the US Treasury yields is a testament to a strong US economy. The reduction in monthly US unemployment to 5.4% in July and the creation of 943k new non-farm jobs against a forecast of 845K in the month underlines the strong standing of the US economy.

Effects of the new Covid-19 Delta variant on EUR

The rapid increase of the new Covid-19 Delta variant cases might make the markets unwilling to loosen up their uptight trade in the dollar over the coming week. On the bright side, the restricted downfall of the EUR/USD pair is due to the Eurozone countries that have administered a high number of vaccines.

European countries are riding on the confidence of high vaccinations to restrain from enforcing new strict measures despite the increasing cases. Therefore, it can be deduced that the Euro’s weakness against the USD has more to do with a strong US economy than the Eurozone’s economic slowdown.

For example, a recent report by the Bank of France indicates that the economic activity of France was about 1% to nearly 2% below the pre-pandemic levels last month. The industrial activity and services sectors of France were firm last month and expected to remain so this month. Germany’s manufacturing PMI released eight days ago also beat analysts’ forecasts of 65.6 to record 65.9.

Technical outlook

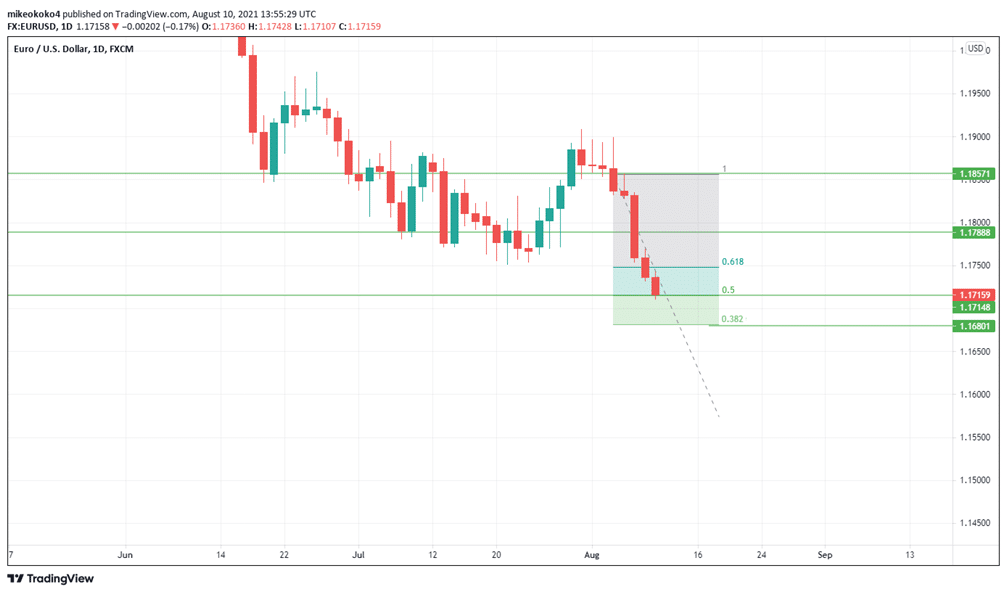

The EUR/USD is still correcting downwards. The pair is currently below the 50% Fibonacci retracement level at $1.17159. If the bears continue to be in control, the pair is likely to find the first support at $1.17148.

A sustained bearish sentiment could send it lower to a 38.2% retracement level, corresponding to $1.16801. Upward-bound price action may go as far as the first resistance at 1.17888 and possibly to the second support level at $1.18571.