- UK’s industrial trend orders (for August 2021) rose to 18 from a previous score of 17.

- Fed Chairman Jerome Powell continues to uphold his dovish stand on US interest rates.

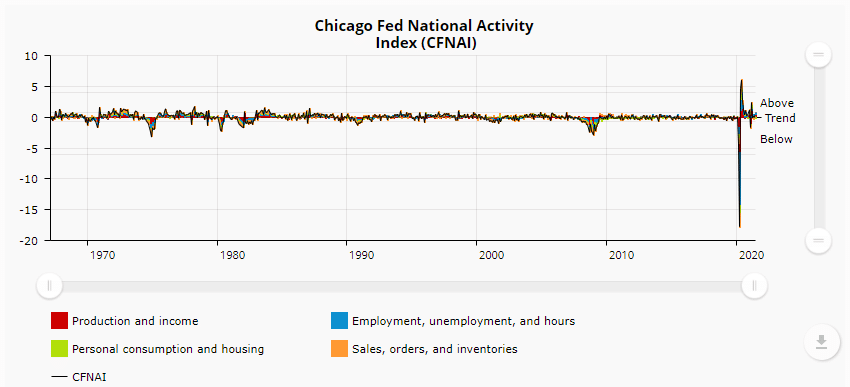

- The US dollar was negatively impacted by the 0.15% decline in personal consumption and housing.

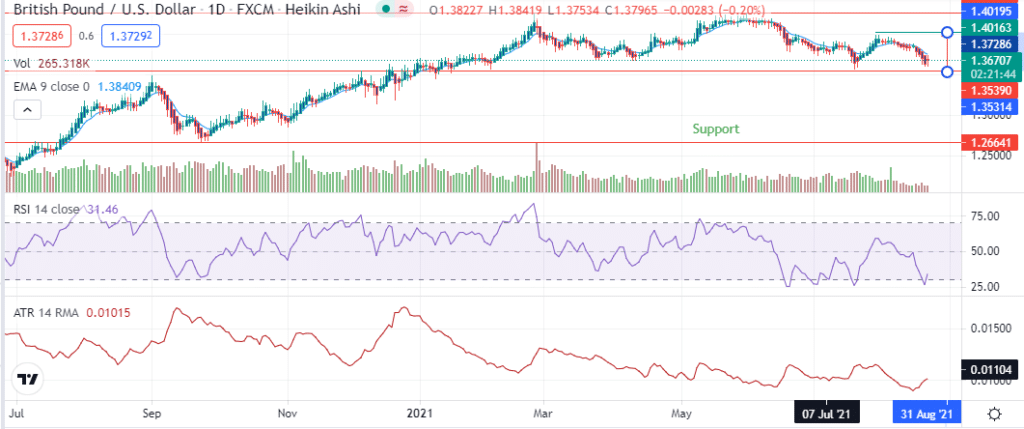

The GBPUSD pair gained 0.65% as of 10:38 am GMT on August 23, 2021, after opening at 1.3627. It rose to a high of 1.3714 after industrial trend orders (for August 2021) by the Confederation of British Industry (CBI) rose to 18 from a previous score of 17. The metric beat estimates at 16, indicating improved manufacturing in the UK.

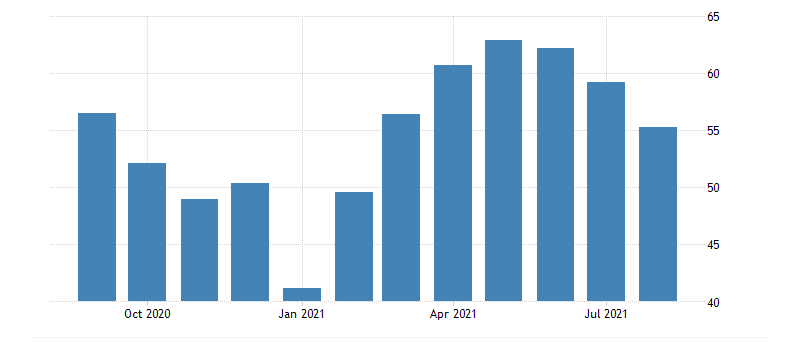

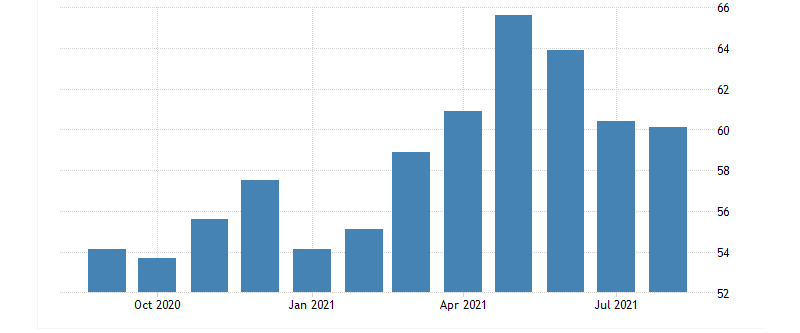

Output growth

UK’s composite PMI for August 2021 slowed its growth to 55.3 from a high of 59.2 realized in July 2021. It signified a business expansion in the UK despite the slight decline that failed to beat estimates at 58.4.

The private sector in the UK showed signs of slowing down in August 2021, after a strong post-Brexit recovery that began in March 2021. As of 12:14 pm GMT on August 23, 2021.

Preliminary/ flash manufacturing PMI for August 2021 stood at 60.1 from a high of 60.4.

Manufacturing output declined for the third month in a row, with the growth of new orders easing slightly. The decline in domestic demand was offset by rising export sales and the growth of new business volumes. Further, there was an increase in unfinished work as backlogs increased slightly but were feeblest since April 2021.

The British pound gained 0.26% against the euro and was up 0.68% against the Japanese yen.

At the same time, the US dollar index (DXY) edged down 0.44% after hitting a low of 93.09 from a daily high of 93.50 on August 23, 2021.

US Covid-19 cases and recovery options

New Covid-19 cases hit a high of 40,573, levels last seen in early May 2021. The vaccination rate increased to 52.0%, representing 171 million people out of a total dosage of 363 million.

Federal Reserve Chairman Jerome Powell continues to uphold his dovish stand even as he nears his final term in February 2022. However, the dollar inched lower as analysts pointed out his possible reappointment due to Treasury’s Yellen’s support. The Fed is still comfortable with the current standpoint of inflation due to the slack in the labor market.

Dallas Fed CEO Robert Kaplan warmed the market with his earlier assertion that the FOMC would consider tapering the $120 billion monthly asset purchases. However, Kaplan reversed his view by stating that asset purchase tapering would be subject to a decrease in the spread of the Delta Covid-19 variant.

July 2021 saw the Chicago Fed National Activity rise 0.53 from a prior decline of 0.01.

Production and income stood at 0.38, sales/ inventory at 0.02, while employment jumped by 0.3. However, the dollar was negatively impacted by the 0.15% decline in personal consumption and housing.

The US dollar lost 0.08% against the Japanese yen and 1.32% against the Canadian dollar as of 2:30 pm GMT on August 23, 2021.

Technical analysis

The daily chart shows the GBPUSD is looking to recover lost ground with the price heading for a possible bullish reversal. The upside may see the price test 1.4016

The pair is recovering from strong selling pressure, with the 14-day RSI slightly above the oversold zone at 31.46. There is a rise in volatility as the 14-day ATR shows an increase at 0.01015.

A reversal can push the pair towards 1.3671. The decline continuation may see 1.3539 and 1.3531.