Dividend aristocrats are companies that have paid and increased their dividends for 25 years consecutively. The list also includes dividend kings, companies that have raised their payouts for 50 years, and more.

While aristocrats are favored by retirees, in reality, they have underperformed the market in the past few years. As shown below, the ProShares Dividend Aristocrats ETF has underperformed the market in the past five years. While most aristocrats are great companies, some are not. In this article, we’ll look at the dividend aristocrats you need to avoid.

Dividend aristocrat ETF vs. S&P 500

Archer-Daniels-Midland (ADM)

Archer-Daniels-Midland is one of the oldest American agricultural companies. Started in 1898, the company has paid dividends for the past 36 consecutive years. It serves the food and beverage, animal nutrition, industrials, and fuel industries. Some of its products are beans, corn, flour, edible oil, and proteins.

In general, things have been good for the company as the process of farming has been made easier by machinery. Also, the rising global population has led to more demand for its products.

However, ADM’s growth has waned in recent years. For example, its annual profit had declined from more than $80 billion in 2011 to just $62 billion in 2020. Its net income has also fallen from more than $2 billion to more than $1.5 billion, respectively.

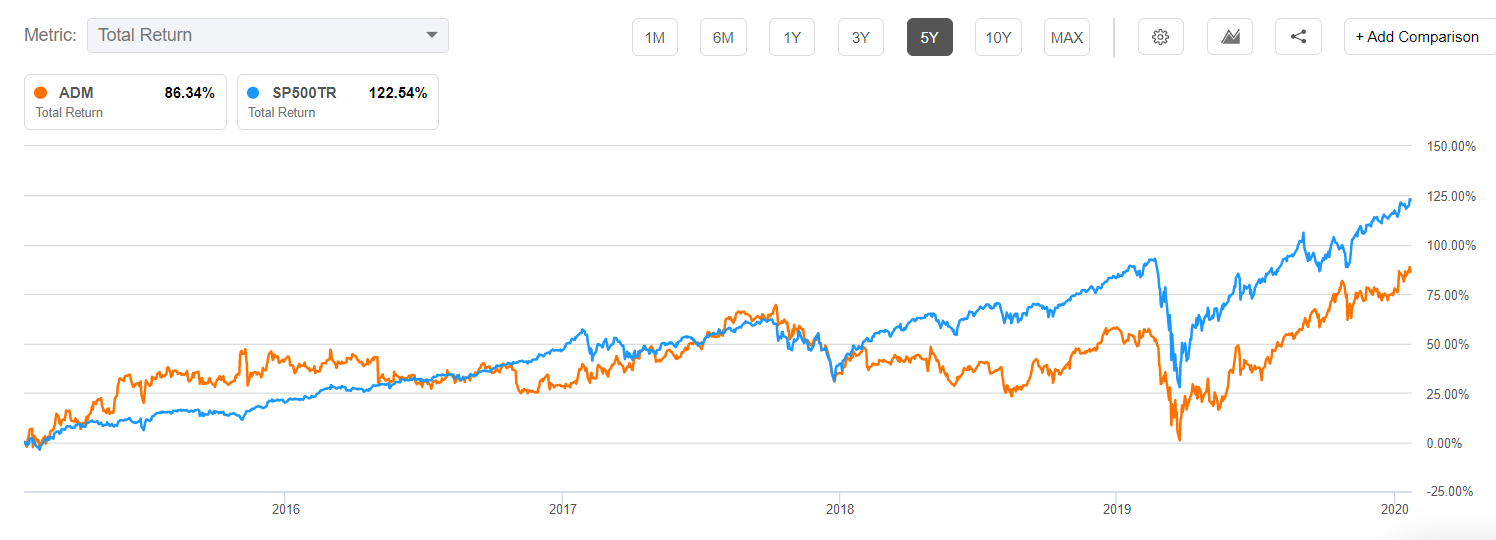

Most importantly, ADM’s total debt has risen substantially. It now has less than $1 billion in cash and short-term investments and more than $7 billion in debt. As a result, in the past five years, the company’s total return has been about 75%, while the S&P 500 has returned about 125%. The total return includes the share price performance and dividends.

While ADM is a good company with a payout ratio of about 66%, we believe that you could find better returns investing in other dividend aristocrats with some substantial growth.

ADM vs. S&P 500

ExxonMobil (XOM)

ExxonMobil is one of the biggest oil and gas companies in the United States. It now has a market cap of about $200 billion, which is substantially lower than where it was about a few years ago. The company is a dividend aristocrat that has increased its payout for 25 consecutive years.

In the past 12 months, the company’s share price has dropped by more than 30% because of the pandemic. As a result, it was booted from the prestigious Dow Jones Industrial Average (DJIA).

ExxonMobil’s star has been dimming for several years now. The company’s revenue has dropped from more than $433 billion in 2011 to more than $195 billion in the past 12 months. In 2019 it made more than $255 billion. Exxon’s profit has also fallen from more than $40 billion to about $20 billion.

Looking at its balance sheet, Exxon’s cash and short-term investments have declined from more than $12.6 billion to more than $8.8 billion. Its long-term debt has risen to more than $46 billion. Worse, while the company lists more than $358 billion of assets, there is a likelihood that it will have a major write-off like Royal Dutch Shell and BP have done.

Therefore, while Exxon is a good company with a substantial market share, we would not recommend investing in it. Sure, its 7.35% dividend yield is strong, the company faces substantial risks, including those connected with financing and the transition to clean energy.

Exxon vs. S&P 500

AT&T (T)

AT&T is one of the biggest telecommunication and media companies in the United States. It is also a dividend aristocrat that has increased its payouts for more than 45 years.

The company operates a large telecommunication network that serves millions of people and businesses in the country. It has also recently expanded its business to the media industry. It did this by acquiring Time Warner for more than $70 billion. The company also owns satellite TV assets through its DirecTV business.

AT&T is a strong brand, but it is also one we believe you should avoid. That’s because, for one, the company has the biggest debt in the country. It has a total debt load of more than $155 billion. This is against total cash of about $9.8 billion.

AT&T’s media business is also struggling. While it acquired DirecTV for more than $40 billion, media reports say that the company is considering selling it for less than $20 billion. Also, while it has launched its streaming business, early signs are that users have not yet embraced it.

Therefore, while AT&T has an attractive dividend yield of more than 7%, we believe that its business has significant challenges going forward. If you want similar returns from a telecommunication firm, we recommend that you invest in companies like Comcast and Verizon.

AT&T vs. S&P 500

Franklin Resources (BEN)

Many Americans have never heard about Franklin Resources. But in reality, many of them have heard about Franklin Templeton Investments, the asset manager with more than $1.5 trillion of assets under management. Recently, the company acquired Legg Mason, another well-known asset manager.

Franklin Resources has increased its dividends for more than 52 years, making it a dividend king. However, its business has recently been under pressure because of its emerging market business. It also increased its debt substantially after the LEGG acquisition.

Looking at its books, you can immediately spot problems. Its total revenue had dropped from more than $7 billion in 2011 to about $5 billion last year. Its profit has also dropped below $1 billion. At the same time, its total debt has increased to more than $3 billion. Therefore, while BEN’s 4% yield and 38% payout ratio are good, the company still faces substantial risks going forward.

Franklin Resources vs. S&P 500

Summary

Dividend aristocrats offer sustainable dividend growth for most investors. Of the 66 aristocrats in existence today, we believe that most of them, like Target, Walmart, and Procter & Gamble, are great companies. However, we see several problems in the four that we have mentioned above.