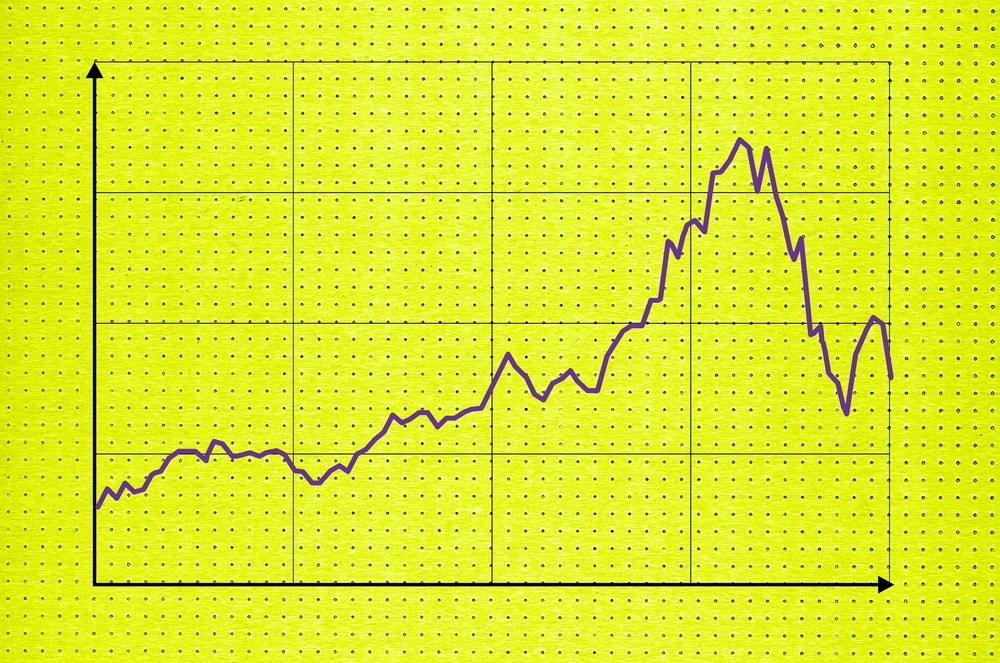

A dip refers to a situation whereby an asset that was previously trending upwards experiences a sudden reversal, leading to a sharp decline in its price.

Investing in such a stock is usually done to sell it at a profit when it reverses the drop and ascends. Timing is critically important when buying a dipping stock. You wouldn’t want to rush into buying a stock that still has a long way to fall.

The downside to buying the dip

The driving principle behind buying the dip is to make a kill once the stock eventually appreciates. However, this isn’t guaranteed. Not all stocks can make a comeback when they plunge. Some go all the way down to a point of the company getting delisted.

In some instances, a stock may go down and stay down, leaving you with no chance of ever selling it for a profit. With that in mind, you need to tread carefully with such stock and be open-minded.

Learn how to read market signals and be open to the idea of selling at a small loss as opposed to a big loss. Have a plan to profit, but do not stick to it when a reversal seems improbable.

Essential indicators find the dip

Volume

The volume of an asset traded tells us how strong or how weak its momentum is. A high volume even during a downturn tells us that there is a significant interest in the stock, meaning that it could soon bounce back up.

However, if the volume of trade is consistently falling for several trading sessions, then recovery becomes difficult. Volume is also an important consideration in position and swing trading.

Changes in price movement

Price action is another significant parameter for assessing momentum. With a downward trend in action, the margins of change in the price will become the key indicator. The more the stock keeps touching a specific price level, the more likely it is that a key support level is being established, and a reversal is likely.

Support and resistance

With every sustained trend, there comes a period of consolidation, with a characteristic sideways trading, smaller gains, and losses. This leads to the establishment of resistance levels to the upside and support levels on the downsides. These levels will help you spot buying or selling opportunities.

What to consider when buying the dip

1. Assess the segments of the economy that were affected most by the sell-off

By looking at ETFs and mutual funds of securities in sectors that suffered most during the downturn, you can get valuable buying opportunities. You should pay particular attention to the correlation between the share price declines and the performance of the ETFs.

2. Consider buying the stock of large corporations with depreciated stock

Large companies are not immune to stock price dips. However, their strong capital base means that they are more likely to return to profitability faster than small-cap companies.

In some instances, their stock may dip because of widespread causes such as terrorist attacks or global pandemics, as opposed to internal malfunctions. In such instances, they have a high chance of reversing a dip.

3. Get the most out of your 401 (k)

If your job security is assured, market downturns present great opportunities to max out your 401(k). This is a smart way of buying more shares in your portfolio at a lower price. This will significantly reduce your tax obligations while securing your retirement savings.

4. Apply Dollar Cost Averaging

This method works on the principle of spreading risk and optimizing chances of profiting. It is especially appropriate if you intend to buy a stock and hold on to it for a significantly long time before selling.

For example, in this strategy, if you have $50,000 and you want to buy the dip, you can divide the money into four portions instead of spending the whole amount on a single purchase.

If the stock was trading at $45, you could spend $10,000 on the first purchase when it dips to $40. Then, spend $10,000 on the second purchase when it falls further to $35.

Buy $10,000 worth of the stock when it rises back to $40 and then spend the remaining $15,000 when it rises to $45. In the end, you will make a decent profit using this strategy when the stock price rises.

5. Know when to stop

While the ideal situation is to buy a dip and sell at a profit when it appreciates, nothing is assured in trading. There are times when the market may go down and not rise. Therefore, you need to always use stop losses. This will limit your risks in case the stock fails to reverse its losses.

In addition, if you think that the stock price might not rise beyond a certain level after a resurgence, take the small profit and exit. That would be far better than letting the market slip back to the loss-making territory.

Bottom line

Buying the dip sounds fancy, and it can indeed be profitable. However, you should not be overambitious but have an exit plan – take a small profit, or sell at a slight loss.