Mergers and acquisitions (M&A) are popular market events that traders and investors take advantage of. Indeed, corporate consolidation is a growing trend.

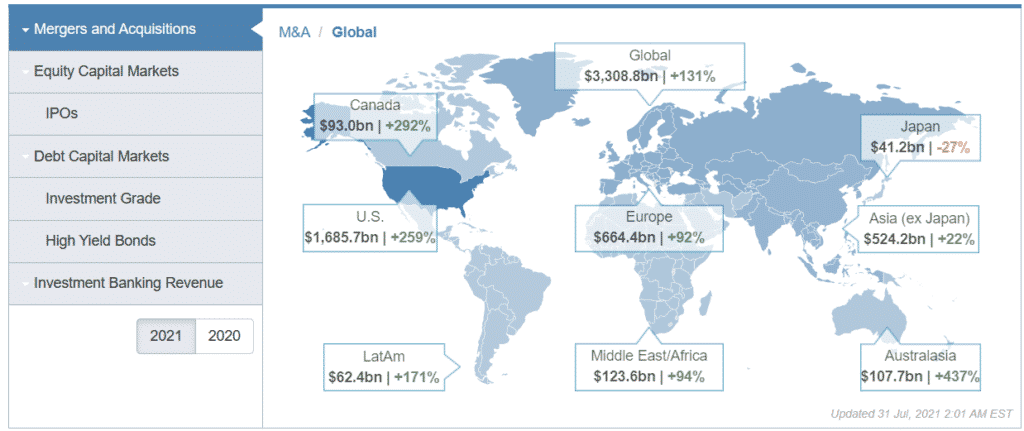

According to the Wall Street Journal (WSJ), the volume of all major deals announced in the first seven months of 2021 totaled more than $3.3 trillion. This was close to the $3.5 trillion deals that were sealed in 2020. Some of the biggest deals of 2021 were the merger of Discovery and Time Warner and the acquisition of Medline by Goldman Sachs.

2021 deals

Spin-offs are also a growing trend. In this article, we will look at what M&A and spin-offs are and some of the top strategies to trade these events.

What are mergers and acquisitions?

M&A is a situation where two companies decide to combine. In a merger, two companies of almost an equal size decide to combine to become one firm. In most cases, this type of combination is known as a merger of equals. Also, the combination is mostly made up of stock swaps.

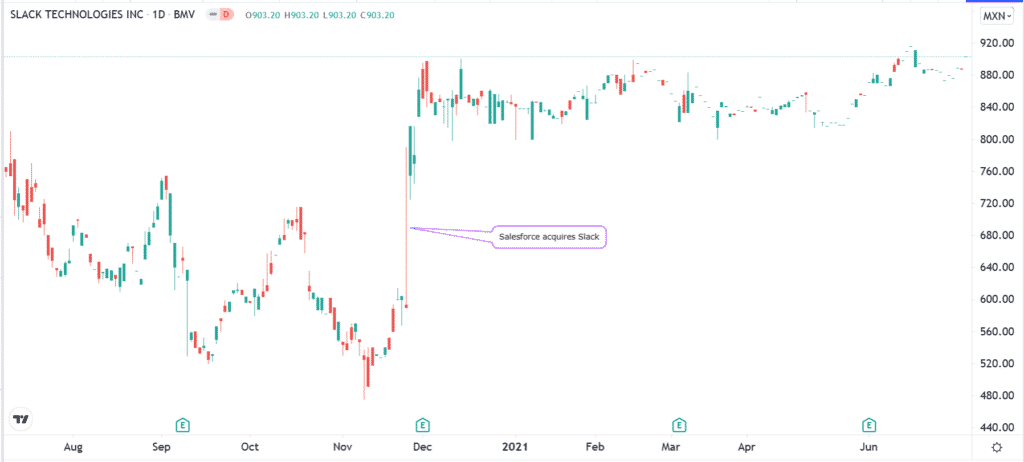

On the other hand, an acquisition is when a bigger company decides to buy a smaller firm. A good example of top acquisitions was when Advanced Micro Devices (AMD) decided to acquire Xilinx and when Salesforce decided to buy Slack, the popular messaging platform. Also, in 2021, Microsoft acquired Nuance Communications.

At times, a smaller company can even acquire a bigger company. The most famous of such deals is when Xerox announced its intention to acquire HP. This was a notable situation considering that Xerox was valued at more than $11 billion while HP had a market cap of over $24 billion.

Meanwhile, spin-offs happen when companies decide to separate some of their businesses. These situations happen when a company feels that the market is undervaluing its business. A good example of this was when eBay decided to separate from PayPal.

Spin-offs also happen when a company wants to exit an undesirable business. For example, in 2021, Anglo American decided to spin-off its coal business to a new entity known as Thungela Resources. In a spin-off, the parent company can sell the smaller business to another entity or list it in the market.

Another relatively unpopular situation is when a public company decides to go private. It does this by raising capital and buying out the rest of the outstanding shares. A good example is when Michael Dell decided to take Dell Technologies private.

How to trade M&A and spin-offs

M&A and spin-offs are popular events on Wall Street. For one, these events are major cash cows for investment banks like Goldman Sachs and Morgan Stanley. Also, they are notable because of the overall volatility that accompanies when these deals are announced. For example, as shown below, Slack’s shares jumped after Salesforce announced that it would acquire the company.

Slack’s share price rose after the Salesforce acquisition.

M&A events are so popular that there are many hedge funds that specialize in trading such events. According to BarclayHedge, M&A arbitrage hedge funds had more than $83 billion in assets under management (AUM) in the first quarter of 2020. Some of the biggest funds using this strategy are AQR, Candriam, and Cerberus.

These funds make money by taking advantage of the price difference that happens when deals are announced. They also anticipate whether a deal will be approved by regulators and whether there will be a bidding war for a company.

Be informed

The first strategy you need to use when day trading mergers and acquisitions are to be informed about when deals are announced. This is because most price action happens when a deal is announced. Therefore, we recommend that you have all the best platforms that are known for delivering breaking news.

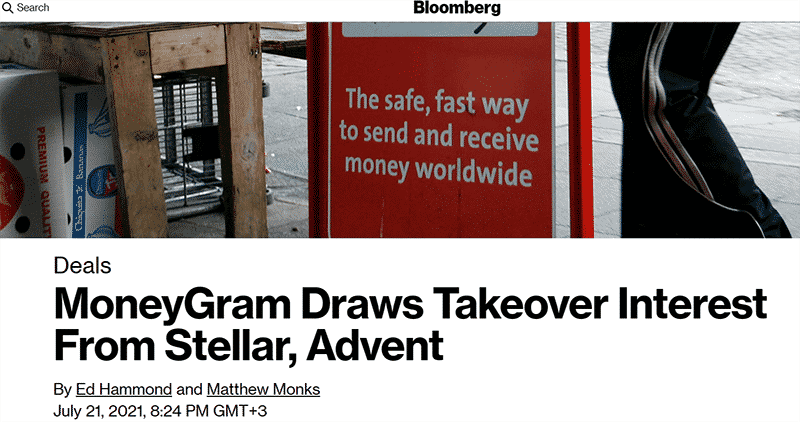

Some of the best platforms for breaking news in the financial market are Bloomberg, Financial Times, Wall Street Journal (WSJ), and CNBC. We recommend that you have access to these platforms in your trading.

These platforms are good because they have hundreds of journalists who have sources at some of the biggest companies in the US and around the world. As such, at times, they tend to have information about potential deals in advance. For example, as shown below, sources told Bloomberg that Stellar Foundation was in talks to acquire MoneyGram.

Bloomberg report on MoneyGram acquisition

Indeed, most M&A deals are usually leaked to the press in advance. Companies involved in the negotiations tend to leak this information in a bid to gauge investor sentiment.

Understand the deal

The next step when trading M&A and spin-offs is to understand the deal. The goal of doing this is to assess whether the deal will be approved by the respective regulators. Also, you should assess whether the approval process will be substantially longer.

For example, the acquisition of Arm Holdings by Nvidia took more than a year to complete because of the global nature of the deal. This means that Nvidia had to get approval from regulators from several countries like the UK, the US, and China. Having a good knowledge of this information will help you trade the two companies well.

Further, looking at the deal will help you identify other potential acquisition targets. For example, in 2021, when a private equity firm announced that it would acquire UK’s Morrison’s Supermarket, the share price of Sainsbury’s also rose. This happened because the firm became an attractive target by bigger private equity firms.

Also, in merger arbitrage, you could short companies that will be affected by a certain deal. For example, Intel’s share price declined after AMD acquired Xilinx and after Nvidia acquired Arm Holdings. Therefore, having knowledge of the sector can help you allocate funds well.

Final thoughts

With global competition rising, the concept of mergers and acquisitions will be around for a while. Companies will keep merging in a bid to cut costs and increase their scale. This will, in turn, lead to more market opportunities that traders and investors can take advantage of. In this article, we have looked at some of the top strategies to day trade M&A events.