Investment is a vital path to increase your wealth, and there are many options out there for investments, including mutual funds, real estate, stocks, precious metals, businesses, and more. If you are finding it difficult to decide where to put your money, you may consider settling for a safer option, which is gold, a precious metal.

The past record of gold

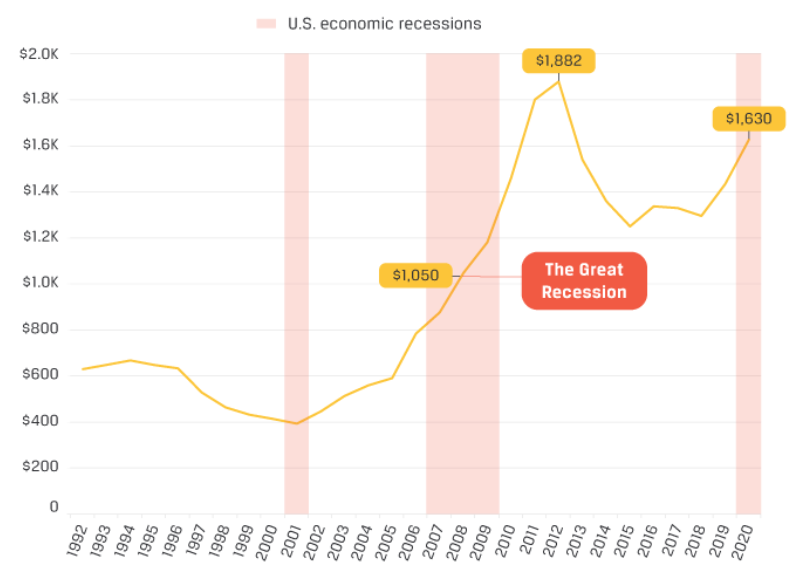

A few financial experts believe that gold was never a more promising investment. Even in historical economic downturns, it can gain value and hedge against the typical currency inflation. To see why gold is considered a solid investment, here we will look at the value of gold over time, beginning in 1992.

The value of gold was that of underpinned currency until the 1930s in the US when Congress nullified creditor’s rights to receive payment in gold. It made gold lose its standard effectively. People who support keeping the gold standard allege that it enforces discipline on modern standards of loading because the dollar amount is always linked to real, tangible gold, which is the opposite of something that can be printed, like paper money.

Look at the chart above. It highlights why so many people put their trust in gold. The metal’s value reached a peak in 1980. Over the last eight years, it has been rising in value steadily. It has also been able to maintain its value largely even during the current pandemic.

The same thing happened during the Great Recession from 2007 to 2009 as well when the value only tracked upwards steadily. This is why gold is usually considered a way to hedge bets against inflationary practices that are usually set in motion by recessions.

Diversification benefits of gold

Correlation refers to the extent to which the returns on two assets move together. While positively correlated assets move up or down together, negatively correlated assets usually move in opposite directions. Uncorrelated assets do not have any obvious relationship. Reducing risk is the primary objective of portfolio diversification.

You can only achieve diversification if the assets you are holding in a portfolio are not correlated too positively. So, it is crucial for investors to include not positively correlated assets with assets held in a usual portfolio of bonds and stocks. Studies on this subject include those below.

Diversifying portfolio

Diversification becomes very important for investors when equity markets experience high volatility and poor performance. There have been various researches on gold as an investment asset. For example, the possibility of diversifying a portfolio with gold stocks was explored in 1990, and it concludes that investors can depend on gold for diversifying portfolios in both the short and long term.

Hedging and safe haven

There was another study on hedging and safe haven properties of gold against bonds and stocks in the United Kingdom, the United States, and Germany. According to this study, gold performs hedging against average stocks, and it is a safe haven during extreme stock market conditions. After the shock, the safe-haven property is limited to 15 days approximately. It was also found that gold does not act as a safe haven when it comes to bonds.

Portfolio implications

Another study was on portfolio implications of gold in 2010. It established the fact that correlations between the US equities and gold were mainly negative or low.

Investment viability

The comparison of investment viability between gold and other commodities, inflation-linked bonds, and real estate also took place in 2010. It states that gold is the most effective portfolio diversifier among these assets that are usually referred to as inflation hedges by US investors.

Comparison of gold with stock and real estate

Let us now look in more detail at the key differences between gold and other assets.

Stock vs. gold

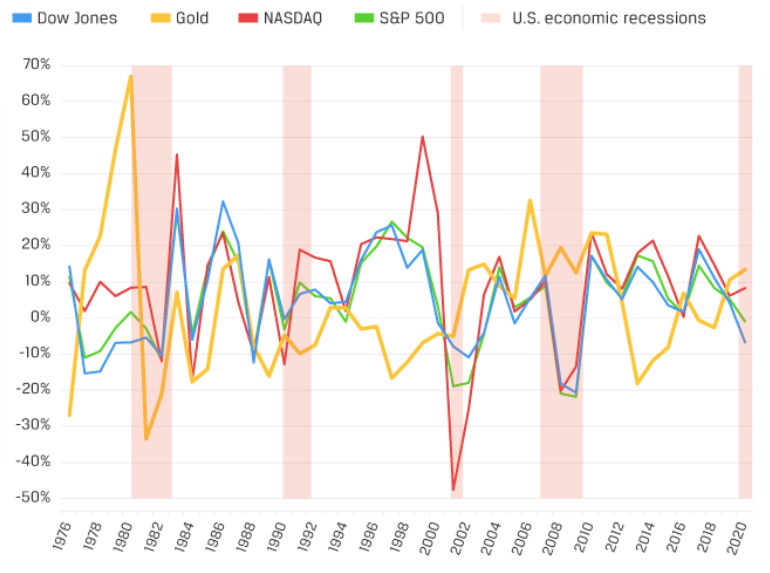

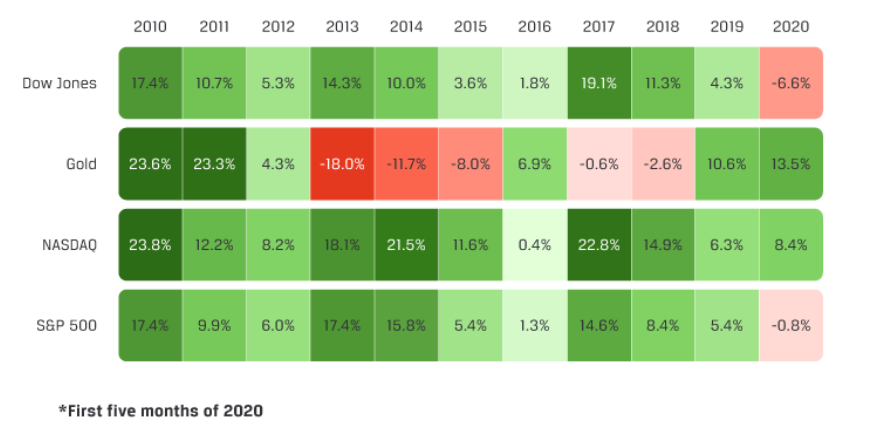

Now, let us compare gold with major stock indices to learn, which is better as an investment. The upper portion of the graph displays the year-over-year percentage difference in the value of gold, the S&P 500, the Dow Jones, and the NASDAQ. From the graph, you can see the price movement of gold compared to the major stock indices over the time of 44 years. Gold outperformed all major indices during the great recession, and it still continues to do the same in the first five months of 2020, which is a bearish year.

The lower portion shows the changes in the percentage value in each type of investment over the past ten years.

If you are not familiar with investing, you may think that the NASDAQ or the Dow Jones are markets, but they are indices that can be tracked by traders. To put it simply, they are slices of the market that can indicate how things may be going within that piece of the market. A mathematical average is simply represented by them. Investors cannot actually trade the NASDAQ or the Dow Jones.

If we look at the year-over-year differences from 2010 to 2020, the value of gold had the most year-over-year decreases compared to the indices. However, there was a rebound of 10.6% in value from 2018 to 2019.

Comparing real estate

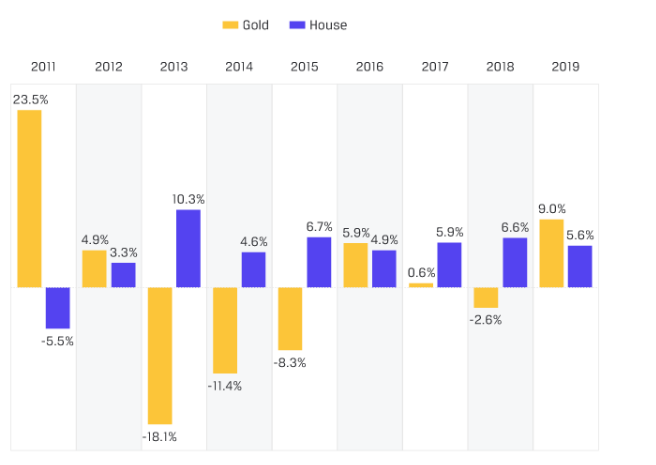

When we think about investing in real estate, the first thing that comes to mind is our home. There are many other options as well, but we will focus on the national median sale price of a single-family home.

When compared to the median sale price of a single-family home, we can see heavier gold fluctuation. Furthermore, the usual single-family home demonstrated a higher year-over-year percentage increase in the median sale price than the value of gold in five of the last nine years. The gold value rose in 2017 and decreased in 2018, while real estate saw a consistent value increase. However, the current pandemic changes things as gold is becoming more reliable in upholding its value.

Conclusion

Gold has become more valuable and reliable for investment, even throughout the great recession and the current pandemic. Not only did it remain more stable than major stock market indices, but it also performed better than most precious metals. So, it would definitely be a good idea to invest in gold.