Night Hunter Pro assures a live track record that has stable returns and a low drawdown. This is a fully automated system using an advanced scalping method. It uses algorithms for smart entries and exits with the help of filter methods. The developer states that the system can provide long-term consistent growth. It does not use risky methods like Martingale, instead uses only a rule-based strategy.

Is investing in Night Hunter Pro a good decision?

As per Valeriia Mishchenko, this FX EA uses advanced innovations and constant updates to limit the risks and increase the returns. To check the veracity of the claim, we have analyzed the features, performance, support, price, and other characteristics of significance in this expert advisor. A backtesting report and live verified trading results are present. The results show a low drawdown but the profits are not high indicating an ineffective approach. Further, the product is overpriced when compared to the market average.

Company profile

Valeriia Mischenko is the developer of this FX robot. As per her MQL5 profile, she is based in Russia and has no experience in the field. She has created 4 products and 15 signals. Waka Waka is the other product she has developed. For support, the messaging option on the MQL5 site is present. There is no further info present like phone number, contact address, live chat, etc. From the info present, we find there is a lack of transparency.

Main features

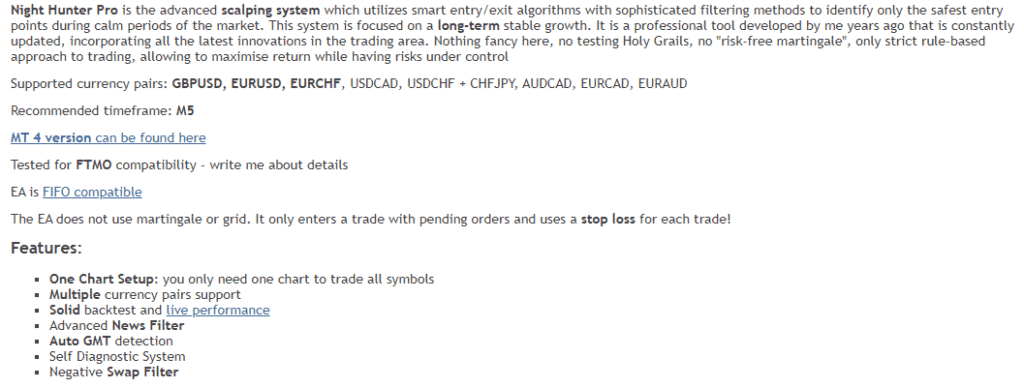

As per the author, the important features that make this FX robot stand apart from its competitors are:

- It is FIFO and FTMO compatible.

- The ATS does not use the grid or Martingale method.

- Only a single chart is needed for trading all currency pairs.

- It supports the EURAUD, GBPUSD, EURCHF, EURUSD, AUDCAD, CHFJPY, USDCAD, USDCHF, and EURCAD pairs.

- The FX robot has automatic GMT detection.

- It uses a negative swap filter and a self-diagnostic system.

- A timeframe of M5 is suitable for this ATS.

Requirements for using the system include the presence of a hedging account, low spread, low slippage, ECN broker, and a VPS for uninterrupted use. The EURUSD on the M5 chart is the recommended pair for use of the default settings.

Price

To purchase this EA, you need to pay $899. As per the MQL5 site info, only one more copy is left at this price and the subsequent price is $999. There are no other details provided as to the features included in the package. No refund offer is present for the product. When compared to the market average, we find the package is overpriced and the lack of refund makes us suspect the reliability.

Trading results

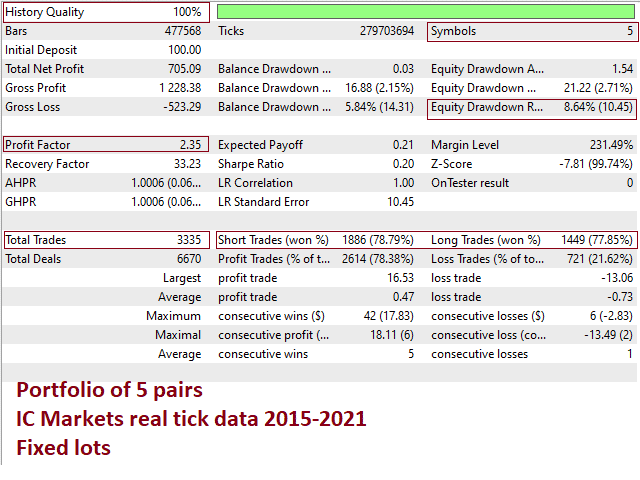

A strategy tester report is present on the official site for this FX EA. Here is a screenshot of the report:

From the above report, we can see the backtesting had generated a total profit of 705 for an initial deposit of 100. The profit factor was 2.35 and the profitability was 78% for a total of 3335 trades. A drawdown of 8.64% was present for the testing done from 2015 up to 2021. From the results, we can see the drawdown was not high but the profits were very low indicating an ineffective approach.

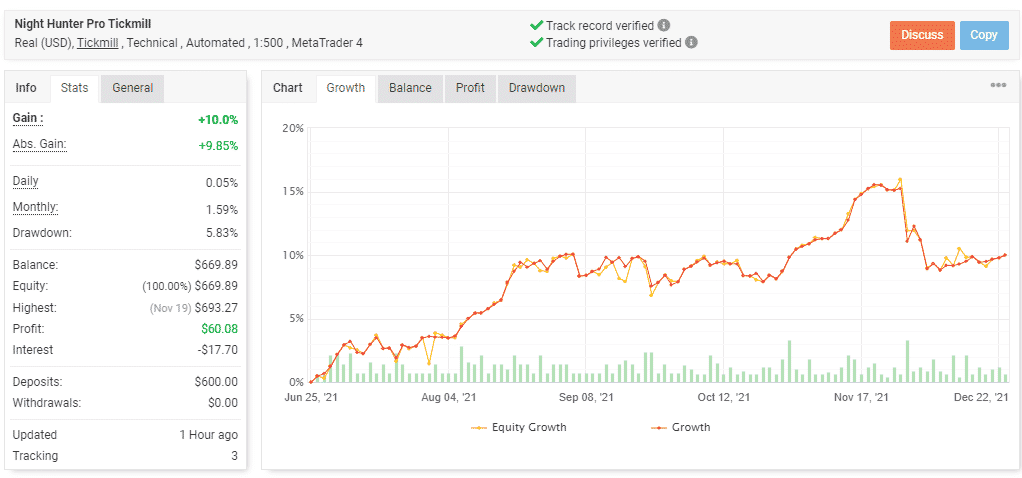

A live trading account verified by the myfxbook site is present for this FX EA. Here are a couple of screenshots of the stats.

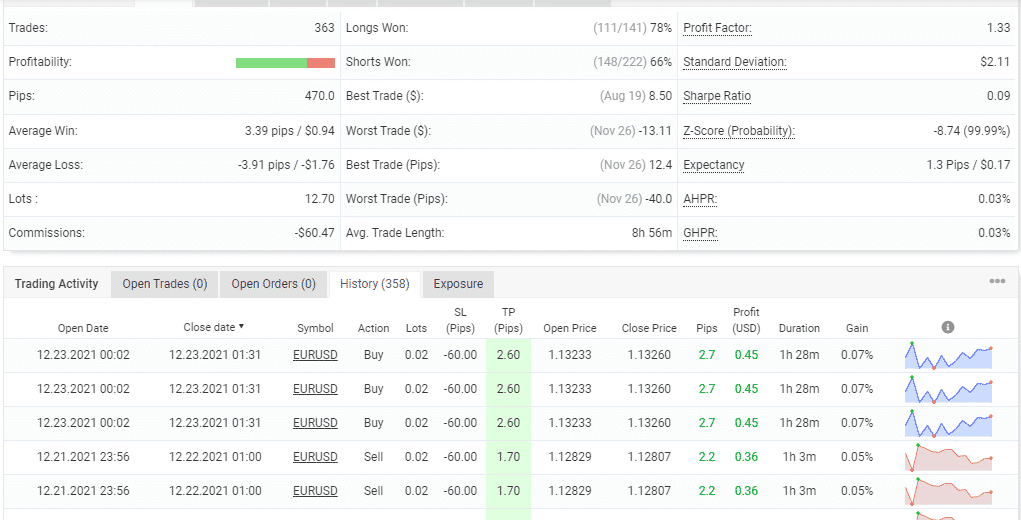

From the above stats, we can see a total return of 10% and an absolute profit of 9.85% are present. The daily and monthly profits are 0.05% and 1.59%. A drawdown of 5.83% is present for the account which started in June 2021 with a deposit of $600. The total number of trades executed is 363 with a profitability of 71% and a profit factor of 1.33.

A lot size of 0.02 is used for the trades. From the results, the drawdown is low as claimed by the developer. However, the profits are not high indicating poor performance. Further, the lot size is high denoting a risky approach. Compared with the backtesting result, real trading results have a lower profit indicating poor performance.

Customer reviews

Unfortunately, we could not find user feedback for this FX robot on reputed sites like FPA, Trustpilot, etc.

Summing up

Night Hunter Pro claims to provide stable long-term returns and low risk. Our analysis of the trading tool reveals backtesting reports and real trading results that have a low drawdown. However, the profits are not high in both results which shows poor performance. There are other downsides that you have to consider. The product is overpriced and does not have a refund policy. There are no reviews present on reputed sites like FPA.