- A strengthening U.S dollar continues to take a toll on majors at the start of the week.

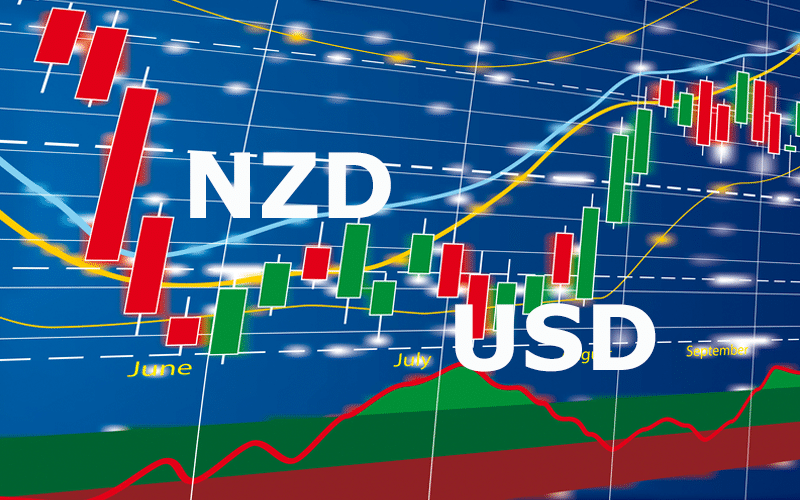

- NZDUSD is down to four-day lows at the start of the week

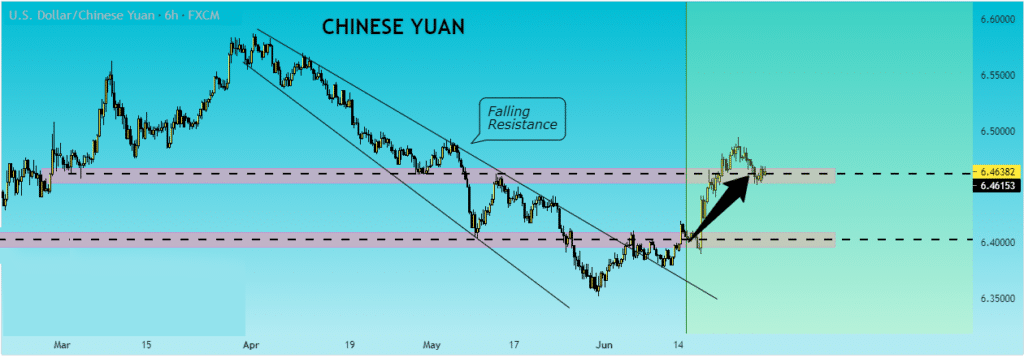

- Chinese yuan continues to hold firm against the dollar at the back of Chinese economic recovery

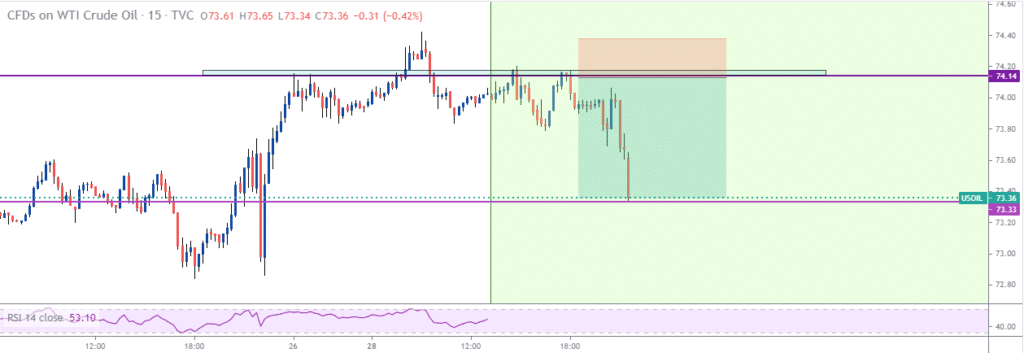

- Oil prices rally is experiencing some resistance near three-year highs

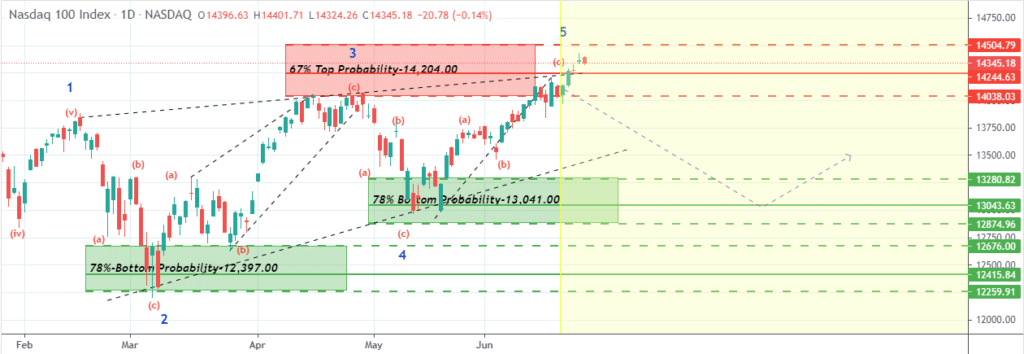

- US equities look set to start the week on a front foot

NZDUSD descended and gathered steam at the start of the week as the dollar strengthened across the board, sending the pair to a four-day low. The pair, which had been on a bounce-back spree the past week, is yet again under pressure.

Failure to rise and find support above the 0.7100 level marked the beginning of another leg lower, with NZDUSD looking increasingly bearish amid a rejuvenated dollar.

To the downside, support is seen at the 0.6980 level. A breach of the support level could result in the NZDUSD pushing lower, probably to the 0.6920 level.

According to an analyst at Westpac, fundamentals remain supportive to the NZD and could help avert a further slide. A more hawkish Reserve Bank of New Zealand vs. the US Federal Reserve could help fuel some bounce back after a recent drop. Supportive growth and monetary policy in New Zealand should also support the New Zealand dollar against the USD.

However, the US dollar strength looks set to curtail any movement to the upside following the recent hawkish shift by the FED.

USDCNH range-bound

The Chinese yuan, on the other hand, continues to hold firm against a rejuvenated US dollar. USD/CNH has since been reduced to trading in a tight trading range of between 6.4300 and 6.4900. The yuan has strengthened in recent days amid bullish sentiments about the Chinese economy bouncing back in the aftermath of the pandemic.

However, a strengthened yuan has so far struggled to fuel a drop below the 6.4550 crucial support level. In recent weeks, a strengthened US dollar following a hawkish FED report has also struggled to fuel a rally past the critical 6.4900 resistance level.

Oil prices retreat

In the commodities market, oil prices are finding the going tough near three-year highs. Prices slipped early Monday morning as a spike in COVID-19 cases in Asia and Australia once again fuelled concerns about an uptick in demand.

Oil prices are coming at the back of a five-week rising spree helped by a rebound in demand in the aftermath of aggressive vaccination campaigns worldwide.

However, on Monday, Brent crude was down by 0.3% to $75.98 as US oil fell 0.1% to 76.60. Amid the pullbacks, oil remains bullish. Market watchers are optimistic that prices will continue rising given the impact of solid vaccination rollout in some of the big economies considered as big consumers.

Some of the tailwinds that could take a toll on further price gains are a spike in COVID-19 cases leading to lockdowns that end up affecting demand. Iran and the US, reaching an agreement could also rattle the market resulting in Iran oil into the market, which could lead to a glut in supply.

US indices at record highs

In the equity market, futures ticked higher, signaling that major US indices should remain at record highs at the start of the week. US stocks turned bullish the past week after President Joe Biden inked a 1.2 trillion infrastructure spending deal. The Federal Reserve hinted it is not close to tapering the loose monetary policy, also continues to offer support to the equity market.

The S&P 500 closed at record highs on Friday at 4,280.70 as the Dow rose 237 points to sit less than 2% from its all-time highs. While the tech-heavy NASDAQ did close in the red on Friday, it was still up by 2.35% for the week, its best rally since April. The NASDAQ is up by 4.45% for the month.

Cryptocurrencies struggles

Bitcoin and Ethereum remain under pressure in the cryptocurrency market after one of the most volatile weeks, the past week. Bitcoin did touch five-month lows after plunging to the $28,000 level before bouncing back.

However, BTCUSD has struggled to rise and find support above the $36,000 level. The flagship crypto remains under pressure owing to the ongoing trading and mining crackdown in China.