- PepsiCo reached an all-time high at $155.14 on July 14, 2021.

- In North America, the sale of beverages shot up 21% as of Q2 2021 (YoY) due to the return of in-house service in restaurants.

- Coca-Cola is offloading up to 200 global brands in its business portfolio.

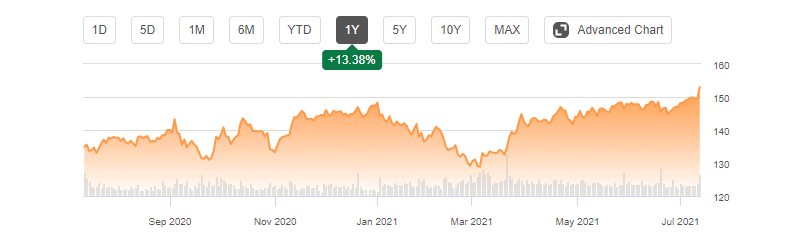

PepsiCo Inc (PEP) added 1.08% as of 12:02 pm GMT on July 14, 2021, from the previous day’s close. The stock’s trading range in the day was within $152.88 and $155.14, bringing the annual change to 13.38%. At the level of $155.14, PepsiCo has already reached its 52-week high.

PepsiCo 1-year Change

PepsiCo released its Q2 2021 results that sent the beverage giant’s stock price to an all-time high, raising its market capitalization to $211.33 billion. Net revenue rose from 6.8% in Q1 2021 to 20.5% in Q2 2021. On YTD analysis, the growth of net revenue stood at 14.1%, while the EPS grew to $2.94. After registering a 12.8% increase in organic revenue in Q2 2021, PepsiCo’s management is keen on realizing a 6% growth in the full-year results.

Soda demand

There was a strong demand for sodas as restrictions around the US were eased across different states. In North America, the sale of beverages shot up 21% as of Q2 2021 (YoY) due to the return of in-house service in restaurants. Products that have flourished on increased home sales include Doritos and Cheetos.

PepsiCo’s snack and branded food business in North America under the Frito-Lay segment increased their organic sales by 7%, with GAAP at +7%. Cereals such as rice and pasta that fall under the Quaker business segment had their organic sales decline 14%. The decrease was attributed to low breakfast intake as the GAAP fell a further 13%. The food business expanded in Europe (+6%) and Latin America (+3%).

PepsiCo announced the extension of the Productivity Plan that started in 2019 through to 2026. The plan intends to save up to $1 billion annually as it embarks on product automation, optimization of the supply chain, and redevelopment of the information systems applicable in the market.

Comparison with Coca-Cola

Coca-Cola (KO) traded to a high of $56.34 on July 14, 2021, from the previous day’s close. It added 2.20% as of 3:32 pm GMT.

Ahead of its next earnings date on July 21, 2021, Coca-Cola is expected to increase its EPS estimate by 1.82% from $0.55 to $0.56. Revenue projections surged 2.55% from $9.02 billion to $9.25 billion. This growth should have a positive impact on KO’s stock price, with the market cap standing at $234.81 billion.

While releasing Q2 2021 financial results, PepsiCo’s CFO, Hugh Johnston, indicated that Mountain Dew would see higher margins later in the year as it dominated the energy-drink space. In March 2020, PepsiCo spent $3.85 billion in the acquisition of Rockstar to help in improving its energy-drink segment. Low food sales did not prevent PEP from acquiring Pioneer foods and BFY Brands.

Unlike PepsiCo, which is increasing its beverage acquisitions, Coca-Cola is offloading brands in its business portfolio. Among the 200 global brands planned for delisting in Coke’s business include Tab, Zico (coconut water), and Coca-Cola Energy. Both companies have ventured into juice, water production, tea, soda, and sports/ energy drinks. PepsiCo announced that it would also raise product prices following Coke’s planned price change.

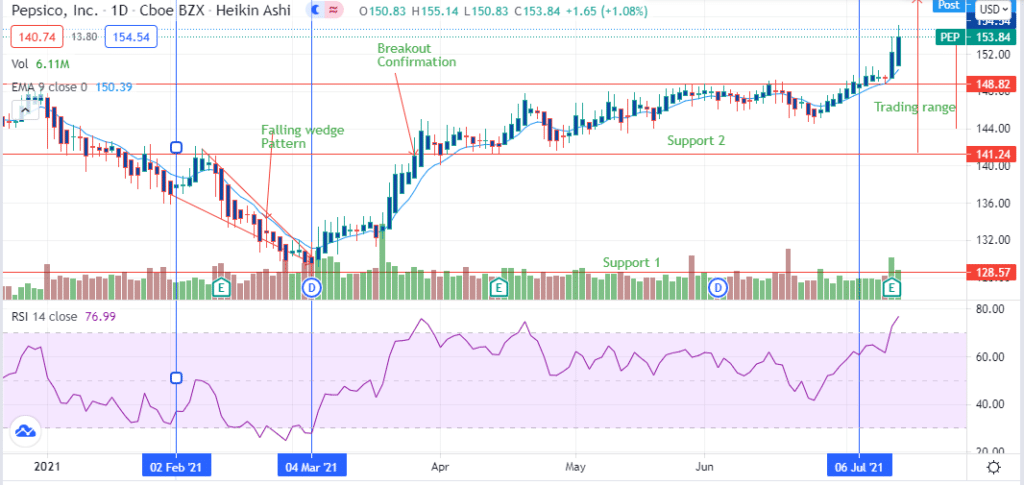

Technical analysis

PepsiCo, Inc formed a falling wedge pattern with the decline visible from February 2, 2021, to March 4, 2021. In response to the pattern, the stock began a short-term bullish reversal.

The decline in the price movement as the wedge continued with the downtrend led to the price hitting support at $128.57.

Price reversal led to the surge, hitting the resistance-turned-support at 141.24, where the upward breakout was confirmed.

The 14-day RSI at 76.99 is in the overbought zone, aligning with the strong uptrend. The uptrend may bring the price to $160. Failure of the uptrend to advance may force prices to trade between 141.24 and 153.84.