Private equity (PE) is an industry that focuses on investing in private companies. In the past few years, it has been one of the best-performing assets in the financial market. Indeed, assets under management (AUM) held by PE firms has risen to more than $4.1 trillion, according to Prequin.

The firms have in excess of $2 trillion in dry powder, which is a term that refers to uninvested funds. Also, on average, private equity funds tend to outperform other asset classes. In this report, we will look at what private equity is and how you can invest in private equity ETFs.

What is a private equity company?

A private equity company is a financial services firm that raises money from investors with the goal of investing in privately-owned companies. The goal is usually to buy relatively undervalued companies that the PE firms understand well and then optimize their performance.

They can do that by expanding the marketing budget, implementing layoffs, and even selling parts of the business. After doing that, the PE firms profit by either selling the company or taking it public. They also benefit by forcing the company to boost its balance sheet using debt and using these funds to pay out a dividend to themselves.

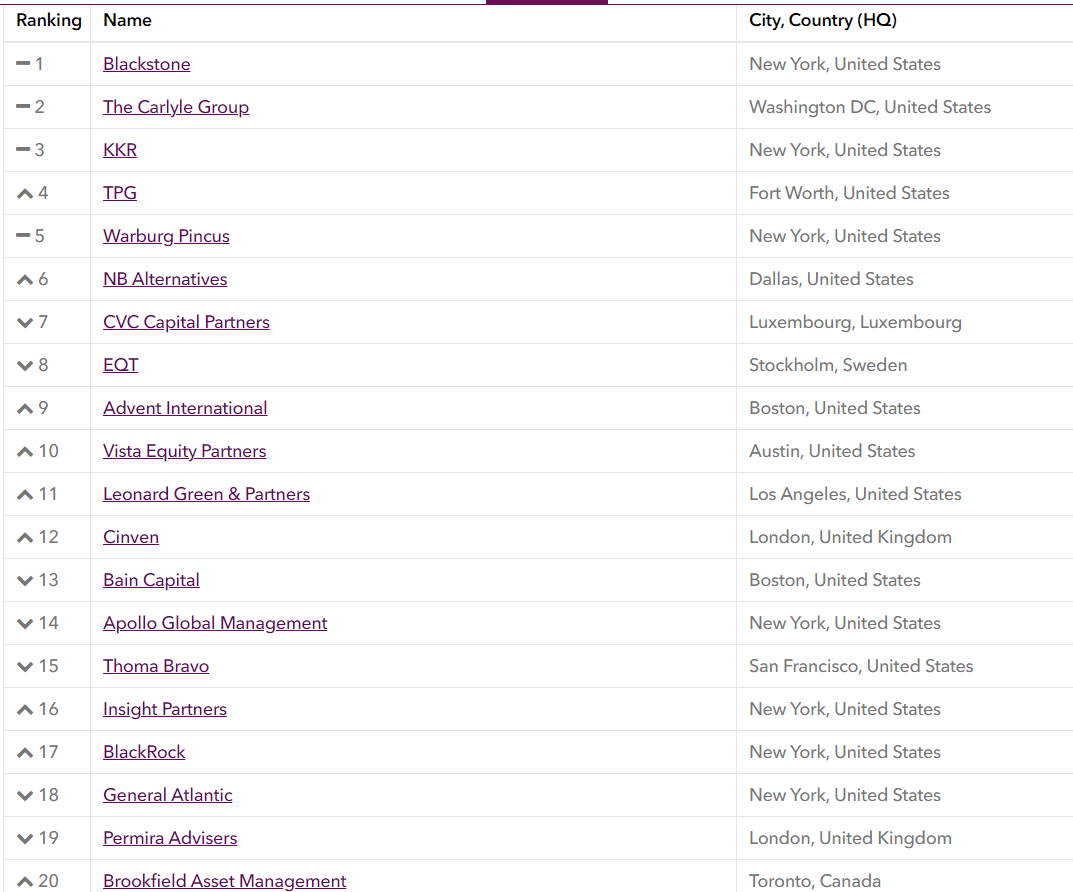

There are several types of PE firms, including: venture capital firms, leveraged buyouts, growth capital, real estate, and infrastructure, among others. Blackrock is the biggest private equity in the world with its more than $500 billion assets. It is followed by Carlyle, KKR, TPG, and Warbug Pincus, among others as shown below.

Top 20 biggest private equity companies in the world

Unfortunately, private equity firms tend to serve relatively wealthy clients, who include high net-worth customers, pension funds, and other types of institutional investors. Also, very few private equity firms are publicly-traded, which makes it more difficult to invest in them. Still, you can invest in those that are already public either individually or through an ETF. Here are some of the best private equity ETFs to invest in.

Invesco Global Listed Private Equity ETF (PSP)

PSP is a relatively small exchange-traded fund (ETF) that has more than $158 million in assets. The fund tracks the Red Rocks Global Listed Private Equity Index, which tracks between 45 and 75 private equity companies. The PE firms in the index own more than 10,000 companies spread across the world.

About 41% of the private equity companies in the PSP are from the United States while 12.9% of them are from the United Kingdom. By sector, most of the firms are in the financial services industry and closely followed by those in the consumer discretionary, industrial, and investment companies.

Some of the biggest companies in the PSP ETF are Partners Group, 3i Partners, Blackstone, KKR, and EQT. These are large PE firms with billions of dollars in AUM. For example, based in Switzerland, Partners Group has more than $96 billion in assets. Blackstone, the biggest PE firm in the world, has more than $571 billion in assets.

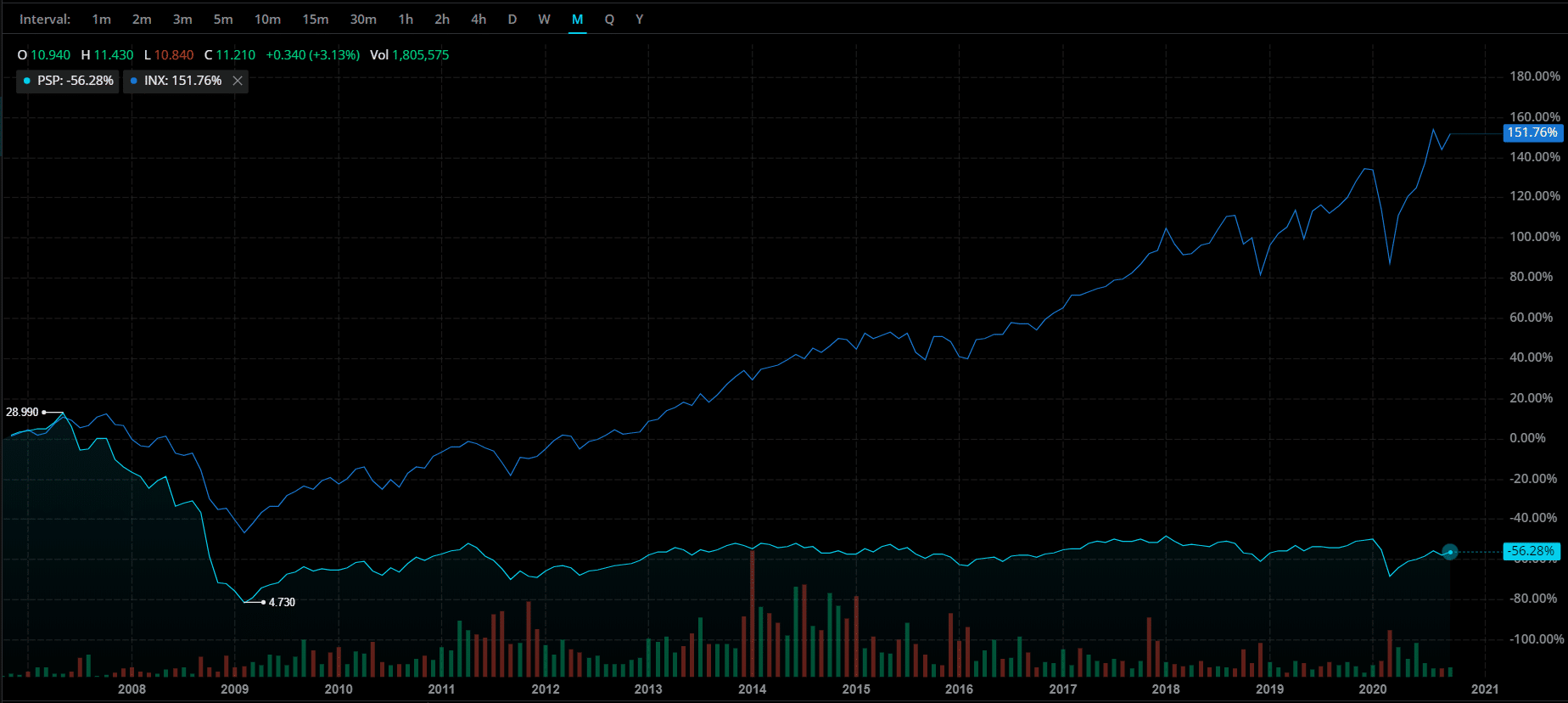

The main benefit of investing in PSP is its global coverage. As mentioned above, it has PE firms from around the world. These are firms that are difficult for retail investors to invest in. Another benefit is that it has a 7% yield, which is above what the average S&P 500 index yields. However, the main disadvantage is that it is relatively expensive to invest in it. It has an expense ratio of 1.58%, which is relatively high. Another disadvantage is that it has underperformed the market since its inception in 2006, as shown below.

S&P 500 vs PSP

Global Listed Private Equity ETF (PEX)

The Global Listed Private Equity ETF (PEX) is a relatively small ETF with just $16.4 million of assets. The fund, which was started in 2013, tracks the LPX Direct Listed Private Equity Index. The index tracks some of the biggest private equity funds in the world. About 55% of all companies in the ETF are from the United States while the rest are from Europe. At the same time, most of these firms report their earnings in dollars while the rest are in euros, pounds, Canadian dollar, and Swiss franc.

Among the biggest constituent companies in PEX are Ares Capital Management and 3i Group. The two asset management firms have more than $50 billion in AUM. They represent ~10% of the fund. Other big holdings are Onex, Wendel Corp, and Eurazeo, among others.

The main benefit of investing in PEX are the fact that it is relatively diversified and that it has a 10.5% annual yield. However, the main disadvantage are that it is relatively expensive since it has an expense ratio of more than 3% and that it has underperformed the market since its foundation.

VanEck Vectors BDC Income ETF (BIZD)

The VanEck Vectors BDC Income ETF tracks the MVISUS Business Development Companies Index. The fund currently has about 26 companies that are mostly from the United States. It has more than $217 million in assets under management. Most of the companies in the ETF are in the financial services industry and 80% of them have a market cap of less than $5 billion.

The biggest holdings in VanEck Vectors BDC are Ares Capital Management, Owl Rock Capital, Hercules Capital, and Prospect Capital, among others.

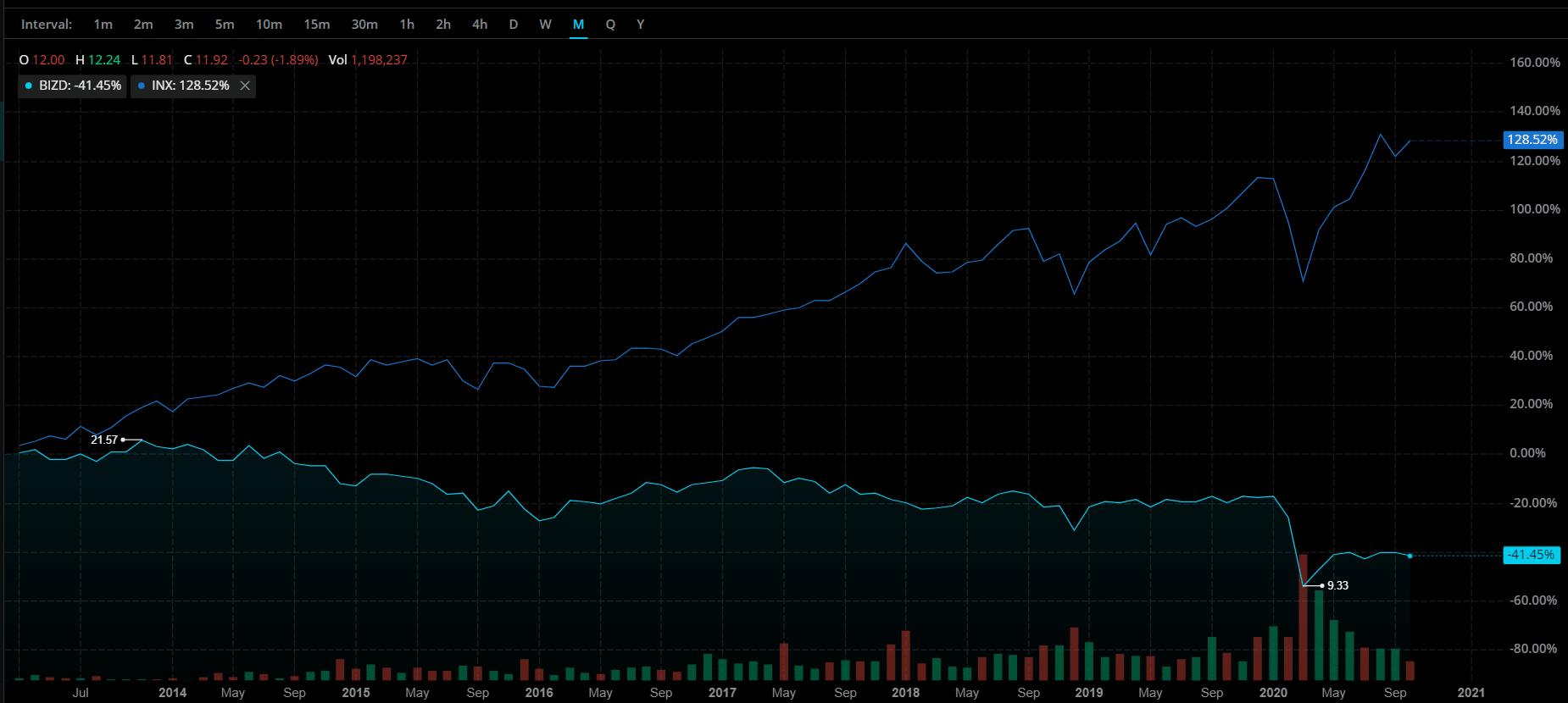

Like the other two ETFs, BIZD has a relatively high yield of more than 12.3%. However, the catch is that its expense ratio of 10.24% is significantly higher than the average ETF. For example, the popular Invesco QQQ plan has an expense ratio of just 0.20%. And, the QQQ has performed relatively well over the years since it tracks the Nasdaq 100 index. At the same time, the BIZD ETF has been a key laggard, which has led to its high yield.

BIZD vs S&P 500

Final thoughts

As shown above, private equity ETFs tend to have a high yield, which is a good thing for income investors. However, they also tend to be extremely expensive and they also underperform the market. Therefore, we only recommend investing in individual PE firms like Blackstone, Carlyle, and Apollo Global Management. Alternatively, we recommend that you invest in other diversified portfolios that have the companies as minor constituent firms.