Robinhood FX EA is an MT4 tool that assures minimal losses and maximal gains. The vendor claims that this is among the most profitable Forex robots. It uses a unique algorithm and is equipped to identify and execute profitable trades. The FX EA analyzes the market every hour daily and uses a trade management method that does not include the Martingale approach. A risk management formulated on automated lot size that is chosen according to the current balance in your account is present in this expert advisor. As per the vendor, you need not disconnect the EA during major news events.

Is Robinhood FX EA a good EA to invest in?

For this review, we have evaluated the features, trading approach, settings, performance, support, and other relevant aspects. Our analysis reveals a lack of vendor transparency and the trading results are verified but for a small sample size only. We could not find a mention of the strategy or an explanation for it. The initial conclusion we have arrived at is that this EA is not a reliable trading tool.

Company profile

We could not find info on the developer or the team behind this FX EA. The official site is registered under the FX EA with a 2021 copyright. An email address and a telephone number are provided for support. There is no location address present for the vendor. The support options and vendor info are inadequate showing a lack of vendor transparency.

Main features

As per the info on the official site, this FX EA is a fully automated system that produces a stable monthly profit. The ATS uses two main methods. One is the management of capital and the other is a meticulously calculated trade entry and exit.

Using these two methods the FX robot ensures that the lot sizes remain proportional to the size of the account. The SL is not revealed to the broker when the EA starts the trades. Another feature that the vendor mentions is the advanced SL technology used by the software.

This includes tight stops and waves that occur in a small timeframe to ensure consistent profits. If the market condition is not favorable, the FX robot closes its trades to avoid losses. However, the vendor maintains that the FX EA works in all market conditions.

This EA works on the EURUSD pair using the H1 timeframe. A lot size of 0.01 for $200 is the recommended amount. As per the vendor, the MT4 tool works with all types of brokers, cent, micro, STP, and ECN accounts.

Price

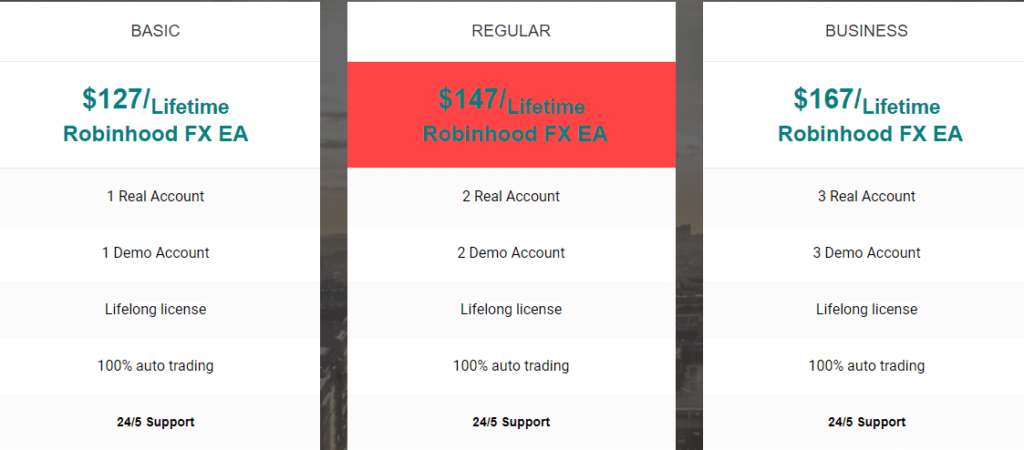

Basic, Business, and Regular are the price packages available for this FX EA costing $127, $167, and $147 respectively. The features common to the three packages are a lifelong license, 100% automated trading, and 24/5 support. They differ in the number of real and demo accounts they come with. We could not find a money-back assurance which makes us suspect that the ATS is not reliable.

Trading results

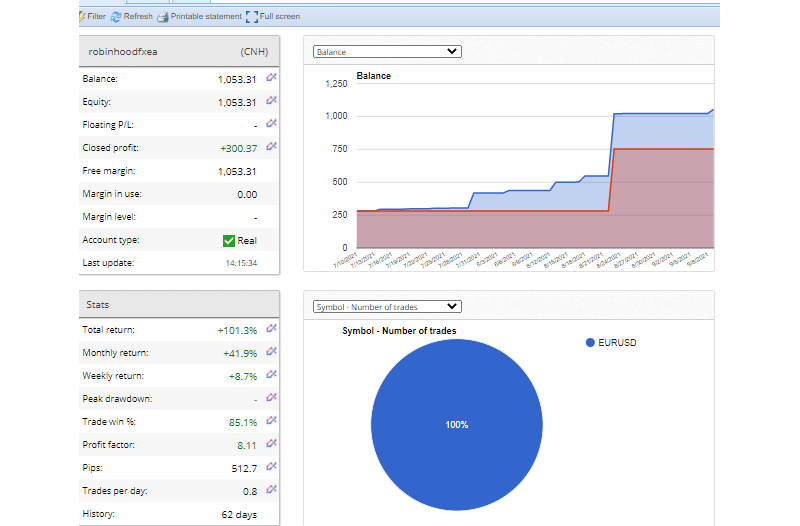

A real live CNH account verified by the FXBlue site is present on the official site. Here is a screenshot of the account:

From the details, we find that the account started in July 2021, has generated a total return of 104.1% and a monthly return of 36.6%. Profitability of 80.4% and a profit factor of 6.71are present with the number of trades per day being 0.8.

The risk to reward ratio is 2.38 which is high indicating poor performance and ineffective strategy. With no backtesting results provided, we are unable to analyze the results properly. Furthermore, the sample size is small hence cannot provide a candid insight into the efficacy of the EA.

Customer reviews

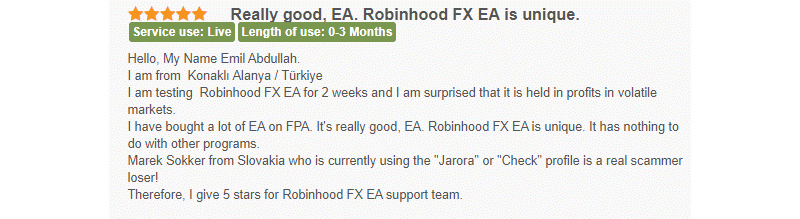

We found a user review for this FX EA on the Forexpeacearmy site. Although the review praises the EA it seems like a scam review with the user complaining about another trader. Furthermore, with just a single review it is not possible to assess the efficacy of a system.

Robinhood FX EA review summary

Robinhood FX EA claims to generate stable profits without losses. Our assessment of the features, trading approach, and performance reveal that it is not a reliable MT4 tool. The strategy is not disclosed and there is no explanation provided. Further, the trading results, although verified, show a very small sample size and the risk to reward ratio is high. Another downside of the system is the lack of vendor transparency. While the price is not expensive, the lack of a money-back policy makes us suspect this is not a trustworthy system. Since the downsides outnumber the benefits found in this FX robot, we do not recommend it.