- Solana down 25% in April

- Solana bearish short term outlook

- Cryptocurrencies hurt by rising inflation

Cryptocurrency market sentiments have turned sour in recent days going by the steep pullback after a stalled bounce back. The Crypto Fear and Greed Index has already tanked to lows of 20, affirming strong fears in the sector.

The sell-off has mostly been fuelled by a lack of substantial catalysts needed to support a new leg higher. Rising bond yields have only complicated the issue as investors shift their attention to assets likely to benefit from rising yields as the US Federal Reserve moves to tighten monetary policy.

SOLUSD technical analysis

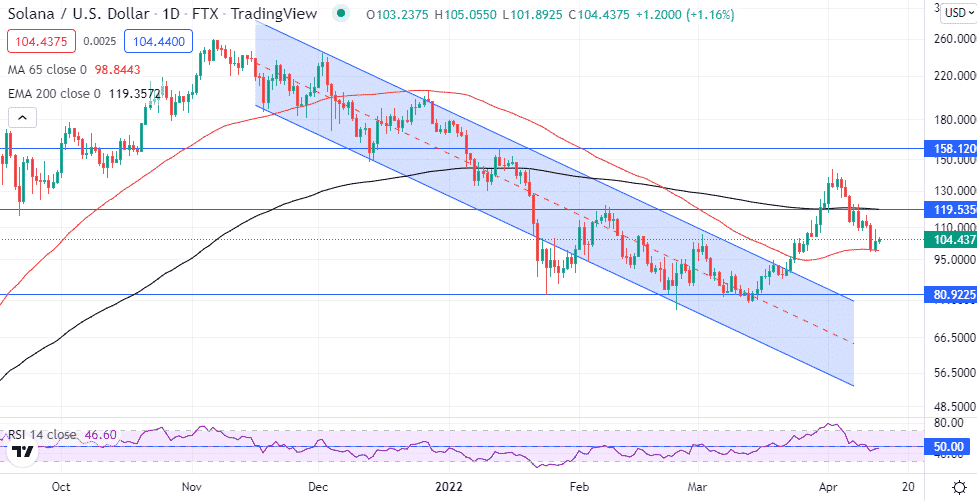

Solana is one of the coins feeling the full brunt of the renewed sell-off in the market. The coin is down by more than 25% from April highs of $142 a coin. SOLUSD has since closed below the 200-day moving average, implying renewed sell-off in the market.

The Relative Strength Index also affirms the strong sell-off in the market after plunging below the 50 level. With the major technical indicators turning bearish, SOLUSD could be in for another leg lower amid the stalled bounce back.

After the recent pullback, short-sellers are staring at strong support near the $100 level. SOLUSD trading and closing below the psychological level would reaffirm the emerging downtrend setting the stage for further losses to the $80 area, the next critical support level.

The bulls defending the $100 level would heighten the prospects of SOLUSD rallying as a pullback play. The crypto rallying and finding support above the $119 area should raise the prospects of a rally back to April highs of $142 a coin.

Why is Solana under pressure?

Solana remains under pressure despite a string of positives in the market. Top on the list is the confirmation that Robinhood has added support for the coin, a development that has had little or no impact.

Concerns that inflation data out of the US will show another Increase in prices is one factor working against cryptocurrencies. The markets are increasingly awaiting the release of the consumer price index, which would provide insights into inflation levels in the US.

While cryptocurrencies are often expected to be a hedge against rising inflation that has not been the case in recent months. As inflation has ticked up, so have the likes of Solana come under pressure amid concerns that the Federal Reserve will be forced into aggressive monetary policy tightening.

The prospects of the FED hiking interest rates by up to 50 basis points has sent the dollar higher, all but piling pressure on SOLUSD and other cryptocurrencies. Investors have been forced to sell growth stocks and other riskier assets and opted to pursue investments around assets likely to benefit from rising interest rates.

In addition to inflation concerns, a cloud of fear has gripped the market as US taxes are due later in the week. A huge tax bill could hit investors who made significant money out of cryptocurrencies in 2021. Some have already started offloading some of their stakes to raise the much-needed money needed to settle the tax bills

Final thoughts

Solana’s short-term outlook has turned bearish as the broader cryptocurrency market remains under pressure. The crypto is likely to post significant losses on breaking through and closing below the $100 level.

However, the crypto’s long-term outlook remains bullish, given the growing use of its blockchain in powering smart contracts and decentralized finance. In the meantime, it would be wise to be extremely cautious until the sell-off dust settles.