- The Russell 2000 index high growth shows that small-capped companies have increased in value over the last three years.

- The small-capped stocks have traded in lock-step with the large-cap stocks in larger indices such as S&P and the DJI during the COVID-19 era.

- Improved manufacturing activities are expected to push the 2000 small-cap companies to new highs in 2021.

The Russell 2000 Index (INDEXRUSSELL: RUT), also known as the 2000 small-cap stocks, is the market index for US companies with relatively small market capitalization. This index represents the two-thirds bottom section found in the Russell 3000 Index. The index contrasts with large companies located in the Dow Jones Industrial Average (DJI) like Apple (AAPL) or the S&P 500 index, e.g., Google (GOOG).

The big companies do have not only large market capitalizations but also do global-based businesses. The Russel 2000 companies do the bulk of their business in the US. In the past year, the index has had a better run than the other indices due to global economic concerns.

More robust insulation from global pressures

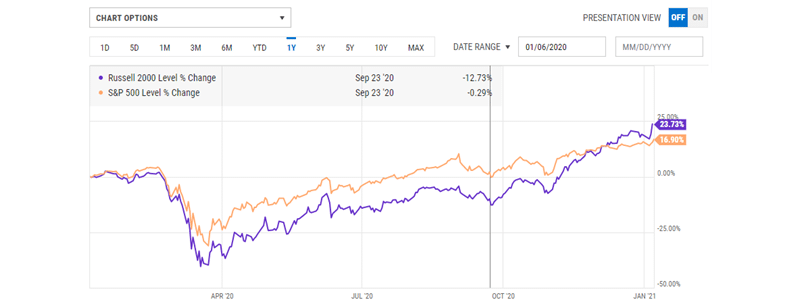

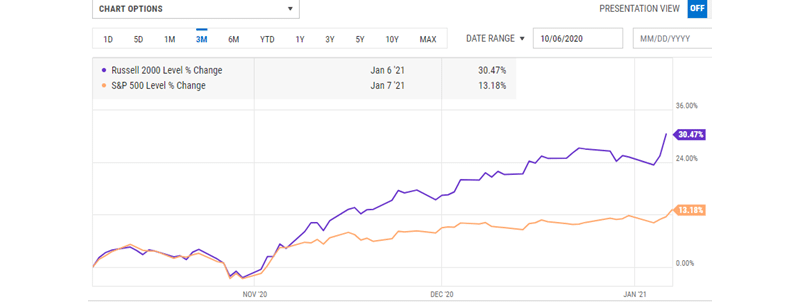

The normalized annual change with the Russell 2000 index is 23.73% against the S&P (SPX) 500 index at 16.90%. The small-capped stocks trade in lock-step with the large-capped stock (as seen in the chart above). The small caps were the first to pick the clue on positive market sentiment regarding the COVID-19 vaccine and the phase one trade deal between the US and China.

The SPX took a hit after the US election in November 2020 and slid lower while the RUT continued to climb. Shares of multinational companies in the US were pressured by the negative news on complaints of election malpractices. This news was enough to push monthly gains in the SPX to a monthly low after November 3, 2020.

Manufacturing concerns

Reduced manufacturing activity towards April 2020 after a nationwide lockdown was instituted in the US, which led the RUT to underperform the SPX. The small-capped stocks began to pick after the stimulus plan was approved in April, and manufacturing began to pick up. Jobless claims were also on the rise towards the half of 2020.

However, into 2021, reports indicate that companies have begun reshoring. At least 12 manufacturing companies will directly benefit from growing manufacturing activity. The Purchasing Management Index (PMI) for December 2020 was set at 60.7. This point was higher than the projection of 56.8 made towards the end of the year. PMI level above 50 shows the growth of the manufacturing sector. Therefore, at 60, manufacturing activity is expected to heat up in 2021.

Various small-capped manufacturing companies are slated to open their facilities in America this year. Such companies include the Bedding Industries of America – located in Rialto. Foreign and local assembly companies are also expecting less strict tariffs, especially from car-parts importers.

Technical analysis

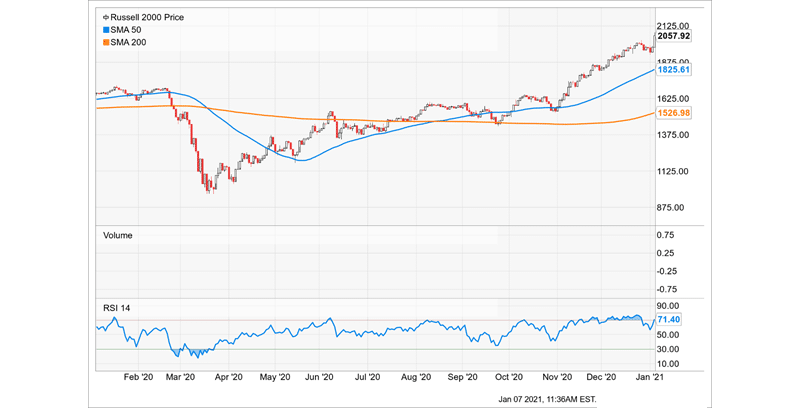

The Russell 2000 Index was trading at $2,057.92 as of January 7, 2021. The 50-day simple moving average (SMA) index shows that it found support at the $1,825.61 level. The SMA 50 began the year on a low of $1.619.31. The index continued rising until it fell when the lockdown was instituted due to COVID-19. The 200-day SMA indicates that the index will find support at $1,526.98 into 2021. The RUT index is 34.77% higher than the SMA 200, showing that the index has a strong trendline into 2021.

The 14-day relative strength index (RSI) is very stable at 71.40. The condition illustrates that investors have increased the purchase of the index into 2021. The market price for the RUT is greater than the intrinsic value. It also shows the price has the potential to keep going up in the long-term.