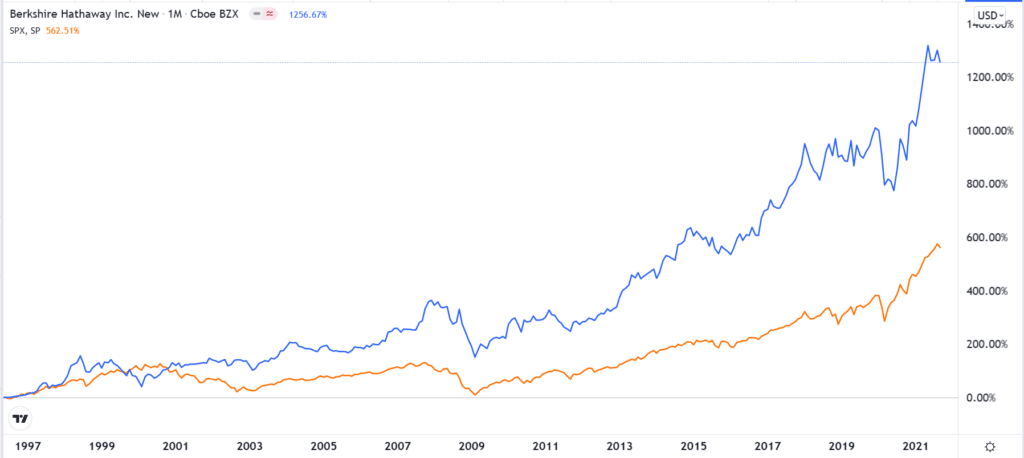

Warren Buffett has had a lot of success in his six-decade career. Shares of Berkshire Hathaway have outperformed the S&P 500 index by far, as shown below.

S&P 500 vs. Berkshire Hathaway shares

Today, Buffett has invested in tens of companies, and his fund has more than $120 billion in cash with a market capitalization of more than $500 billion. In this article, we will look at some of the top 4 Warren Buffett stocks that you should invest in.

Moody’s (MCO)

Moody’s is a financial services company that operates in some of the most sophisticated industries to enter or disrupt. The company is best known for its credit rating services for governments, municipalities, and companies. While these ratings are its biggest income earner, the company has a relatively diversified business.

Moody’s business is divided into two key divisions. There is the Moody’s Investors Service, which provides credit rating opinions and services, and Moody’s Analytics. The latter provides data and analytics services to companies and other large organizations.

Moody’s has thousands of customers globally. They include asset managers, banks, securities dealers, government entities, and hundreds of thousands of individuals.

The company’s business has been on a strong growth path over the years. Its revenue had grown from more than $3.6 billion in 2016 to over $5.3 billion in 2020. At the same time, its profit has moved from more than $266 million to about $1.7 billion.

Moody’s is a good investment for several reasons. First, it operates in an industry that is hard to penetrate. Indeed, many small independent rating agencies have come up, but they have not achieved Moody’s scale. Second, the firm has only two main competitors, S&P 500 and Fitch Ratings. Over the years, these companies have learned to coexist with each other. Third, Moody’s is an excellent rewarder for shareholders with its superior returns. And finally, the company does well in all market conditions.

Mastercard (MA)

Mastercard is a financial services company valued at more than $330 billion. The company provides its services to a diverse group of companies, including banks and fintech firms. It is a well-known brand that is best known for its credit and debit card services.

Mastercard has a relatively simple business model. It develops technology and then provides it to banks. Banks, on the other hand, offer cards to their customers. Behind the scenes, Mastercard ensures that customers can shop using the cards. It also makes money through credit cards even though it is not exposed to the loans business itself. Mastercard owns brands like Maestro and Cirrus.

The Mastercard ecosystem is made up of an issuer (bank), the account holder (the customer), and the merchant. When you shop using a Mastercard card, the merchant pays the company a small commission. With the number of people using cards rising globally, it means that Mastercard keeps benefiting.

Mastercard has grown its annual revenue to more than $15.3 billion and its net income to $6.4 billion. This means that it has impeccable margins on its business.

Mastercard is a good Warren Buffett stock because of its global reach, strong market share, high margins, and its presence in an industry that is seeing strong growth. However, a major risk the firm is facing is the growth of Buy Now Pay Later, a business that is challenging the model used by credit card companies.

United Parcel Service (UPS)

UPS is a leading company in the logistics industry that has a market capitalization of more than $165 billion. The company provides its services through its fleet of hundreds of aircraft and thousands of delivery trucks. Indeed, it is the biggest airline in the world and delivers more than 24.7 million parcels a day. Over the years, the firm’s total revenue has jumped to more than $84.6 billion, making it a bigger firm than FedEx.

UPS has benefited substantially from the growth of e-commerce services. Today, it provides its services to companies like eBay, Walmart, and Amazon. This growth has helped push its revenue from over $61 billion in 2016 to exceeding $84 billion in 2020. It is also a highly profitable company whose net income has grown from $3.4 billion to $4.4 billion.

UPS is a good Warren Buffett investment for several reasons. First, the company has a global presence, making it a preferred shipper. Second, it is in an industry that is seeing significant growth. Third, UPS operates in an industry with few global competitors. Its biggest competitors are firms like Amazon, FedEx, and Deutsche Post.

American Express (AXP)

American Express is a company that is relatively similar to Mastercard and Visa (which Buffett also owns). The company provides credit and debit cards to customers globally. It makes money by helping banks and other financial services companies process funds. Also, it takes a commission when customers shop. Its business is divided into Global Consumer, Global Commercial, and Global Network services.

A key difference between American Express and companies like Visa and Mastercard is that it targets a more affluent customer. As such, while it has a smaller market share in card issuing, the company’s business is almost the same size as the two firms. It also charges a higher commission to retailers, who are glad to pay because of the nature of its customers.

American Express is growing its market share as the middle class expands globally. It is also a growing company whose revenue has jumped from $33 billion in 2016 to over $39 billion in 2019. However, the revenue dropped to $30 billion in 2020 due to the pandemic.

Summary

Warren Buffett has invested in many companies over the years. While their returns have lagged the market recently, he owns some of the most iconic companies in the country. In this article, we have looked at four of these companies and why it makes sense to invest in them. Other companies you could invest in are Berkshire Hathaway itself, Bank of New York Mellon, and Aon.