Market manipulation has always been a big problem. Institutions or investors with huge financial backing often engage in practices intended to deceive the entire market and try to profit from the same. Wash trading is one such practice that remains banned in some jurisdictions.

Understanding wash trading

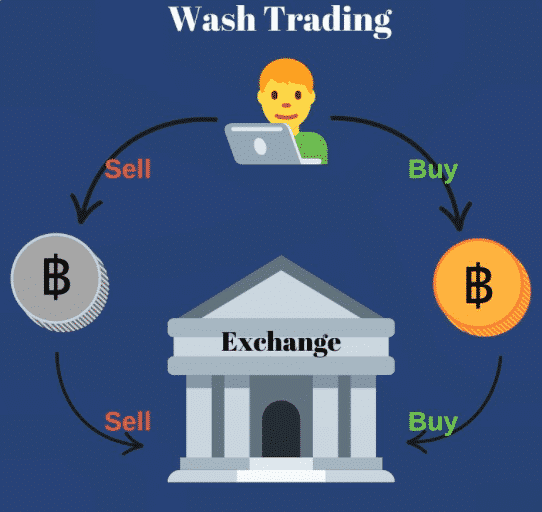

Wash trading is the act of buying and selling security instantly, all in the attempt of feeding the market with the wrong information. The trading practice is characterized by a trader being the buyer and seller of a security at a given time.

The practice mostly comes into play whenever an investor/trader and a broker join forces to influence market sentiments. The practice remains banned in the US. Additionally, taxpayers are not accorded the opportunity to deduct losses that arise from such practices.

In addition, brokers are barred from profiting from wash trades in the US even if they claim not to know what an investor or trader was doing while placing such trades. They are required to carry out due diligence to ensure market participants don’t buy and sell securities to pump misleading information.

How does it work?

In order to place wash trades, one must have sufficient capital to place a huge trade that has the potential to move the market. The huge trades only go to pump market volume, convincing other traders that there is sufficient volume.

For instance, whenever one places a buy position and succeeds in attracting more market players, they immediately sell the order to themselves. The practice is a form of insider trading, given that the player executing such trades has more knowledge than the general public.

Such practice amounts to fictitious trades, given that a transaction is designed to give the appearance of an authentic purchase and sales while it is not the case.

Example

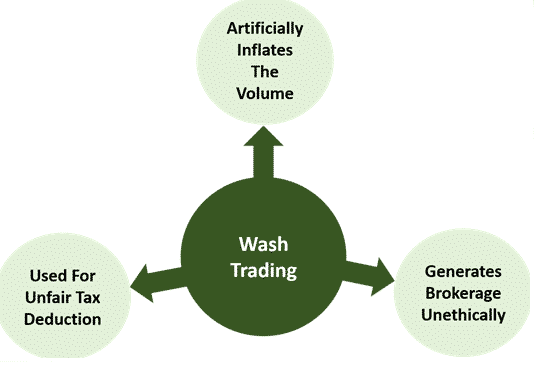

The practice finds great use in the stock market. For instance, a trader can take a position in a stock with the aim of making a small loss. Once the loss is incurred, say a $1,000 loss. The trader immediately or within 30 days takes a similar position with the same exposure.

The second identical position aims to ensure a substantial profit, say $3,000. Once the huge gain is accrued, the trader can go forth and claim a tax deduction on the loss incurred in the first trade. By claiming a tax deduction, the player ends up incurring a much lower tax bill on the gain accrued on the second trade.

For this reason, regulators maintain a close watch on large investors and their beneficial ownership accounts. It is against the law to buy and sell securities under a month in the US with a similar position.

Uses

The buying and selling of securities instantly lead to trades canceling each other. Consequently, such an outcome never amounts to any monetary value for the trader. However, they provide brokers an opportunity to make some money through commissions.

The “Libor scandal” is a perfect example of how wash trades were used to benefit brokers. As part of the scandal, traders at investment firm UBS placed nine wash trades. In return, they needed to incur up to £170,000 in fees which ended up at the investment firm. The fees acted as a reward for the firm on manipulating Libor rates.

In addition, wash trades are commonly used to create the notion of volume in the market. When markets are thinly-traded due to lack of volume, some huge players engage in such practices in a bid to get some players into the game.

Buying and selling immediately on huge volume sends the signal that there is sufficient volume in the market. Unknowing players are often swayed into placing trades once the first trade is placed, only to be trapped as the huge player exists.

Market making differs greatly from wash trading. Market makers engage in a practice that seeks to enable liquidity instead of manipulating other trades. Their actions create an environment whereby other traders can enter and flourish when possible. On the other hand, wash trading seeks to duplicate a position to enjoy tax benefits at the end.

The return of wash trading

Wash trading has gained greater prominence with the development of machines and systems able to carry out high-frequency trading. The use of super-fast computers and high-speed internet connections has made it possible to easily place trades, some of which only go to manipulate sentiments.

In 2012, regulators in the US were called into action amid outcries that high-frequency trading was being used to circumvent wash trading laws. Wedbush was one of the securities firms to find itself at crossroads with authorities for allegedly enabling an environment that allowed investors to buy and sell securities for beneficial ownership.

In the recent past, the cryptocurrency sector has emerged as a safe haven for enabling wash trading. Recent studies show that over 80% of cryptocurrency trades involving Bitcoin in 2018 were mostly initiated to manipulate the market.

Tracking wash trading

Exchange and platforms handling various transactions in the capital markets are increasingly integrating systems designed to track trading patterns. The systems implement technical solutions that ensure no two trades are similar from the same trader over an epicene period.

Consequently, if a buy order from an individual matches the sell order, it is gagged down, and the system blocks the trade execution. Exchanges and institutions are increasingly restricting trading in single trade accounts.

Authorities are also putting systems in place to double-check on investment losses that some investors use to claim tax deductions. In this case, the authorities try to ensure that no two similar trades were placed to reduce the tax bills.