- Canadian foreign investments in US securities dropped 10.01% from CA$20.67 billion to CA$18.6 billion in April 2021 (MoM).

- Canada’s CPI surged 3.6% in May 2021 (YoY) from 3.4%.

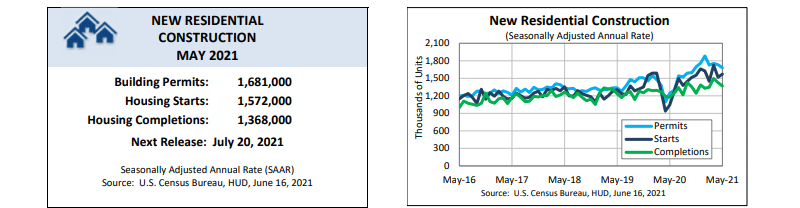

- US housing sales rose to 1.572 million in May 2021.

The USD/CAD pair grew 2.44% last week. The Canadian dollar lost against the US dollar after Canada’s manufacturing sales data for April 2021 (MoM) declined to -2.1% from the previous reading to 3.5%. Sales for new motor vehicles also declined to 167.0% from a high of 173%. The US import price index (for Canada) also surged 11.3% from a previous reading of 10.8%.

Despite Canada’s problems of funding gaps for affordable housing and climate-change assessment, residential buildings in May 2021 surged by 279,500 from 267,400. The government is considering expanding the use of sustainable mortgage bonds (SMBs) to integrate a green social and economic model in the housing sector. As a result, the price index for annualized new houses dropped 1.4% from a previous reading of 1.9%.

Canadian foreign investments in US securities dropped 10.01% from CA$20.67 billion to CA$18.6 billion in April 2021 (MoM). Total foreign securities purchased by Canadians since May 2020 have increased to CA$140.9 billion, consisting mainly of US securities.

Inflation

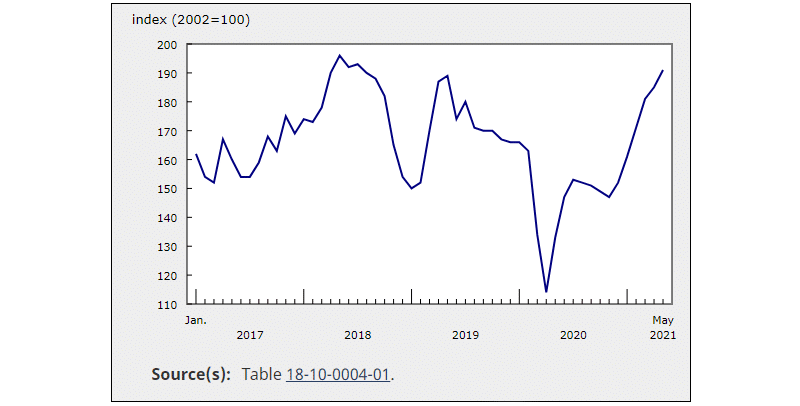

The CPI surged 3.6% in May 2021 (YoY) from the previous month’s reading of 3.4%. This increase was the largest since May 2011 that saw a record of 2.5% (YoY), excluding the price of gasoline. The commodity’s price in May 2021 slowed to a growth record of +43.4% against the previous month at +62.5%.

However, monthly analysis shows gasoline prices inched up 3.2% in May 2021, driven by supply disruptions in the US and OPEC’s production cuts.

Gasoline Prices in Canada

Wholesale trade

April 2021 saw sales in the wholesale sector increase by 0.4% to CA$71.5 billion. The surge was powered by solid growth in the sale of construction materials at 8.7% in the month to stand at CA$13.1 billion. However, wholesale volume declined 0.2%, caused by low sales in motor vehicles (and accessories). There is a higher housing/ renovation demand in Canada and the US, with exports of sawmill materials rising 7.8%.

The US Fed kept interest rates unchanged at a range of 0.00-0.25%, with the next meeting scheduled for July 28, 2021. It was optimistic that inflation by the end of 2021 might rise to 3.4% (+1.0% point- increase from the prediction in April 2021). However, it is expected that it will rise to 3.5% in 2022 and 2023, similar to the unemployment rate projection.

Housing statistics in the US indicated a rise in sales to 1.572 million in May 2021 from a previous reading of 1.517 million. However, the figures failed to meet estimates of 1.630 million. Monthly stats indicated a 3.6% increase from a decline of -12.1%.

Construction of new residential buildings in the US

The decline in crude oil imports also helped to trim losses for the US dollar at -0.845 million from a previous record of 0.620 million. Gasoline inventories also fell to 1.954 million barrels from a previous record of 7.046 million barrels. Further, (weekly) production of gasoline in the US inched up by 0.495 million from a previous decline of -0.135 million barrels.

Technical analysis

The USD/CAD pair has formed a rounding bottom pattern signifying a potential uptrend in the short term.

There is also an increase in trading volume. The 14-day RSI supports a strong bullish momentum at 80.81 (in the overbought region). The pair is moving towards key resistance at 1.2574.