- Indian scheduled commercial banks (SCBs) had a higher capital to risk-weighted asset ratio (CRAR) at 16.03%.

- Consensus estimates have put the trade balance at a deficit level of $6.32 billion.

- Forecasts have put the US trade deficit at $71.40 billion from a previous record of $68.90 billion.

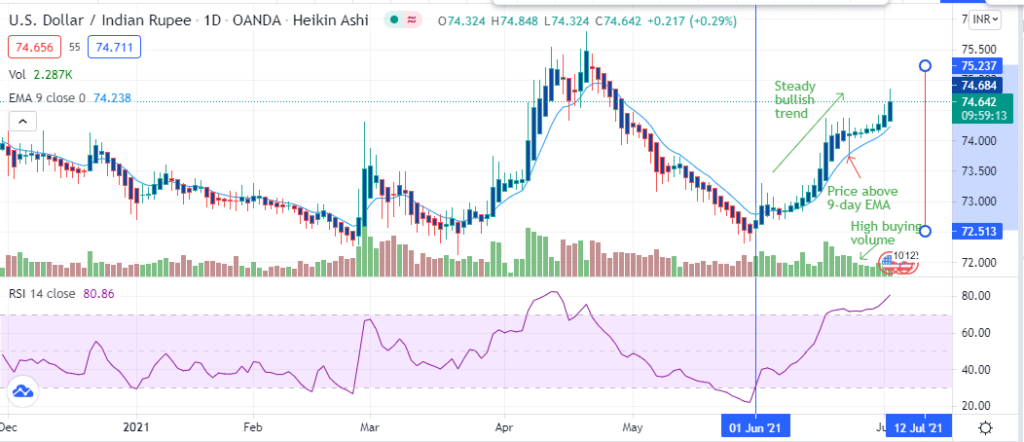

The USDINR pair added 0.33% as of 5:21 am GMT on July 2, 2021, from the previous day’s close. It traded from a low of 74.550 to a high of 74.885.

The Indian rupee lost steam after the Reserve Bank of India (RBI) released macro test results indicating increased non-performance of assets under commercial banks. Indian scheduled commercial banks (SCBs) had a higher capital to risk-weighted asset ratio (CRAR) at 16.03%.

The bank indicated that the ratio of the gross non-performing asset (GNAP) among the SCBs would increase from 7.48% (in March 2021) to 9.80% in March 2022.

India’s loan guarantee program

This record comes a day before the RBI releases the growth rate of bank loans (on July 2, 2021) that previously stood at 5.7%. India is planning to extend its bank loan guarantee program for small businesses to mitigate the effects of Covid-19. The program amounting to $35 billion is seen as a temporary measure and may not offer a robust push towards economic growth.

With the most affected businesses falling under the health and tourism sectors, the government would work well to consider the waiver of visa fees. In addition to the $35 billion loan guarantee, economists view it imperative to waive up to 500,000 visa fees for foreign tourists visiting India.

India’s economic growth forecast for the Fiscal Year 2021/22 has been reduced to 7.5-8% from a previous approximation of 10-11%. Despite the impact of the ravaging Delta Covid-19 variant, India has maintained a slow vaccination rate. About 11% of the population has been fully vaccinated, totaling 854 million people out of a total dosage of 3.09 billion.

Out of the 30.5 million cases identified, about 29.5 million people have recovered, while 400,000 have died since the start of the pandemic in 2020. The increased recovery shows a positive response rate of the Indian population to the vaccination mechanisms despite the slow progress. New coronavirus cases since June 16, 2021, have declined 63.39% from 2,330 cases to 853 cases on July 1, 2021.

Trade balance and forex reserves

Ahead of the release of the growth of deposits on July 2, 2021, India witnessed stagnated growth (of deposits) at 9.7% for May 2021. International (forex) reserves decreased 0.68% from $608.08 billion to $603.93 billion.

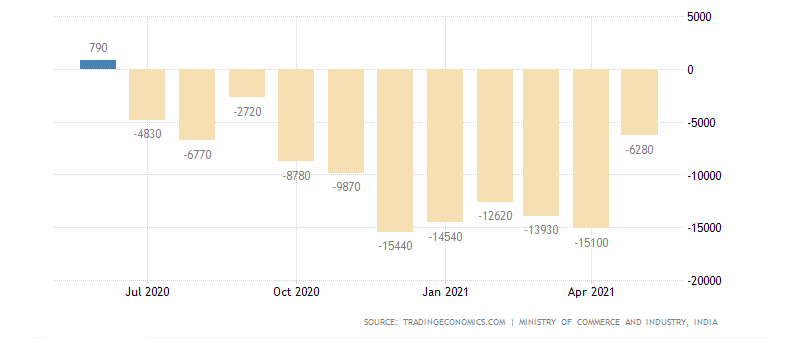

India reduced its trade deficit in May 2021 to $6.28 billion from a preliminary forecast of $6.32 billion.

Trade deficit of India since 2020

The increase in exports to $32.3 billion (69.4%) in May 2021 was offset by a rise in imports, particularly oil that surged 170.77% from $3.49 billion to 9.45 billion. Consensus estimates ahead of the trade balance report released on July 2, 2021, have maintained the deficit level at $6.32 billion. Imports are expected to stand at $38.53 billion against the import value of $32.21 billion for June 2021.

The US is also expecting to release the trade balance report for May 2021. Forecasts have put the deficit at $71.40 billion from a previous record of $68.90 billion and a decrease of international transactions to $195.7 billion. Personal income declined 2.0% despite a 6.4% growth in the GDP as of Q1 2021.

Technical analysis

The USDINR began a steady bullish trend on June 1, 2021, with the upward movement expected to hit 75.237, which is a key level before proceeding towards 75.500.

The price is moving above the 9-day EMA at 74.218, suggesting a bullish continuation. The 14-day RSI has stayed in the overbought zone at 80.84.