In the context of trading and investing, the term diversification means holding a broad variety of investments in a way that one’s portfolio isn’t dependent on any one investment. It’s mainly done to strike a balance between the potential risks and rewards that is best suited to an individual’s circumstances and financial goals.

Asset allocation refers to an investment strategy that focuses on diversification through different asset classes including stocks and bonds to optimize the risk/reward trade-off. Well allocated portfolios focus on maximizing returns for a given level of risk. How the proper asset mix is determined, entirely depends on one’s time horizon and financial goals.

Strategically Allocating Assets

The allocation of assets is the single most important factor when it comes to assessing long-term risk and return of a portfolio. Strategies that take into account a healthy mix of stocks, cash, and bonds in a portfolio are more successful than others. Poor asset allocation can result in diminishing returns and thus you should allocate your investment across a variety of investment classes. The concept of correlation is central to diversification. You should always examine how the returns of two investments move together and whether they move in the same or opposite direction to each other. As different asset classes have risk-return trade-offs, investors should always diversify.

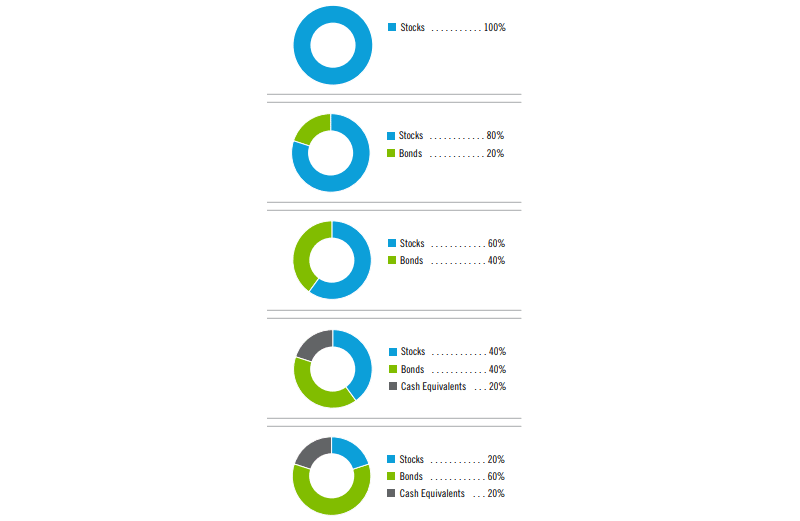

Choosing an Appropriate Mix of Assets

One of the first things you should do is to choose a healthy mix of bonds, stocks, and cash that suits your investment goals. You should take your time horizon, financial situation as well as tolerance for market shifts into consideration. When selecting bonds or stocks, you can use company size and geographical considerations as well as other factors while making your decision.

- Stocks: When it comes to stocks, it impossible to predict which one of them will outperform. Thus, you should always try to diversify within an asset class as well and stocks are no different. For instance, you can build a portfolio consisting of the small, medium, and large scale companies, along with some domestic and international stocks as well. Growth and value stocks should be considered as well.

- Bonds: Bonds provide a good way for fixed income investing, allowing investors to effectively diversify across a broad spectrum of sectors, maturities, and fixed income issuers. These help in improving your portfolio’s risk-adjusted return while protecting it against interest rate changes. They can prove to be a reliable income stream with the potential for capital growth and also offers a higher interest rate.

- Cash: You should always include cash in your portfolio for short-term needs, such as an impending down payment. You can go for a cash deposit at a financial institution for a fixed term.

- Property: Properties provide the benefit of diversification through access to retail, industrial, office, and infrastructure properties across various industries.

- Short-term investments: Short-term investments include short-term certificates of deposit and money market funds. Money market funds usually provide lower returns when compared with bond funds or individual bonds. Short-term certificates of deposits are insured and guaranteed by regulatory bodies.

It’s important to follow an asset allocation plan which is consistent with your time horizon, risk tolerance, and financial situations. Do not get distracted by rising markets and end up chasing higher-risk investments. Similarly, do not move to lower-risk investments and miss out on good opportunities during market downturns.

Portfolio Rebalancing

Simply diversifying is not enough. Once a target mix of investments has been established, you should regularly review and rebalance your portfolio. Market performance can have an impact on your portfolio allocation. You can either make it more aggressive or conservative than originally planned. Thus, evaluate your portfolio at least once per year and make the necessary modifications to bring it back in sync with your targeted mix.

Sample Allocation Plan

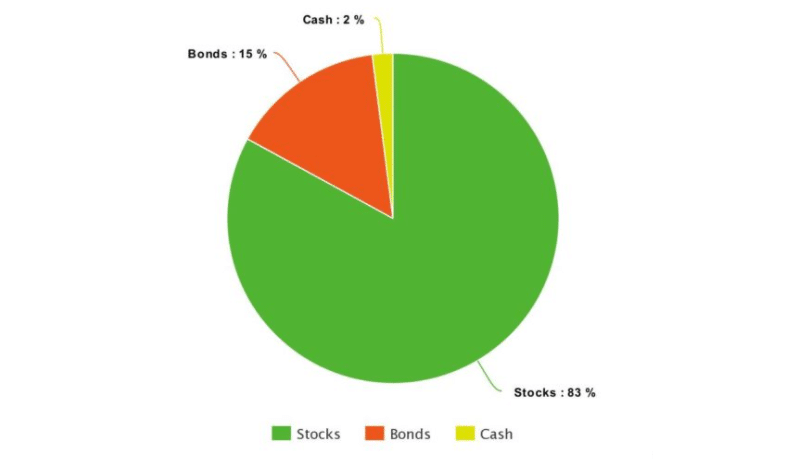

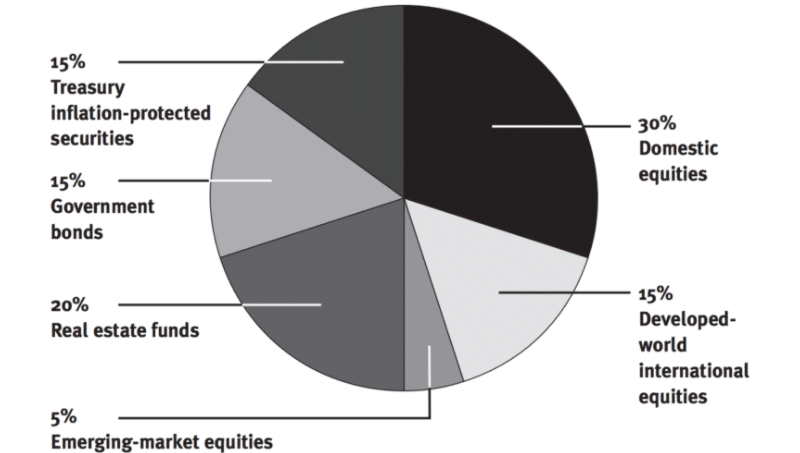

The samples below can offer you a general idea of what various asset allocation plans look like.

Examples of Diversified Portfolios

#1

| Asset Class | Percentage Breakdown |

| Cash | 2% |

| Stocks | 83% |

| Bonds | 15% |

#2

| Asset Class | Percentage Breakdown |

| Domestic equities | 30% |

| Real estate funds | 20% |

| Government bonds | 15% |

| Developed world international equities | 15% |

| Treasury inflation-protected securities | 15% |

| Emerging market equities | 5% |

Problems with Asset Allocation

Different notions of risk

There can be different notions of risk for different people. Some consider the risk to be the potential for, and magnitude of a capital loss. There are others who view risk as to the probability of achieving an investment return below some benchmark return. Thus, one asset allocation plan that is suitable for one investor cannot guarantee success in the portfolio of another.

Missed Opportunities to Switch assets

The capital market moves quickly. If you are too slow in interpreting markets, you can miss out on an opportunity to reposition your portfolio, undermining the overall portfolio performance as a result.

Based on Incorrect Information

The information you or your find managed uses to allocate assets can be stale, leading to false interpretations. This can cause inappropriate or ill-timed asset mix switches.

The Importance of Strategic Asset Allocation

Encourages long-term investing

A proper asset allocation strategy is designed to control the portfolio’s long-term makeup. Any changes made should be based on changes in your financial situation or age or progress towards your financial goals, and not based on present economic conditions or sudden market fluctuations.

Eliminates The Need To Time Investment Decisions

All investors know that market timing is difficult to implement. However, asset allocation helps in basing your strategy on risk tolerance and not on how to time the market.

Reducing Risk

Since different investments are affected differently by economic events and market factors. Owning different types of investments helps mitigate that risk. Investments with higher returns have more volatility and higher risk in the year to year returns. Proper asset allocation will achieve a balanced mix between more aggressive investments with less aggressive ones.

Final Thoughts

A proper asset allocation plan can help you to stay focused on your investment time-frame rather than reacting to market swings and news. Thus, you should choose this strategy only if you are in it for the long-run.