- Bitcoin and Ethereum under pressure.

- Terra up 70% outperforms the overall market.

- Geopolitical tension supports Terra price rally.

Cryptocurrencies are again under pressure after a recent bounce back from one-month lows. The likes of Bitcoin and Ethereum have struggled to hold on to gains above key support levels. The net effect has been a pullback below key support levels, all but fuelling concerns of a further correction lower.

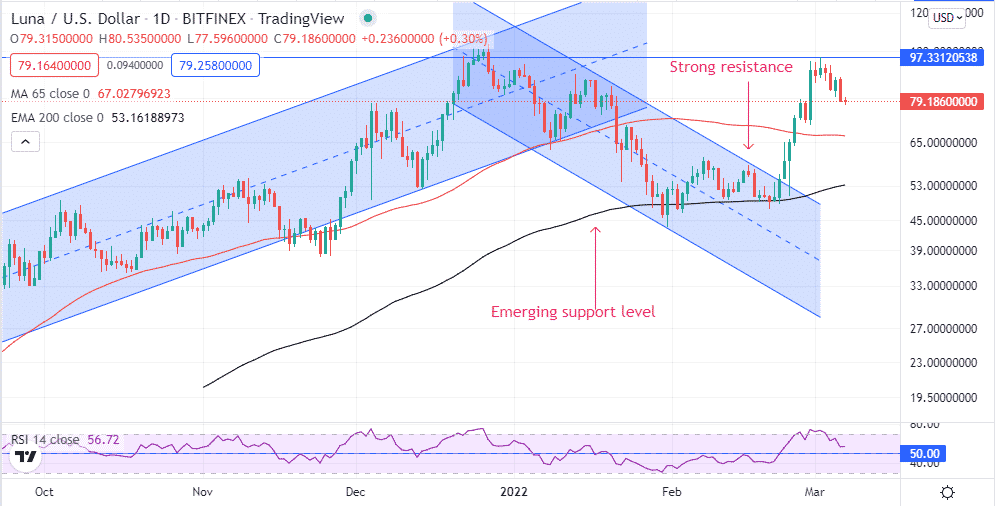

LUNAUSD technical analysis

Amid the ongoing sell-off, one coin has stood out, outperforming the overall sector. In recent weeks, Terra (LUNAUSD) has been flying high amid strengthened investor confidence on coins pegged to stable currencies.

Terra has turned out to be the best performing large-cap cryptocurrency by a mile. A 70% plus rally has seen it emerge as the seventh-largest coin above Cardano and Solana. After powering through a crucial descending channel, Terra has turned bullish, powering to two-month highs in recent days.

A rally to highs of $96 a coin left the coin on the cusp of powering through the $100 a coin psychological level. While LUNAUSD has pulled back to the $80 a coin level, it remains bullish, supported by a number of factors that affirm the underlying uptrend.

Source: Tradingview.com

In the short term, the $70 area is the immediate support level above which LUNAUSD remains well supported for further upside action. A breach of the support level could trigger renewed sell-off that could see the coin dropping back to the $59 handle, which happens to be the next substantial support level.

On the flipside, LUNAUSD finding support above the $80 a coin level could reignite upside action, resulting in the coin-making run for the $100 a coin level. A rally past the key psychological level should reaffirm the uptrend, setting Luna’s stage to register new higher highs.

Why is Terra rallying?

Terra has been on the front foot for the better part of the past few weeks on bulls flocking the unique algorithm stablecoin network. Luna Foundation Guard is fresh from raising a $1 billion Bitcoin fund to diversify the network’s reserves. It should also provide much-needed finance during times of financial distress.

In addition, Terra has benefited from investors turning their attention to stablecoins which tend to be relatively stable compared to other cryptocurrencies not pegged on any real-world asset. The risk-off mood in the market has seen investors shun riskier assets in favor of stable assets such as Terra, which is pegged on the US dollar.

Stablecoin demand is on the rise in the aftermath of Russia invading Ukraine. Western nations’ countries hitting Russia with crippling economic sanctions already have a ripple effect. Russian citizens are increasingly turning to stablecoins to hedge against the impact of the fallouts.

Strong demand for stablecoins as a store of value away from the Russian Ruble has helped support Terra’s recent rally to two-month highs. Investors looking to hedge against the geopolitical tensions should continue to support price rallies in the broader industry.

LUNAUSD has also benefited from the US dollar coming under pressure on treasury yields retreating in recent days. Treasury yields have retreated from one and half year highs amid concerns that the US Federal Reserve will go slow on rate hikes amid the geopolitical tension in Europe. Waning expectations of accelerated monetary policy tightening has triggered dollar weakness, all but offering support to LUNAUSD’s recent rally in the market.