Founded in 2009, XM.com broker provides traders with a full suite of MetaTrader platforms from MetaQuotes Software Corporation. Over the years, XM has grown into a significant online broker with various assets and over 400 instruments, including 57 currency pairs and 356 CFDs. Five cryptocurrency CFDs are available, such as Bitcoin, Dash, Ethereum, Litecoin, and Ripple.

Can XM be trusted?

Regulation

The XM.com brand (XM Group) is one of the trademarks of Trading Point Holdings Ltd (Trading Point Group), which owns an FCA registered UK legal entity with EU certification from MiFID, a CySEC registered legal entity in Cyprus, and an ASIC registered legal entity in Australia.

The company has three licenses that give it the right to provide services in different parts of the world:

- СySEC №120/10

- IFSC/60/354/TS/17

- ASIC №443670

Foundation

The broker made its foray into the financial industry in 2009.

History

XM Global Limited was established in 2017 and is headquartered in Belize, and is regulated by the International Financial Services Commission (IFSC / 60/354 / TS / 17).

Since its founding in 2009, XM has had over 300,000 active accounts. Traders from nearly 200 countries choose Forex broker XM because it offers trading tools such as Forex trading, stock CFDs, commodity CFDs, stock index CFDs, precious metals CFDs, and energy CFDs.

Location & Offices

Cyprus and offices in the UK, Australia. Head office address: No. 5 Cork Street, Belize City, Belize, California.

Markets overview

The broker provides trading opportunities in indices, FX, CFDs, commodities, and shares. Therefore, the company has a strong position based on the availability of instruments and diversification opportunities.

Forex trading

- There are more than 50 trading instruments in majors, minor, and exotic pairs through 16 trading platforms.

- Leverage is a maximum of 1:888 for all pairs.

Stocks

- Besides share trading accounts, XM offers CFDs trading in stocks so that investors can make money from both buying and selling.

- The broker provides the opportunity of trading stocks from more than 17 countries.

Commodities

- The broker offers commodities trading through most of its trading platforms.

- There are almost ten commodities for trading, including wheat, cocoa, coffee, corn, sugar, etc.

Equity indices

- Equity indices show the market sentiment and work as an influential price director.

- Besides, you can trade equity indices through XM brokers that include AUS200, EU50, FRA40, GER30, etc.

Precious metals

- The broker offers trading in silver and gold from the precious metals, futures CFDs in platinum, and palladium.

- Spreads in gold are as low as 0.3, and for silver, it is 0.03.

Energies

- The broker allows trading in energies like crude oil, Brent oil, and natural gas.

Shares

- You can buy shares (from the USA, the UK, and Germany) directly and without any CFD through this broker.

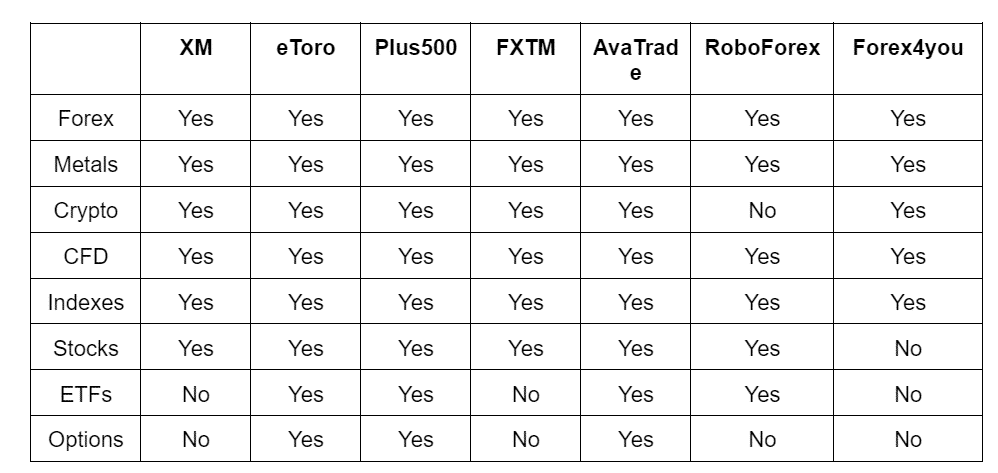

Comparison with other brokers

Platforms overviews

XM tried to catch all traders to introduce most platforms suitable for Mac, PC, mobile, and tab.

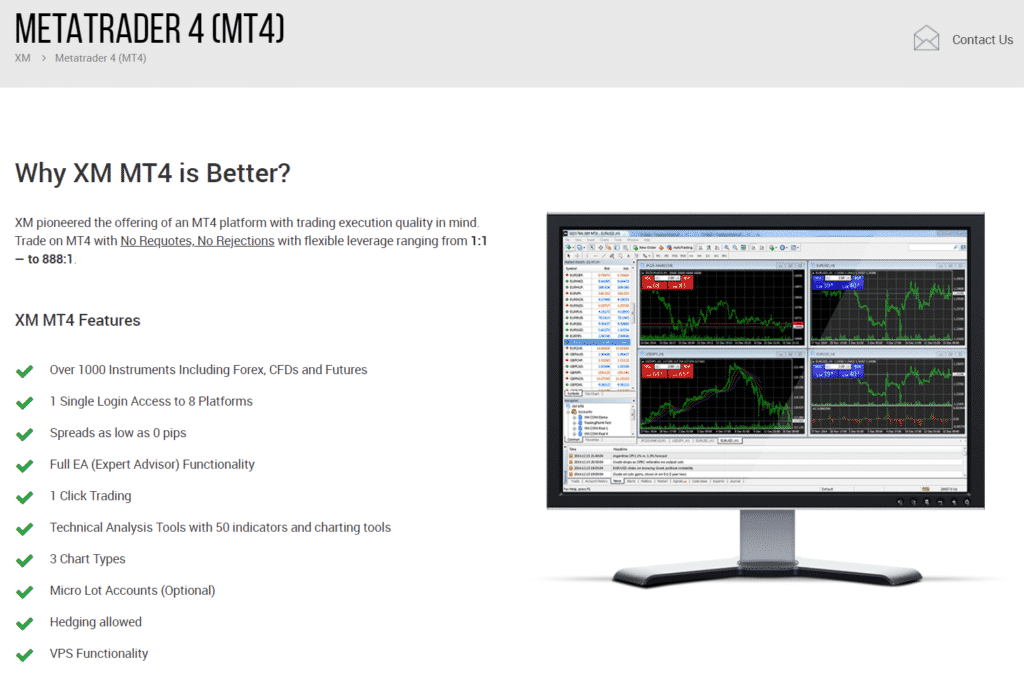

XM MT4 platform

It allows trading in a low-cost environment with a maximum of 1:888 leverage. In addition, this platform is easily accessible from both Windows and Mac.

Other functions are mentioned below:

- Over 1000 instruments

- Full EA functionality

- One login access to eight platforms

- Spreads as low as 0.6 pips

- One-click trading

- Technical analysis tools with 50 indicators and charting tools

- Three chart types

- Micro lot accounts

- Hedging allowed

- VPS functionality

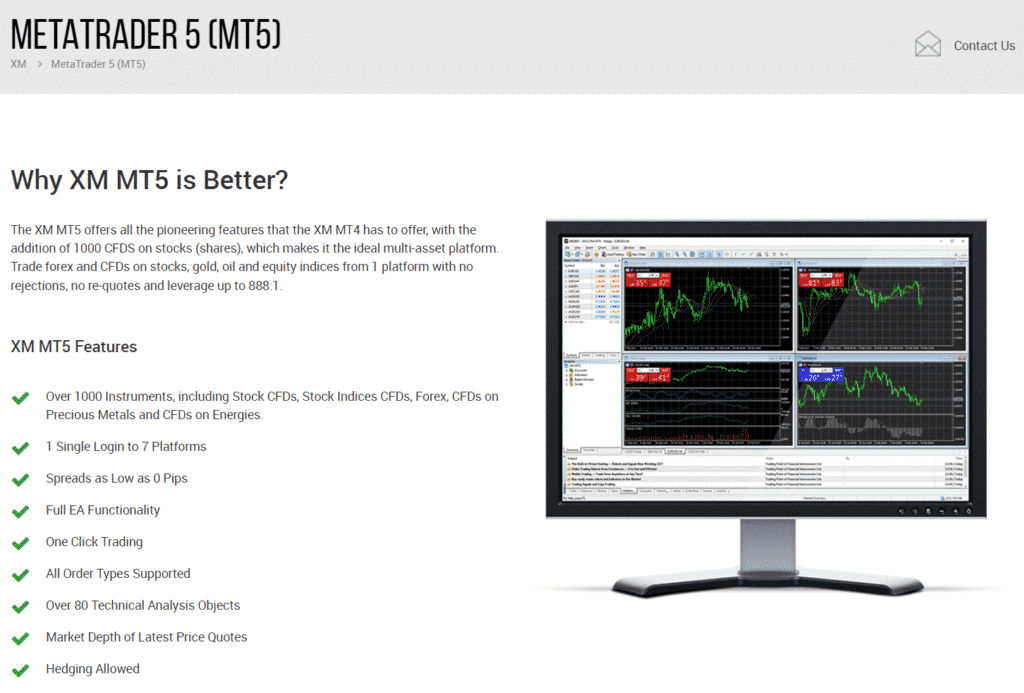

XM MT5 platform

MT5 is an advanced platform where traders can get the maximum benefit from the market. Moreover, here is the maximum number of timeframes and trading indicators with the opportunity of trading with an EA using the MQL5 languages:

- Over 1000 instruments

- Over 80 technical analysis objects

- One login to seven platforms

- Spreads as low as 0.6 pips

- Full EA functionality

- One-click trading

- All order types supported

- Market depth of latest price quotes

- Hedging allowed

Is XM good for mobile trading?

The broker is compatible with all smartphones and tablets, granting mobile traders a choice from two dedicated downloadable apps. The app works seamlessly on devices based on Android Lollipop and newer versions of the OS. Android users can get theirs from the Google Play Store.

XM fees

XM fees vary by account type. There are three account options available for traders to choose from, including Micro and Standard no commission, as well as XM Zero, which charges commission.

For example, on an XM Zero account, the average spread on EUR / USD is 0.1 pips (excluding commission), while on Standard and Micro accounts, where there is no commission, the average spread on the same pair is 1.7 pips.

Even with a commission of 5 USD per side (10 USD per full transaction) and an average spread of 0.1 pips on EUR / USD, the trade value is 1.1 pips (spread 0.1 + commission 1.0), which makes the accounts XM Zero is the firm’s most competitive offering.

It should be noted that XM acts as a dealer (principal) in all transactions, and as a market maker, does not carry out re-quotes on all types of accounts. This allows the broker to offer lower spreads in certain market conditions. Accordingly, both types of accounts can be helpful for clients with different needs.

Non-trading commissions

Among non-trading fees, XM covers all deposit and withdrawal transfer fees for payments from the following payment methods:

- Neteller

- Skrill

- Credit cards (VISA, VISA Electron, MasterCard, Maestro, and China UnionPay)

- Bank transfer is above $200

Market participants should be aware that some financial instruments can only be traded at certain times of the day, especially considering different time zones, and additional commissions may be charged if they hold these positions after they are closed.

Traders should always keep in mind that overnight fees, also known as swap or rollover fees, may be charged for positions left open for more than one day. For Islamic traders, XM offers an Islamic account option. The broker does not offer spread bets to traders, and therefore commission for spread bets does not apply to this broker.

Deposit & Withdrawal

Payment methods

The broker has both electronic and bank payment opportunities for traders. However, you have to follow some simple steps after opening the account to make a deposit.

Deposit options

To make a deposit, log in to your XM account using the user ID and password and click on deposit from the upper section of the page.

Later on, all deposit options will appear as shown in the image below:

- Credit/debit cards

- Neteller

- Skrill

- WebMoney

- Perfect Money

- SticPay

- Bank Transfer

- VLOAD

Withdrawal method

The deposit and withdrawal method should be the same for making transactions with XM. You have to log in to the website and click on withdraw from the upper right corner to initiate a withdrawal.

Other withdrawal methods are mentioned below:

- Neteller

- Skrill

- WebMoney

- International Wire Transfer

- Perfect Money

Minimum deposit

$5

Base currencies

USD

Where does XM excel?

- Lots of available trading instruments

- Provides trading opportunity through widely-used MT4 and MT5 platform

- Lots of research and education materials to keep clients profitable

- The possibility of using advisers

- Scalping strategies are allowed

- The possibility of several accounts opening

What are XM’s disadvantages?

- Does not provide cTrader platform

- Delays in the withdrawal of funds

- Just a few financing methods

- Difficulties in the work of technical support

Why is it best for?

The broker offers various accounts and instruments to attract more new clients. They have a solid training base where you can find different materials to help both experienced traders and newbies. The broker also offers various trading platforms to suit absolutely any type of trader.

Conclusion

XM is a broker that has been around since 2009 and is regulated by several bodies worldwide, including top-tier ASICs. It has a diverse set of tools to suit the needs of its users.

Since it relies on MetaTrader as its trading software, nothing will surprise you in this regard. The broker has a decent welcome bonus matching your first deposit 100% up to a maximum bonus of $5,000. It also has an extensive educational section, including free weekly interactive webinars. It is an ideal training platform for novice traders, and with three different account types, they cater to all types of traders depending on their specific needs.