Retirement portfolio creation is the process of creating an investment account that will help you in your old age. It is one of the best decisions you can make, especially during your younger years.

Furthermore, with the average retirement age being 61 and the average life expectancy being 78, you will need some income for about 17 years. Many experts recommend the so-called 80% income-replacement rate. The rule states that after retirement, you will need to make at least 80% of your working salary to live a comfortable life. For example, if you earn $70,000, you will need to make at least $56,000 per year.

In this article, we will look at the best strategy you need to take when creating a good retirement portfolio. As a rule of thumb, you should start this process early and save as much as you can for your retirement. Further, you should strive to match your 401 (k). This is where your employer puts a certain amount of money into your retirement account. This could be a dollar-to-dollar or a 50% matching.

Starting your retirement portfolio creation early

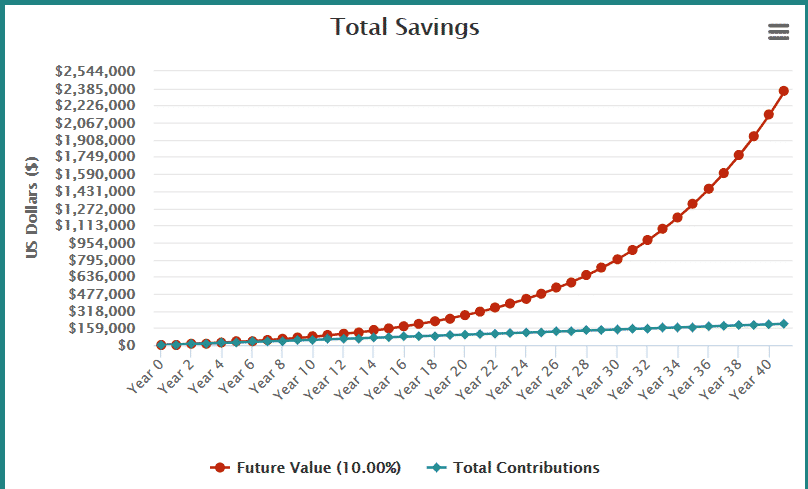

As mentioned above, it is recommended that you start investing for your retirement as early as you start working. For example, if you start working at 20 years and you decide to save about $400 per month, without interest, you will have $246,000 if you retire at 61. If you place these funds in an investment account that brings in a 10% return, you will have more than $2 million in your retirement account, as shown below.

Retirement simulation

However, if you start investing the same amount at 30, you will have about $881,000 when you retire at $61. Therefore, this example shows you the benefit of starting early and having money in an interest-yielding account. Without interest, your funds will be losing value because of inflation.

Assets to invest in for your retirement

Fortunately, there are many assets you can invest in when creating a retirement account. Here, we look at the most popular ones.

Stocks or equities

A stock is partial ownership of a company like Amazon, Microsoft, and Google. Stocks make you money through share price appreciation and dividends. When creating a self-managed retirement fund, you should go for companies that meet certain criteria, including:

- Market share. You should focus on companies with a substantial market share in their respective industries.

- Growing or stable growth. Focus on companies that have demonstrated a track record of increasing their revenue. Avoid firms with slowing revenue and profits.

- Growing industry. Focus on companies within growing industries. For example, companies like Microsoft and Amazon are leaders in the fast-growing cloud computing industry.

- Shareholder returns. Unless for growth companies, invest in companies that return money to their shareholders through buybacks.

Exchange-Traded Funds (ETFs)

An ETF is a financial product made of tens, hundreds, or thousands of assets. For example, the Invesco QQQ is a single financial product that tracks 100 companies that make up the Nasdaq 100. There are many types of ETFs, including stocks, commodities, and bonds.

Stocks ETFs track companies that meet certain criteria. For example, the Vanguard Value ETF only invests in companies that are undervalued while the Vanguard Real Estate ETF tracks REITs.

If you don’t have any experience in picking individual stocks, having a few ETFs in your retirement portfolio is the easiest path to take. For example, you can select just five diverse ETFs and have a solidly diversified ETF.

Bonds

Bonds are loans offered to large companies, municipalities, and countries by investors. The recipients then promise to pay interest periodically. The maturities of bonds can range from two months to more than 100 years.

Most retirement experts recommend that you have some bonds in your account. Like in stocks, you can set aside some of your money to buy several bonds. Alternatively, you can invest in a few quality bond ETFs.

However, with interest rates so low, it means that the overall returns from the bond market are relatively weak. Also, because of the importance of your retirement portfolio, you should only invest in safe government and corporate bonds. Avoid high-yield bonds because of the risk of defaults.

Alternative assets

There are other alternative assets that you can invest in your portfolio. Some of the most popular ones are:

- Real estate. You could build and lease homes or offices. This option is relatively expensive to start with, but it offers you excellent cash flow and value appreciation.

- Cryptocurrencies. These are high-risk assets that have experienced robust growth in the past decade. You should invest a tiny amount of funds in them.

- Commodities. These assets include gold, silver, lumber, and platinum, among others. You can invest a small amount in them directly or through an ETF.

- Peer-to-peer lending. These are companies like Lending Club and Prosper that let you lend money to other people.

Creating an ideal retirement portfolio

Now that you know the types of assets you can invest in, how do you create this portfolio? It is recommended that you sit down and think about your retirement needs. This is important because we all have different needs. After this, you should come up with an asset allocation strategy.

For example, you can decide to allocate 70% of all your retirement funds to stocks and ETFs, 20% to bonds, and the remaining 10% to high-risk assets like cryptocurrencies and commodities. The benefit of such a portfolio is that stocks have a long history of generating solid returns.

Therefore, you can be sure that your funds will do well in a long period. Also, the 20% you have allocated in bonds will help to provide stable interest income. While assets like cryptocurrencies are highly risky and volatile, they also offer substantial returns.

Final thoughts

In this article, we have looked at the importance of having a retirement portfolio and the benefits of starting early. We have looked at some of the best assets that you can invest in for your retirement and how you can create a model portfolio from scratch.