Absolute FX uses a scalping method that does not produce any loss as per the developer. It does not use dangerous methods like the grid and Martingale. The Smart Forex Lab, the company behind this system claims that the EA has a win rate of 99.5%. The use of trend-following strategy, Bollinger Bands, and SMA are attributed to the high win rate.

Is Investing in Absolute FX a good decision?

According to the company, this FX EA has a proven winning rate of 99.5% based on the backtesting done from 2015 to 2020. To check the veracity of the claim, we have analyzed the features, performance in real and backtesting, and other aspects. Our evaluation reveals that the ATS has backtesting and real trading results that show decent profits. However, the lot size used is high indicating a high risk and the profits are not very high,

Company profile

This FX EA is developed by Aleksei Ostroborodov based in Russia. He is the founder of the Smart Forex Lab. He has four years of experience and has created 11 products and 16 signals. Other products of the author include True Range Pro, Euphoria, and Good Morning. The author provides links to the Telegram channel of the company, the Telegram group, YouTube channel, and Instagram for support.

Main features

Some of the significant features that the author focuses on for this FX EA are:

- The ATS uses calculated or hard SL and TP levels.

- It has regular or relative money management levels.

- Different modes are used including manual, risk, and auto volume modes.

- An optional trailing stop is present along with spread control.

- The FX robot is optimized and backtested from 2015 to 2020.

Recommendations for using the FX EA include the use of aWeltrade Hedge account with a minimum deposit of $200 and the leverage starting from 1:50. For VPS, the author suggests the use of TradingFX VPS and FxCash for Rebate.

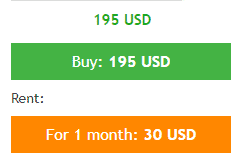

Price

To buy this MT4/5 tool, you have to pay $195. A monthly rental package is present that costs $30 per month. The developer does not provide info on the features included with the package. There is no money-back guarantee for the product which makes us doubt the reliability of the product. Furthermore, when compared to the market average, the price of the product is expensive.

Trading results

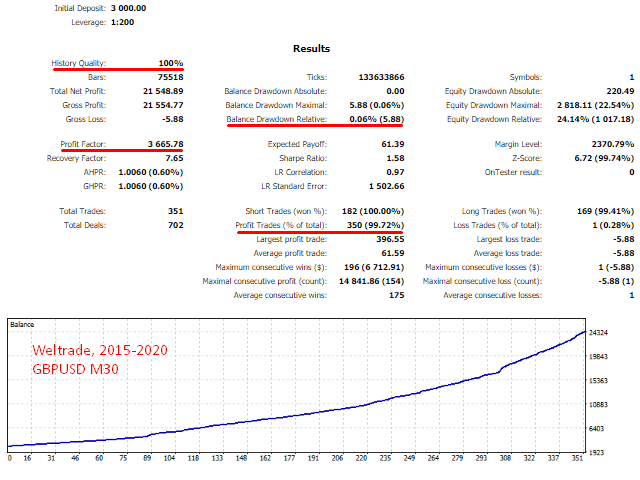

A couple of backtests are present on the official site. Here is one of the backtesting results:

From the above strategy tester report, we can see a total net profit of 21,548.89 was generated from an initial deposit of 3000 for the GBPUSD pair and the leverage of 1:200. The profit factor was 3665.78 and the profit trades percentage was 99.72%. A maximum drawdown of 22.54% was present. From the above results, we can see that out of 351 trades all short trades have won resulting in a very high profit factor. However, the performance cannot guarantee a similar result in the future as backtests are based on historical data.

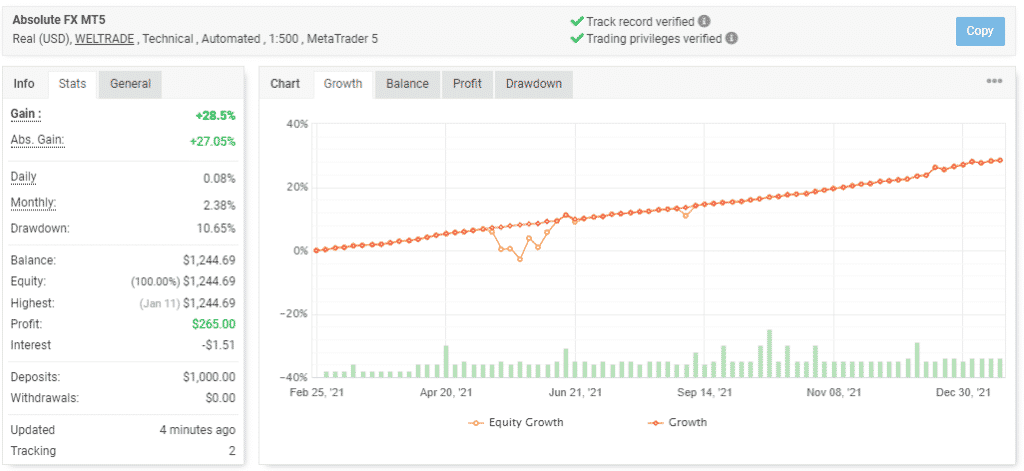

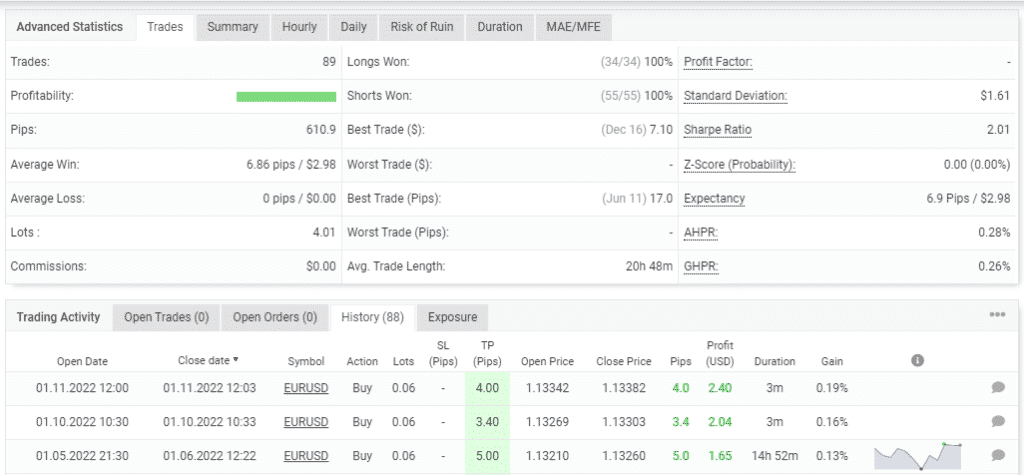

We found a real trading account for the FX robot verified by the myfxbook site. Here are a few of the screenshots.

From the above stats, it is clear that the system has a high winning rate. The real trading stats show a profit of 28.5% and an absolute profit of 27.05%. A daily return of 0.08% and a monthly growth of 2.38% are present. The drawdown for the account is 10.65% which is very low indicating a low-risk approach. For a total of $1000 as a deposit, the system had generated a profit of $265 and completed 89 trades. The profit factor value is not provided.

From the trading history, we can see that the lot size used is very high and sizes of 0.05 and 0.06 are used. Comparing the backtesting results with real trading, we find that the performance seen in the backtesting cannot predict the future performance of the system. A comparison of the backtesting and real trading reveals a high win rate with a low drawdown value.

Customer reviews

Unfortunately, there are no reviews from users of this FX EA. Sites like Forexpeacearmy, Trustpilot, etc. provide an unbiased review.

Absolute FX review summary

Absolute FX claims to provide a 99.5%-win rate as proven by its backtesting. Our assessment of the system shows that the backtesting and real trading results show decent profits. But the big lot size used in real trading indicates a high-risk approach. Other downsides of the system include the lack of strategy explanation, expensive price, and the absence of a money-back assurance.