Adaptive EA is available on MQL5 at a fair price. It can trade on any currency pair, metal, cryptocurrency, or oil. To learn how the system works, you are advised to just run it in the tester. Moreover, you need to watch the tutorial video posted on the MQL5 page before using the advisor.

Is investing in Adaptive EA a good decision?

We have learned that the EA works with high risks to the balance, having generated a high drawdown in a live account. Traders are also not happy with its overall performance.

Company profile

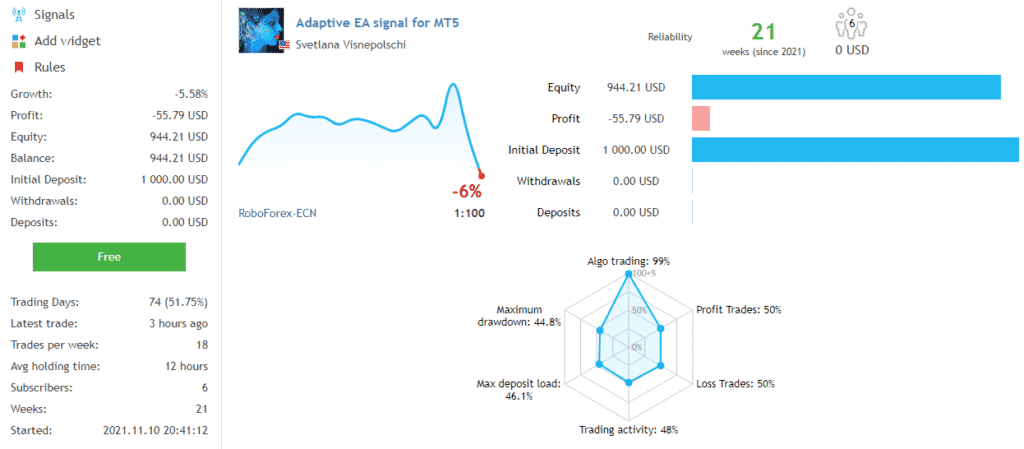

This EA was authored by Svetlana Visnepolschi. She lives in the United States and has not created other trading systems. Svetlana’ trading experience or professional background is not indicated. As a result, her ability to develop efficient trading tools is not known.

Main features

Below you will find a list of the key features of the robot:

- It is fully automated and easy to use.

- It includes a take profit, stop loss, and trailing stops.

- The system restricts buy and sell orders.

- The EA comes with a grid order size multiplier.

The system works with neural networks, which are trained to carry out random transactions. Unfortunately, the vendor doesn’t take the time to explain this trading approach thoroughly.

Price

Adaptive EA is fairly priced as the vendor is currently selling it at $185. You may ask, is the system worth this price? Well, the next section will help us to see if it generates significant returns on investment.

Trading results

The EA’s backtest results are missing. This test normally seeks to approximate the performance of a strategy. It posits that if the approach worked earlier, it has a better chance of performing efficiently again. The reverse is true for a trading method that didn’t work in the past.

You can already tell that these results are not verified since they do not come from a third- party site like FXBlue and Myfxbook that usually substantiate the authenticity of trading data.

This account was deployed in November 2021, and by trading with a deposit of $1000, the EA has made a loss of -$55.79. As a result, the balance has decreased to $944.21. About 18 trades are implemented per week, and the average holding time for each is 12 hours. The large drawdown (44.8%) produced is a sign that the trading strategy is risky.

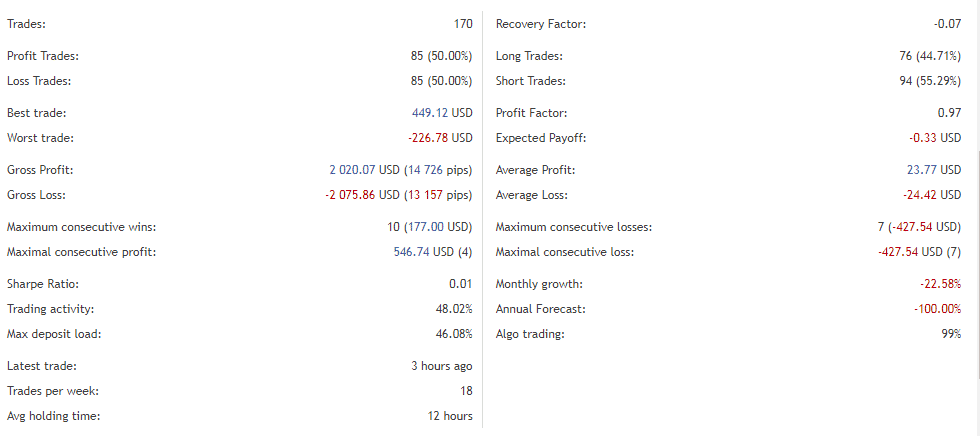

Out of the 170 trades executed so far, only 50% were successful. Going by the average loss (-$24.42) and the average profit ($23.77) data, we see that the EA’s losing streak is a bit higher than the profitability rate. The profit factor of 0.97 also shows that the bot brings lesser returns than the amount invested.

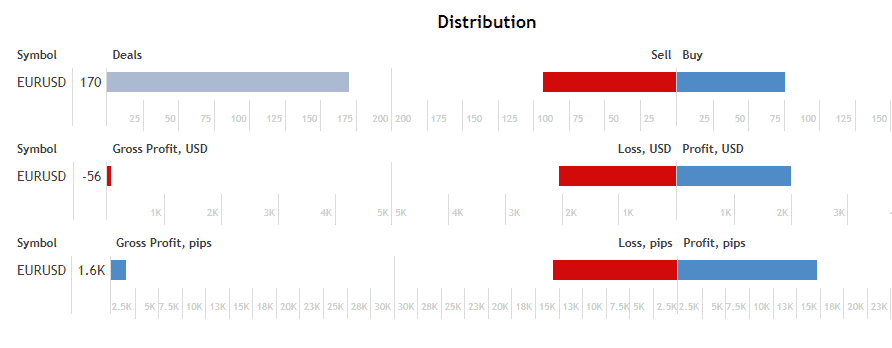

All trades were completed using the EURUSD currency pair. The resulting gross profit is 1.6K.

Customer reviews

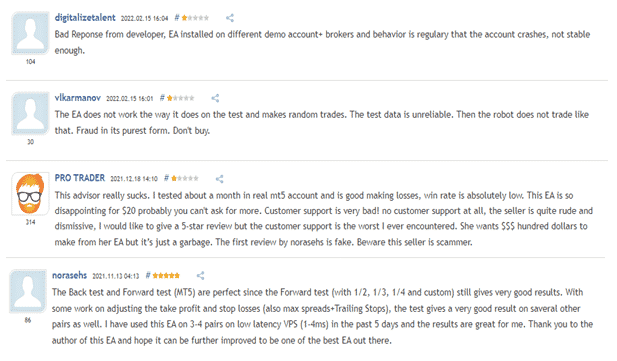

Adaptive EA has received a total of 7 reviews on MQL5, where 5 of them are negative. According to these customers, the EA is not stable enough, makes random trades, generates low win rates, and can crash accounts. The vendor is also accused of providing poor customer support. One of the happy customers says that backtest and forward tests for this robot give good results.

Summing up

Obviously, Adaptive EA is fully automated and easy to use. Unfortunately, traders say that the system is inefficient and unreliable. As we assessed the live trading results, we also noted that it has made losses for the account and generated a high drawdown as a result. These findings coincide with the customer’s comments.