Agimat Trading System is an FX trading service offering actionable FX indicators for the MT4 and MT5 platforms and TradingView. The company boasts more than 11000 product installations. With the various FX trading tools this vendor offers, you can trade stocks, commodities, cryptos, metals, futures, and more besides currency pairs. As per the vendor, the trading tools use the scalping strategy for ensuring high performance.

Is investing in Agimat Trading System a good decision?

For reviewing this FX trading service, we have assessed the features, performance, support, user reviews, and other factors meticulously. From our analysis, it is obvious that this service is not worth investing in. The insufficient contact information, suspicious-looking real account results, and negative user reviews indicate reliability is an issue with this company.

Company profile

This FX trading software is developed by Dennis Buchholz, the founder of the F.X.Tech Group Ltd. The company comprises offices in Hong Kong and Span and has approval from the USPTO (the United States Patent and Trademark Office). In the About Us section, we can find the images of the founder and other team members.

However, there is no info about their experience and expertise. We could not find the location address or phone contact. An online contact form and a live chat feature are present for support. We find the vendor details insufficient indicating that transparency is not present.

Main features

As per the website info, the features of this company include free FX signals, a dedicated trading app, continuous software updates, and a single upfront payment with no additional charges. On purchasing the software license from the company, you will be linked to the FX trade copier where all the scalp trades of the developer can be copied. The developer offers the trade copier free when you purchase the trading software.

A combination of artificial intelligence and neural network processes is used by the developer for ensuring accuracy and profits. While there is mention of the scalping method of approach used, the developer does not explain the strategy which is disappointing. Furthermore, there are no backtests to know about the efficacy of the approach and the performance of the system.

Price

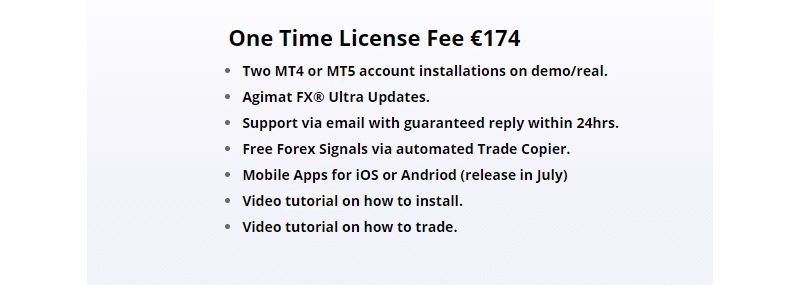

For using this FX trading system, you need to pay a one-time license fee of €174. The price includes two demo/real accounts of MT4 or MT5 version, regular updates, email support, free FX signals through the automated trade copier, and video tutorials for installation and trading methods. Compared to the price of competitor trading systems, we find the price of this MT4/MT5 trading tool is expensive. The absence of a money-back guarantee indicates the unreliability of the software.

Trading Results

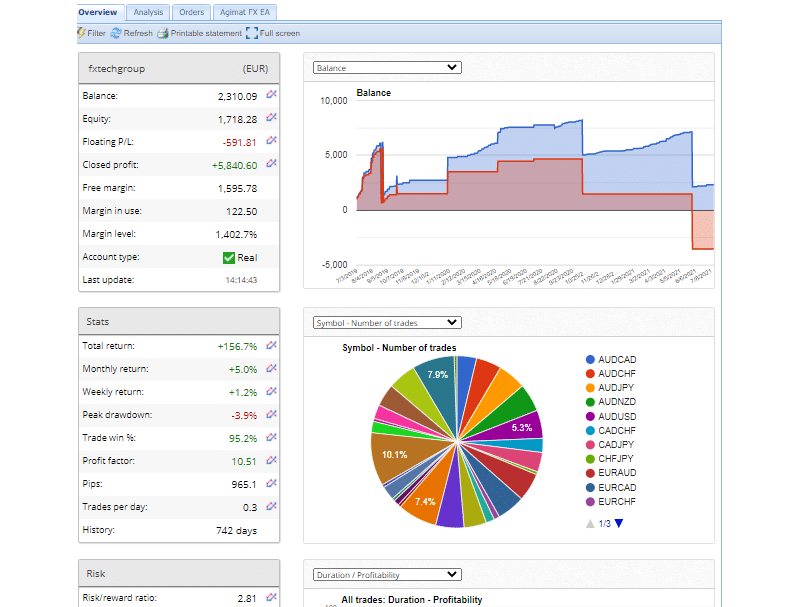

A real live account verified by the FXBlue site is present on the official site. Here is a screenshot of the EUR account trading statistics and other details:

From the above image, we can see the FX EA has turned up a total profit of 155.9% with a monthly and weekly return of 5.0% and 1.2%. The peak drawdown for the account is less than 3.95 and profitability is 95.2%. A profit factor value of 10.51 is present.

For a trading history of 742 days, the risk to reward ratio is 2.81 with the average number of trades per day being 0.3. While the sample size is large, the profits are not satisfactory comparatively and the profit factor value and low drawdown look suspicious. Without backtests to compare the real trading results with, we are unable to assess the efficacy properly.

Customer reviews

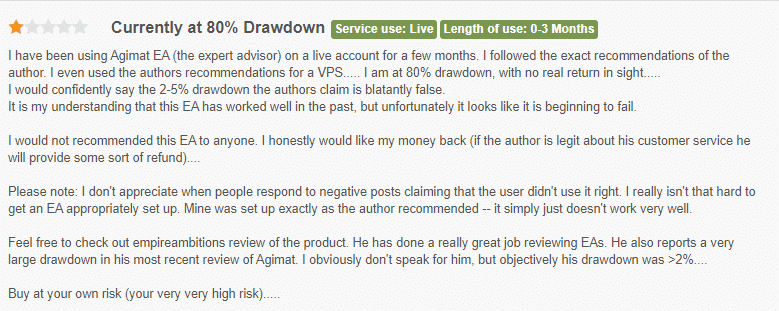

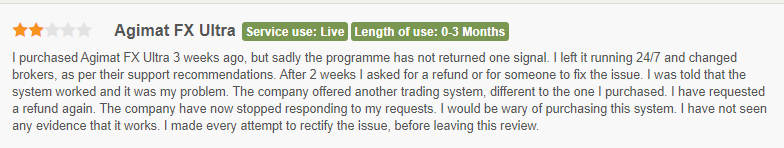

We found 267 reviews for this company on the Forex Peace Army site. Here are a few of the feedbacks:

From the reviews, it is clear that the drawdown is not as low as the developer claims. As we already indicated in the trading results analysis the stats appeared suspicious and the review confirms our suspicion that the performance is not as good as the vendor claims. Another user indicates that the program has not generated any signals and also reports that the customer support is poor.

Agimat Trading System review summary

As a company offering indicators and expert advisors that focus on the scalping approach, this service does not appear to be trustworthy. While the developer claims that the drawdown is low and trades are accurate, our analysis reveals the performance is not effective. The lack of explanation of the strategy, absence of backtests, and suspicious-looking real account trading results raise a red flag. The insufficient info related to the vendor, inadequate support, and negative user reviews confirms our suspicion that this is not a trustworthy system. We would not recommend this service due to the abovementioned reliability issues we found in the service.