For beginner investors, all assets look and sound the same. As you grow more teeth and learn to take bigger and more difficult bites, you will begin to notice some subtleties. Thankfully, the industry has been fortunate enough to have professionals who bundled assets into categories, usually based on liquidity, risk, and many other factors.

One such crucial categorization is ordinary versus alternative investments. Ordinary/conventional assets are those that you probably heard the first time you knew how to invest. Such assets include foreign currency (forex), bonds, and stocks. Even cash is a conventional investment instrument.

Why are they called alternative investments?

The word conventional speaks of commonality and multitude, something that all market participants are likely to get into from the outset. This means access to conventional assets is easy, and the associated risk is manageable even by novices. Also, this implies that alternative investments are, in a sense, too complex or complicated for beginners to find their way around easily.

Various reasons preceded the idea of alternative investments, but the most prominent one is that major regulators such as the SEC do not regulate them. Also, the assets are comparatively illiquid, and only institutional investors or deep-pocketed and accredited individuals can dabble in them successfully.

Also, alternative investments get their designation because their correlation with conventional investments is usually low. Further, their valuation methods are complicated.

Despite their peculiarities, alternative investments are not infeasible to retail traders. Thanks to mutual funds, exchange-traded funds (ETFs), and alt funds, retail traders can access alternative investments without exposing their money to huge risks and illiquidity.

Alternative investments: Major categories

There are five major categories of alternative investments, and we will look at each of them separately.

Private debt

Private debt arises when privately-held companies borrow money to plug a shortage. Note that the word “private” does not refer to the borrower; instead, it refers to the instrument. Private debt also arises when a non-bank institution buys debt from secondary markets.

Often acquired when borrowers are in financial distress, private debt takes on substantial leverage. Institutions that offer private debt are called private debt funds. These institutions earn from the instrument through interest paid on the loan amount.

Investors tap into the income potential of the private debt sector by buying into private debt funds. The investment instrument generates higher yields than conventional investment instruments, and they are inflation-adjusted (through adjustable interest payment on the loans).

Private equity

The “equity” part of the term is evident as it refers to a company’s shares. The “private” part means the shares belong to a company not listed on an exchange, such as the NYSE. This category of alternative investment instruments is broad, but we can divide it into two smaller categories:

- Venture capital. It involves financing startups and small businesses that would typically be of little interest to risk-averse investors. This kind of financing identifies assets believed to potential to grow immensely in the long-term.

- Growth capital. It is the money that goes to mature companies that intend to expand their operations. The capital could go into restructuring operations, financing acquisitions, or venture into new markets.

The risks involved in private equity investment are higher, and so are the rewards. Because private equity firms target early-stage companies, the return from investments is often immense when the companies pick up as expected.

Real estate

This asset class is popular for being a rich man’s source of passive income. The asset class comprises real assets such as farmland or timberland and even intellectual property. Because of capital appreciation, the real estate grows in value with time, making it difficult for small investors to make an entry.

Investing in real estate is challenging for retail traders because one needs a great understanding of real asset valuation. The valuation process often requires skilled professionals whose compensation is pricey. This is why the asset class is popular among institutional investors and high-net-worth individuals.

Hedge funds

Consider this scenario: you and your friends have been meeting regularly, and in one sitting, one of you suggests that you pool money to put in an investment instrument. Because none of you has investment skills, you decide to hire a professional to manage the pool of funds. This is a bare-bones description of a hedge fund.

Hedge funds have set targets – largely to minimize risk and to maximize income. Most hedge funds are exclusive clubs for deep-pocketed investors. However, mutual funds and ETFs have extended access to small traders.

Commodities

A commodity is anything that has intrinsic value. For example, gold makes expensive jewelry, and natural gas powers automobiles and enables you to cook. Most commodities are expensive, and the only realistic channel that retail traders can use to access them is through CFDs. But CFDs are not safe because they come with overblown risks due to leveraged trading.

In a sense, we can categorize commodities like real estate because their value tends to appreciate over time. Investors often exploit this attribute to hedge against inflation. As you can guess, there is a high demand for commodities, especially when conventional assets are underperforming.

How can you buy into alternative investments?

We have already spoken about the risk involved in alternative asset investment and that retail traders cannot manage it. The initial capital required to acquire these assets is vast, which again cuts retail traders out. How then can retail traders tap into the growth potential of this sector?

Retail traders can buy into mutual funds and ETFs that include alternative assets in their portfolios. For instance, a mutual fund can summon enough capital to buy gold or farmland and then distribute its shares to individual traders. All the mutual fund investors will divide profits and losses depending on the size of their shares, or as set out in the constitution.

Benefits of investing in alternative assets

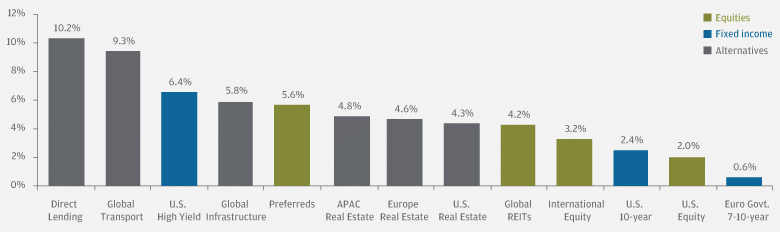

As you have seen, alternative investments are high risk but with high rewards. So, the biggest benefit of buying into alternative assets is the possibility of earning a larger income within a short period. A JP Morgan analysis shows that alternative assets outperform other asset classes in terms of yields.

Additionally, alternative assets complement traditional portfolios by helping to hedge against inflation. They are particularly important to long-term minded investors.

Conclusion

Sophisticated investors are always looking for ways to maximize the return of their portfolio. Such investors will not miss the opportunity to leverage alternative asset high-yield potential to complement conventional assets.