Amaze is a fully automated expert advisor that claims to spot and capitalize on global vulnerabilities that occur in the market. Developed by Anton Kondratev, this MT5 tool works on multiple currency pairs. As per the developer, every trade executed by the FX robot has a fixed level for its TP and SP. He claims that this EA uses pending orders present already in the server of a broker which helps to reduce latency.

Is investing in Amaze a good decision?

This FX robot claims to provide maximum profits with minimum risk. We have evaluated the features, settings, trading approach, and performance of the system in this review. While the vendor provides a few backtests, there are no verified real account trading results. Further, the developer does not explain the approach used and there are other factors like the price, support, and user reviews that are not satisfactory. Our initial conclusion is that this is not a reliable FX EA.

Company profile

Anton Kondratev is the developer of this ATS. As per his MQL5 profile info, he is from Russia and has developed 2 products namely the MT4 and MT5 versions of Amaze. He has published 3 signals and 805 demo versions. There are 16 subscribers and he does not have prior experience in trading.

Under his profile, he has given the Telegram link and links to several of his blog posts including his strategies posted on the myfxbook site. We could not find a phone contact or any other forms of support other than the Telegram channel link which is inadequate.

Main features

According to the developer, the MT5 tool has inbuilt features for protection against issues like gaps, repeated levels, large spreads, and broker slippages. This EA focuses mainly on the EURUSD pair and uses the H1 timeframe. It does not trade at night and executes only one trade for a currency pair. Virtual SL and TS are optional settings. A Grid with a fixed SL for averaging is another optional setting.

With the new filter feature, the system is capable of analyzing the broker and adapts to the delays and slippages. The developer recommends a minimum deposit of $100 and a leverage of 1:500. Other recommendations include brokers with minimal and zero spreads and VPS with PING less than 5ms. There is no mention of the strategy or an explanation of the trading approach used by this EA. This raises a red flag.

Price

To use this FX EA, you need to shell out $395. A rental option is also present which costs $345 for three months. There is no info on the features you get with the package. Moreover, there is no money-back guarantee offered. This makes us suspect the product is not a reliable one. Further, compared to other similar expert advisors in the market, the cost of this ATS is exorbitant.

Trading results

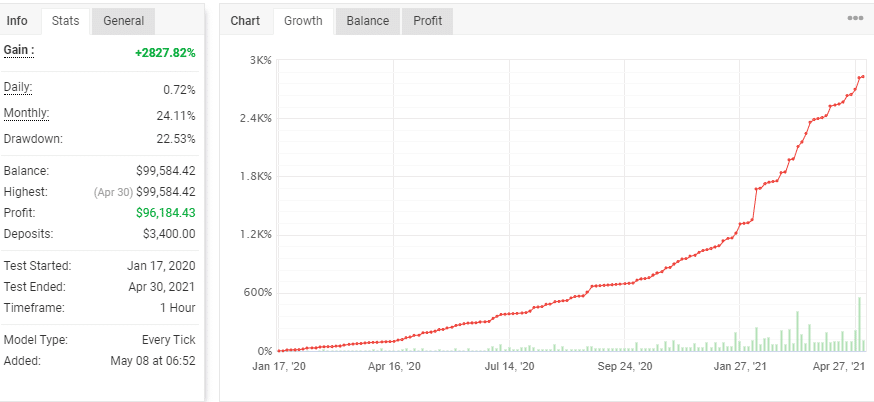

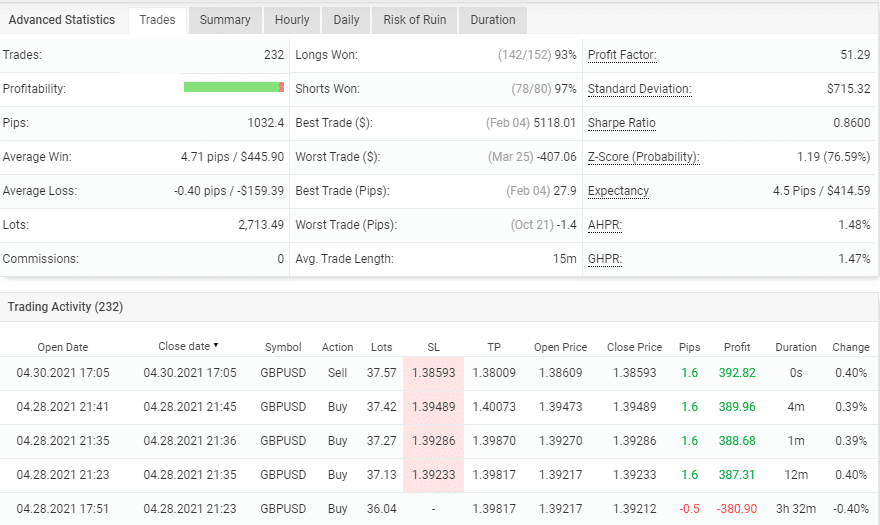

The developer has several backtests posted on the myfxbook site. Here is a backtest done on the GBPUSD pair.

From the trading stats, we can see the test started in Jan 2020 and ended in April 2021 using the H1 timeframe reveals a total gain of 2827.82% for a deposit of $3400. A daily profit of 0.72% and a monthly profit of 24.11% are shown for the account which has a drawdown of 22.53%. For a total of 232 trades, the profitability is 95% and the profit factor is 51.29.

Lot sizes are high and range from 31.65 to 37.57. While the profits are high, since the test is based on historical data, we cannot expect a similar result in future performance. Further, the developer does not provide real account trading results. Thus, it is not possible to compare the two and find out the efficacy of the FX EA.

Customer reviews

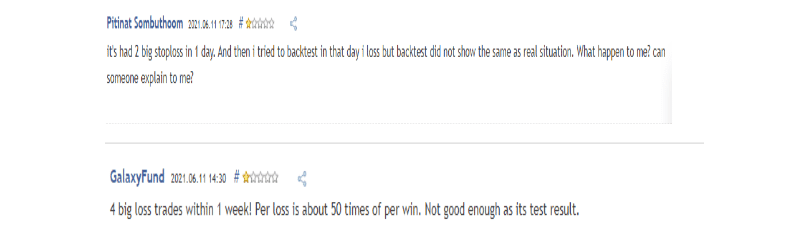

We found 16 reviews on the MQL5 site for this EA. Here are a few screenshots of the feedback.

From the user testimonials, we find that the real account results are not as shown in the backtest. One of the users reports two big SLs in a single day and another user reports four losing trades in a week. The reviews confirm our suspicion that the performance is poor and the strategy used is of high risk.

Amaze review summary

Amaze is an MT5 tool that claims to provide big profits and low risk. But our evaluation of the system reveals that it does not provide a proven track record. The developer provides only backtests which show suspicious-looking results. Further, the absence of real account trading makes us suspect the reliability of the system. The expensive price, lack of money-back guarantee, and negative user reviews are other downsides that confirm this is an unreliable EA.