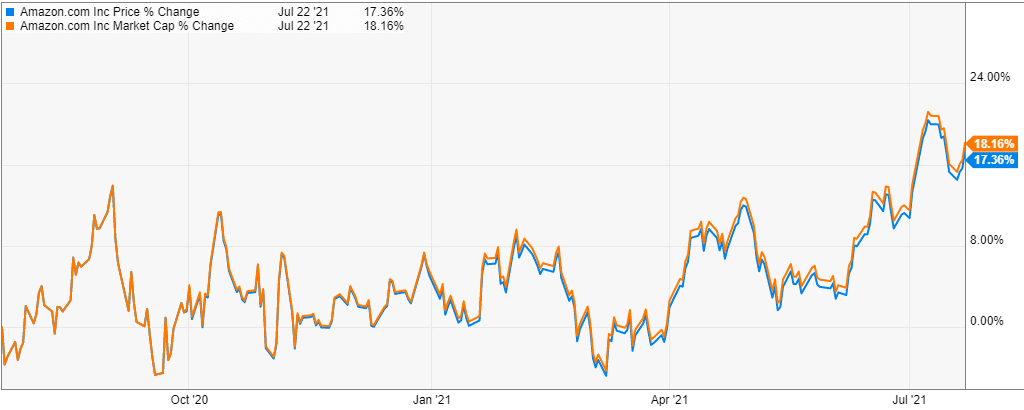

- Amazon stock has risen more than 388% in the past five years and added 17.36% since July 2020.

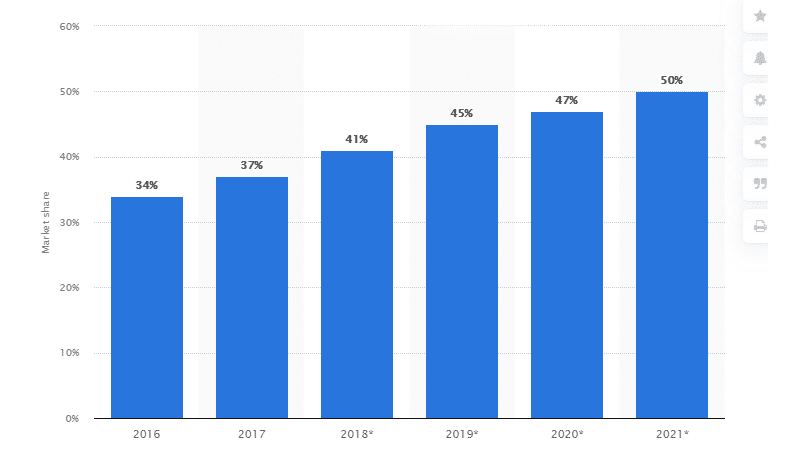

- Amazon’s market share has risen from 34% in 2016 to a projection of 50% in 2021.

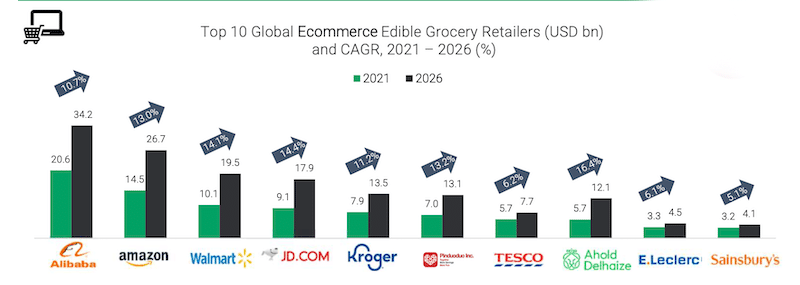

- The sale of edible groceries in Amazon is expected to grow 84.14%, from $14.5 billion in 2021 to $26.7 in 2026 at a CAGR of 13%.

Touted as the world’s fifth most expensive stock, Amazon.com, Inc. (AMZN) added 1.53% on July 22, 2021, from the previous day to close at $3,638.03. Pre-market trading as of 6:02 am GMT on July 23, 2021, saw AMZN gain 0.52% to trade at $3.655.93. The stock has risen more than 388% in the past five years and has added 17.36% since July 2020.

In the past year, Amazon’s market capitalization has increased 18.16% to $1.835 trillion. By 2022, Amazon’s market share in the US e-commerce platform is projected to reach 50% from 47% in 2020.

Amazon’s market share has risen exponentially from 34% in 2016 to a projection of 50% in 2021. Q2 2021 earnings are scheduled for release on July 29, 2021.

Sale of edible groceries

This increase is expected to be powered by the strong sale of edible groceries expected to grow 84.14% from $14.5 billion in 2021 to $26.7 in 2026. The compound annual growth rate (CAGR) of Amazon’s sales was 13%. Market research in the US also shows that Amazon’s beverage business (like online food) will also grow close to 100% in the next 5 years and surpass market leaders like Walmart.

The fiscal year 2021 saw Walmart’s revenue jump 6.72% to $559.15 billion from $523.96 billion in FY 2020. The forecast for Walmart’s CAGR is expected to reach 14.1%, with the online sale of groceries expected to reach $19.5 billion by 2026. This growth in online retail sales from both Amazon and Walmart was boosted by the pandemic shopping.

Alibaba leads the pack with a CAGR projection of 10.7%. The sale of food and beverage (online) is expected to rise to $34.2 billion in 2026 from $20.6 billion in 2021 (see figure 3).

EU’s appeal and Bezos effect

Amazon’s share price shot up after the EU appealed the €250 million tax case that the online retailer had won. The EU, whose capital is in Brussels, had hoped to win in a similar move that the Irish government pulled against Apple when the giant tech company was ordered to repay €14.3 billion in tax.

Arguing on the premise of a “fair tax burden” among multinationals, Brussels stated that Amazon, through its Luxembourg entity, had artificially reduced taxes to be paid in Luxemburg. Rather than ruling on the profits/ interests recorded in Luxemburg, the General Court (according to the EU) ruled on interests declared in the US. Amazon has intellectual property (IP) rights in America. A win against this appeal will provide a bullish turn to Amazon.

In the past month, Amazon’s share price has grown 3.78%, buoyed by Jeff Bezos’s space-flight on July 20, 2021, which saw his net worth gain $1.1 billion. Bezos owns an 11% majority stake in Amazon.

EPS estimates

AMZN’s EPS estimates are projected to decline 22.80% to $12.19 from 15.79. However, revenue is expected to increase 5.95% from $108.52 billion to $114.98 billion.

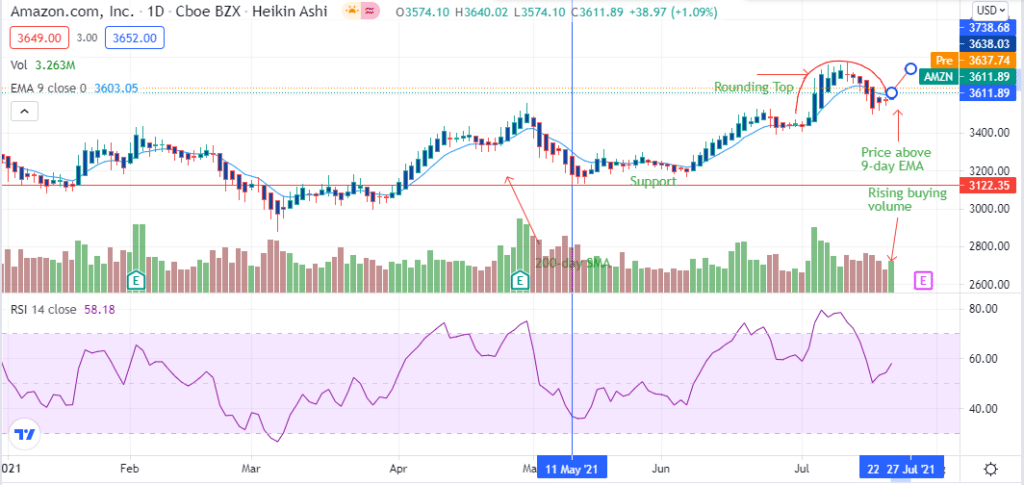

Technical analysis

AMZN has formed a rounding top, with the price headed towards an upward breakout of the recent high around 3630.0. The volume is rising on the buy-side, indicating the rising strength of the uptrend.

The stock found support at $3122.35 on May 11, 2021, after a sharp decline. There is a strong buying momentum with the rising 14-day RSI at 58.18. Failure of the uptrend to get above 3630.0 may pull prices back to $3611.89.