Auro Pro is an FX robot that uses the grid method for successful returns. The developer claims that it uses deep machine learning and hyperparameter search methods for effective analysis and execution of trades. This FX EA uses the Martingale method in addition to the grid technique. It works on 7 currency pairs.

Is investing in Aura Pro a good decision?

As per the developer, this ATS uses methods like Grid and the Martingale for its trading. In this review, we have evaluated the features, recommendations, settings, and other characteristics of this trading tool.

From our assessment, we find that the approach used is risky despite the developer’s claims of using advanced methods like machine learning. Further, the product is overpriced and the trading results show a very small sample size. Our initial conclusion is that this EA is not worth trying.

Company profile

Stanislav Tomilov is the developer of this FX EA. He has published this MT5 tool in September 2021. As per his MQL5 profile, he is based in Russia and has more than 6 years of experience in developing FX tools. He has created 13 products and 17 signals. For contact, a Telegram channel link and the messaging option on MQL5 are present.

Main features

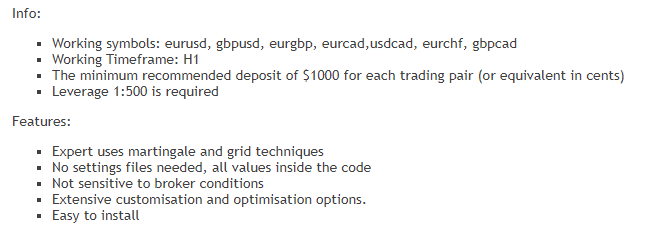

According to the developer, the main features and recommendations for this ATS are:

- It works on seven currency pairs namely, EURUSD, GBPUSD, USDCAD, GBPCAD, EURCHF, EURGBP, and EURCAD.

- The H1 time frame and the leverage of 1:500 are the recommendations for using this trading tool.

- A minimum deposit of $1000 is needed.

- This FX robot uses the grid and Martingale methods.

- It is not broker sensitive and does not need settings files as the values are integrated into the code.

- The EA has many optimizations and customization options.

Other than mentioning the Grid and the Martingale methods, the developer does not elaborate on the approach and how he manages to offset the risk involved in the methods. Since these two approaches are considered dangerous, the failure of the developer to provide a proper explanation raises a red flag for this EA.

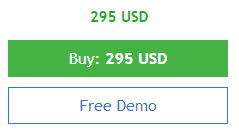

Price

To buy this FX EA, you need to pay $295. As per the developer, only 100 copies are present for this EA and the price will increase by $100 for every ten copies, with the final price offer of $1000. A free demo account is present. We could not find info on the features available with the package. No mention of a money-back guarantee is present. The lack of refund makes us suspect this is an unreliable system.

Trading results

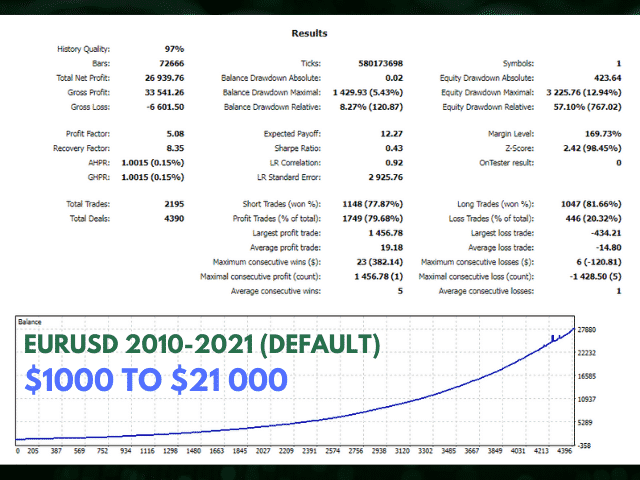

A few backtesting results are present on the MQL5 site. Here is one of the backtesting results for the testing done from 2010 up to 2021 on the EURUSD pair.

From the above report, we can see a profit of $26939 was generated for the account after executing a total of 2195 trades. The test, done with a history quality of 97%, shows a profitability of 79.68% and a profit factor of 5.08. The maximum drawdown for the account was 12.94%. From the results, we can see that the drawdown value is not high and the profits look decent. But since the test is based on historical data, we cannot predict a similar result in real trading.

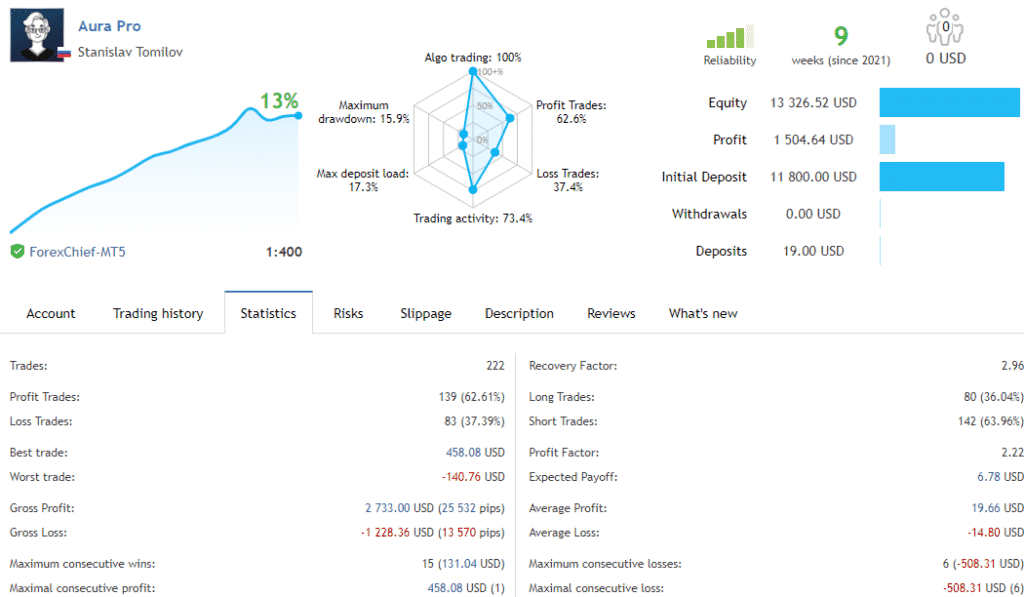

A live signal is posted on the MQL5 site for this FX EA. The account started in September 2021, uses the ForexChief-MT5 broker and the leverage of 1:400. Here is a screenshot of the account:

From the trading stats, we can see the account has generated a profit of $1504.64 for an initial deposit of $11,800. The maximum drawdown for the account is 15.9% and profitability is 62.6%. For a total of 222 trades executed over 37 days with an average of 34 trades in a week, the system shows a profit factor of 2.22. The overall growth percentage is 13%.

While the drawdown is low and profits look decent, the small sample size shows that the results are not stable and are subject to fluctuations. Further, comparing the results with the backtesting we find that the values are higher in the backtesting revealing that the system does not perform well in real-time.

Customer reviews

We could not find user feedback for this FX robot on reputed third-party sites like Forexpeacearmy, Trustpilot, etc. The lack of reviews shows that this is not a popular product among traders.

Aura Pro review summary

Our analysis of Aura Pro exposes many drawbacks in the EA. To begin with, the strategy used is of high risk which most traders would shy away from. The developer provides only a small sample size which makes it difficult to assess the real-time performance. Further, the product is overpriced and does not have a refund policy. With so many shortcomings, we do not recommend this FX EA.