Bender FX has produced Big Poppa EA and claims to have sold more than 300 licenses for traders. The algorithm uses a price action trading strategy and aims to provide a 30 to 50% return for a single month. To see if we can get such profitability while maintaining a good drawdown, we will go through all the details about the system in our article.

Is Big Poppa EA a good decision?

Big Poppa EA uses a martingale strategy and is not transparent about its live records. Using such an approach is extremely risky for your trading account. There is a high chance of receiving a margin call.

Company profile

The author of the product does not provide us with any information about their whereabouts and experience. They claim to trade in the markets for about five years and have recently automated their strategies. There are no certificates to verify the claims presented. The total number of developers is three, and the total hours they have spent on coding is 1623.

Main features

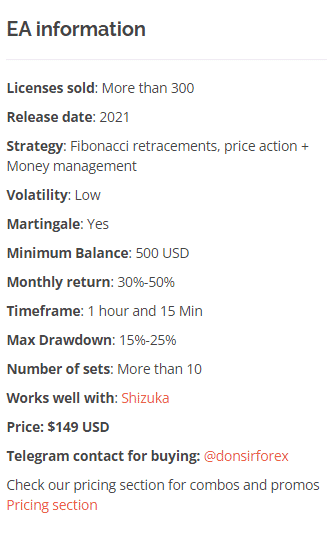

The robot comes with the following main features:

- It comes with money management techniques.

- Traders can boost backtesting performance to find the best set file.

- The maximum drawdown is maintained under 25%.

- The minimum balance requirement to use the system is $500.

To install the EA, use the following steps:

- Purchase the system from the developer and provide your live account number

- Provide your email address

- The product will be shipped to your mail

Price

The robot is available for an asking price of $149. There is no money-back guarantee.

Strategy

The developer states that the EA uses price action techniques along with Fibonacci intervals and money management. It also employs martingale, which is quite risky. Unfortunately, there are no live records that we could use to study the history of the system.

Trading results

There are no backtesting records available for the robot. The system might have defaulted while being on the historical charts. Failure to provide us with such information shows that the system is not entirely trustworthy.

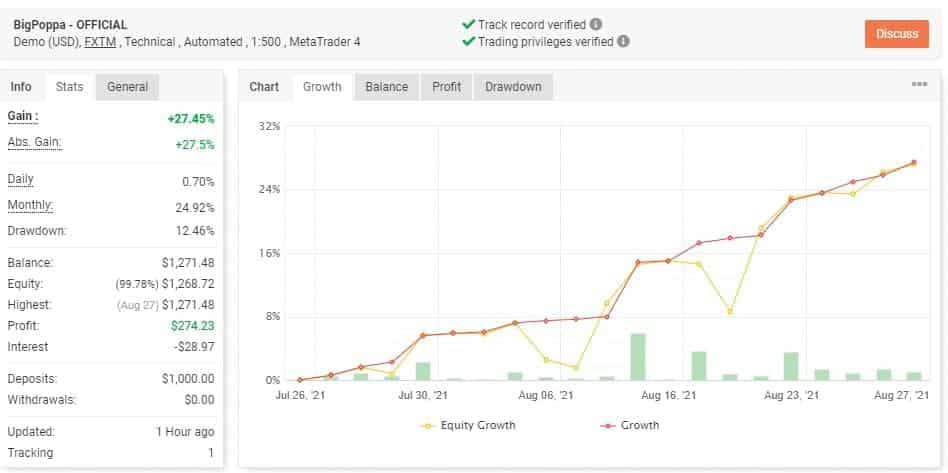

The developer only provides us with an image of the live results that are on a demo account. From the image on the website the verified trading records on Myfxbook show performance from July 26, 2021, till August 21, 2021. The system made an average monthly gain of 24.92%, with a 12.46% drawdown.

The total gain made by the same was 27.5%. The initial deposit in the account was $1000, where the robot made a daily gain of 0.7%. The final value of the balance was $1271.48.

The frequent separation between the equity and balance curve shows that the robot has constant drawdowns. This is not good for the mindset of a trader. The phenomenon occurs due to the implementation of the martingale strategy.

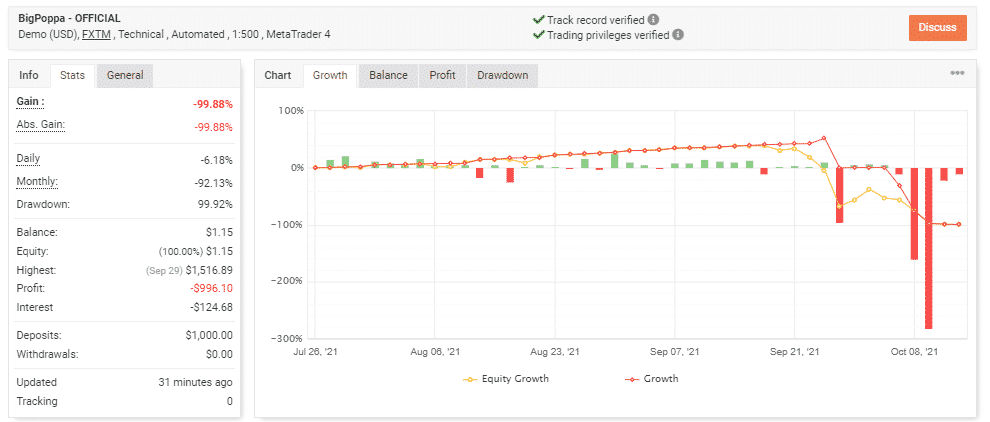

While searching Myfxbook for the records we found some results which show that the same system traded onwards to receive a margin call on the account. This might have been the reason why the developer did not share the link with us.

Interesting facts

There are no customer reviews available on the Forex Peace Army platform showing the lack of interest by traders in the system. The claim of selling more than 100 licenses might be fake in this regard. This raises our concerns even further that the system might not be profitable in the long run.

Summing up

Big Poppa EA is not a trustworthy system due to the lack of transparency. The robot uses martingale for trading, which can be extremely risky. There is a high chance that it can cause a margin call on a trader’s account, turning their balance into zero. It would be better if traders did not purchase the system.