Jamie Dimon is among the world’s highest-earning Chief Executives and one of the many distinguished people who thought Bitcoin was a fraud. In a 2017 speech, the JPMorgan czar argued that the cryptocurrency would never amount to something useful. He even threatened to sack any of his employees who attempted to dabble in the Bitcoin trading.

Fast forward, a JPMorgan report produced in early January 2021 predicted Bitcoin to hit $146,000 before December. By the end of the year, the bank’s analysts ventured that Bitcoin would have dethroned gold as the most preferred safe haven. What changed? Do not sneer at Dimon just yet. Let us see if Bitcoin has a chance at JPMorgan’s claims.

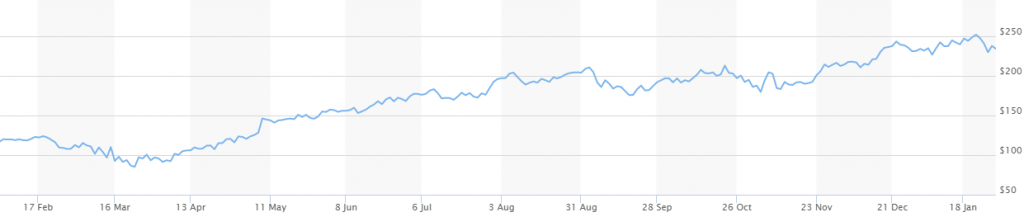

Bitcoin opened the year on the upside

At the time of writing, a single coin of Bitcoin fetched $32,641.69. Twenty-three days ago, this figure was at $41,941.56, putting the current price 22.46% on the downside. Nevertheless, digital currency is trading at all-time levels.

There is not much difference between the current rocketing of Bitcoin price from the one experienced in late 2017. Although the price crashed by almost 80%, it never went back to the pre-mania levels. JPMorgan does not see the cryptocurrency behaving in the same manner this time around, as long as the market begins to view the coins as a safe haven.

Interestingly, JPMorgan is even modest in its estimates compared to what its peers are thinking. Citibank is rumored to be betting for a Bitcoin price tag in the region of $318,000 by the last month of 2021. According to Citibank, “the arguments in favor of Bitcoin could well be at their most persuasive ever.”

The case for Bitcoin as “digital gold”

Gold is valuable for many reasons, but two are outstanding. First, the metal exists in the right amount for making coins but scarce enough to avoid oversupply. Secondly, civilizations upon civilizations have trusted gold to store value over long periods sustainably. For our discussion, we will assume that any asset that can claim the status of gold is gold, which should explain the phrase “digital gold.”

The first argument supporting the case for Bitcoin as digital gold is price skyrocketing without mainstream mania. In 2017, there was a manic excitement within the Cryptoverse when Bitcoin’s price started to lift. By early 2018, when the Bitcoin price was at its zenith, there was a palpable feeling that a major correction was imminent.

When the crash came, it was breathtaking. In under two months (between December 17, 2017, and February 6, 2018), Bitcoin price had collapsed by 66%. The environment around Bitcoin price is different this time around. Though there has been a decline from the January 08, 2021 zenith, the drop is just about 22%, and there is no observable reason for any further drop.

The second argument has to do with Bitcoin’s entry into the mainstream. During the first Bitcoin mania (2017-2018), many mainstream financial institutions and professionals were dismissive of the digital currency. Jamie Dimon’s speech cited in the introduction appeared around this period.

Bitcoin seems to have knocked on Central banks’ doors so hard that they are now awake to its reality. Talks of a Central Bank Digital Currency (CBDC) framework are in high gear with the Chinese leading the way. The US Federal Reserve System has also hinted at cryptocurrency ambitions if it can clear the “great deal of work” ahead.

Why do experts compare Bitcoin to gold?

In making a case for Bitcoin as digital gold, we argued that Bitcoin is scarce and can store value sustainably. Many items are nonetheless scarce, but few can beat inflation like Bitcoin and gold can.

For example, the paper that prints fiat currency is scarce (only a few institutions across the world have the permission to make the paper). However, the paper currency cannot hold value for long. Governments often speed up their money printing activities when faced with an economic crisis. But too much paper money flowing through the economy eventually debases the fiat currency.

In the same way that gold miners cannot flood the market with the yellow metal, Bitcoin miners cannot overwhelm demand for the digital currency. In fact, the Bitcoin algorithm limits the total supply of the tokens to 21 billion, and mining activity becomes incrementally difficult as the threshold draws closer.

Another aspect of Bitcoin that perhaps drives much of its appeal is its decentralized nature. In comparison, only government-appointed institutions can print fiat currency. Through monetary policy instruments, the government can decide – arbitrarily – to raise or reduce the supply of fiat currency to achieve certain ends. Conversely, Bitcoin takes the government’s hands away from the money supply tap and controls the people. As such, consumers cannot suffer the ills of inflation because of the government’s irresponsibility.

What if bitcoin does secure the safe haven status?

A lot of what Bitcoin could become is currently hypothetical. But if the digital currency does transition into the gold of the future, then the financial services sector will cease to exist in its current form.

Let’s take a look at what is happening currently. In October 2020, PayPal introduced a service where users can buy, hold, and sell Bitcoin and some altcoins. As a result, the payments service provider has gained popularity, and it has more users than before.

PayPal’s support of crypto came at an opportune time when Bitcoin was soaring. During 2020, PayPal’s stock also grew by a huge margin. This means that Bitcoin could change the face of finance if it becomes the official inflation hedge instead of gold. For one, we are likely to see a massive shift from brick-and-mortar banking to online and from centralized payment services to decentralized.

Additionally, increased use of Bitcoin is likely to pull more people into the global financial system because bank accounts will no longer become a prerequisite for receiving financial services.