- Bitcoin is looking increasingly bearish with a slide to $30,000 on the cards.

- The AUDUSD pair has slid to 1-year lows amid AUD weakness.

- Gold bounce back above the $1800 is gathering steam.

- US equities are struggling to hold on to gains at all-time highs, with indices edging lower.

Bitcoin has turned bearish and depressed after failing to bounce back and find support above the $35,000 level. Sentiments around the flagship cryptocurrency have turned sour in recent weeks in the aftermath of the massive cryptocurrency crackdown in China. Additionally, a resurgent dollar has continued to pile pressure on BTCUSD, curtailing any bounce back.

With all higher time frames painting bearish views on BTCUSD, a slide back to the $30,000 level is on the cards.

A potential slide to the critical support level of $30,000 comes at the backdrop of BTC volatility and volume subsiding significantly. Similarly, the current situation is reminiscent of that of 2018, resulting in a 70% plus pullback in BTCUSD from $20,000 to about $3,150.

The 2018 pattern repeating itself could result in BTCUSD sliding to the $20,000 levels, with some indicators signaling $16,000 as a key confluence level. BTCUSD needs to rally and find support above $36,000 to have any chance of powering high back to the $40,000 level on the flipside.

Bitcoin bounce back is highly dependent on the easing of regulatory pressure that continues to trigger fears among investors. Institutional investors who have been the major force behind the spike to record highs of $64,000 are becoming increasingly concerned about the cryptos’ long-term prospects.

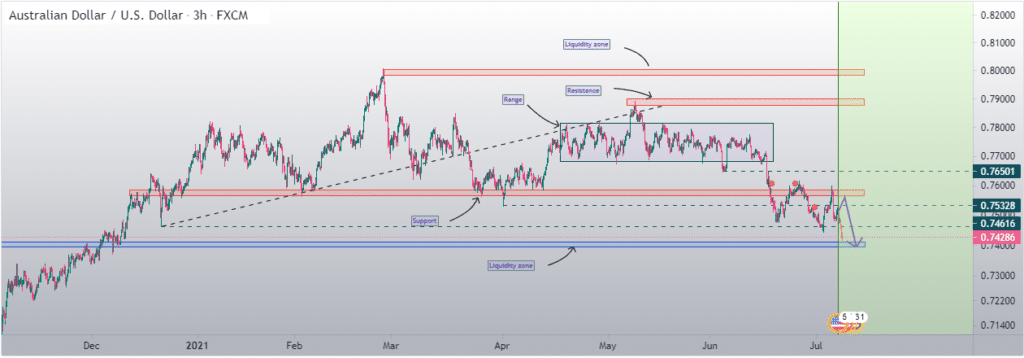

AUDUSD tanks to 1-year lows

In the forex market, the Australian dollar is one of the majors under immense pressure. AUDUSD has since dropped to one-year lows and on the back foot for the third consecutive day. A slide below the 0.7500 level has left the pair susceptible to further losses.

The slide could continue to the 0.7360 level, given the strength of the US dollar and weakness in the AUD. The Australian dollar is taking a lot of heat in the market in the aftermath of lockdowns. There are growing fears that rising cases could cause consumers to pull back and slow down economic activities.

AUDJPY tanks

Growing coronavirus concerns is increasingly fuelling a surge in bets on safe havens. Likewise, the Japanese yen continues to attract lots of bids against the majors. The AUDJPY is one of the pairs feeling the brunt of a rush into safe-havens.

AUD/JPY has since plunged to a 15-week old support line above the 81.00 level. The sell-off comes on the backdrop of AUD losing some strength amid growing fears about Australia’s economic recovery owing to the COVID-19 lockdowns.

Gold bounce back

In the commodity markets, Gold is trying to find support above the $1800 an ounce level. XAUUSD has come under immense pressure in recent days owing to the US dollar strengthening across the board. After plunging below the $1800 level in the aftermath of the FOMC minutes for June, the precious metal appears to have regained its upward momentum.

A bounce-back above the $1800 level has once again raised hopes of the precious metal making a run for its three-week highs of $1815.

However, XAUUSD faces an uphill task to find support above the $1815 level amid risk-averse market conditions. The dollar is the subject of increased buying pressure amid growing talks that the FED could start easing monetary policy soon. A stronger US dollar is making gold expensive for other currency holders, explaining the struggles in powering high.

US indices under pressure

US stock futures are trending lower on Wednesday amid growing fears of a spike in COVID-19 cases globally. The S&P 500 hit a new record high on Wednesday, rising 0.3% to 4,358.13 as the Nasdaq Composite index extended its winning streak jumping 0.015% to 14,665.06.

The upward momentum in the equity markets appears to be losing steam amid growing economic and monetary policy uncertainty. With the FED failing to clearly indicate whether tapering will come into play sooner, waning investor sentiments could trigger a market pullback.