Traders and investors have the unenviable task of rummaging through thousands of stocks that they can work with. But, fortunately for them, this article will go through different stocks and classifies and categorizes them to help them narrow their choices down according to their needs. So, let’s get started with the two main types.

Common Stock

These stocks, as their name suggests, are exactly what people think of when they are talking about nominal stocks. When we consider that most stocks are issued in this form, we can understand why that is so.

The idea of the form is simple enough; shares constitute ownership of a part of a company and claim a share of the profit. Investors receive one vote for every share to choose the board members who will supervise the management goals.

Common stocks also have a good deal of risk associated with them as the profits and dividends are not guaranteed and if the company liquidates, the common shareholders are the last to get paid. But, because their returns are high, investors naturally gravitate towards them.

Preferred Stock

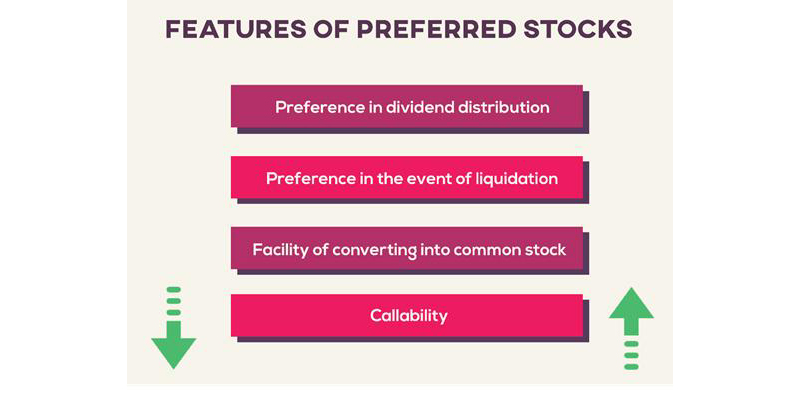

These stocks constitute some form of company ownership but without the voting rights that come with common stocks (although this varies from company to company). If you have a preferred stock, a fixed dividend is assured forever that is why they are paid first. Even if the liquidation takes place, preferred stock owners are the first to get paid after debt holders.

These stock types can also be called back by the company and purchased from the shareholder (usually at a price).

Different classes of stocks

A company is not just restricted to having only these two types of stocks mentioned above. They can customize their own stock classes, thereby restructuring the system such that the voting power remains with a select group.

For instance, a particular class of shares that is held by a certain group of people may get 10 votes for every share they own, while the other class made up by the majority of investors may only get one vote for every share they own.

In such cases, these classes are generally indicated as Class A and B, which are represented by the letter after the company’s ticker symbol. For example: ‘AAPLa’ or ‘AAPLb’, where AAPL is Apple Inc. and ‘a’ or ‘b’ represent stock classes.

Different stock classifications

Stocks can further be classified based on different factors. Let us take a look at some of them to further understand them better.

1. Market Capitalization

Stocks can be classified based on the size of the company for which we utilize market capitalization. This is the total value of a company’s share and can be found out by multiplying all the shares of the company by their current market price. Depending on how big a company is, it can have small – mid – or large-sized caps.

Based on the size, stocks can also be divided as either penny stocks (which can be traded for less than $5) or blue-chip stocks. Where the former is attractive to beginner investors, the latter is much more resilient and performs better.

Stocks may also be categorized as Mega– and Micro-caps depending on their size, though such classification is seldom used.

2. Industry and sector

Another categorization that one can make is based on the industry or sector that stocks fall into, such as Energy stocks, Commodity stocks, Automobile stocks, etc. Each industry will have multiple companies operating in it (most of the time) and all the stocks will be specific to that industry.

But, there are times when it can be tricky to classify companies, especially when their modus operandi and revenue is dependent on two or more industries.

3. Defensive and cyclical

Stocks can also be categorized based on business cycles. Cyclical stocks are tied to the movements of the market. When the economy is good, the stocks do well; when the market is down, their value dips as well. Industries that offer services such as travel, tourism, luxury items, etc. are cyclical ones.

Defensive stocks defend themselves well against economic downturns and continue to do well even in times of economic depression. This is because they are based on industries that are not influenced by where the market is going. These include medicines, tobacco, food, and utilities.

4. Growth and value

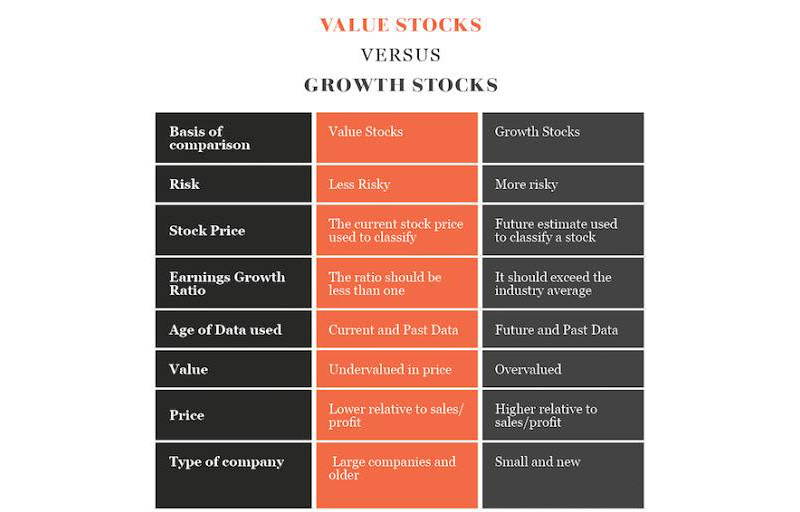

The last two classifications that we can make with stocks is based on the style of investment. As such, they can be seen as either growth or value stocks.

A company that is growing at a rate faster than the market index will have growth stocks. That means that their share prices will increase speedily and investors will readily pay big bucks for these shares.

Value stocks, on the other hand, are completely different. These stocks are of those companies that have slow growth. Investors can get these stocks at a much lower rate than what their actual value is.

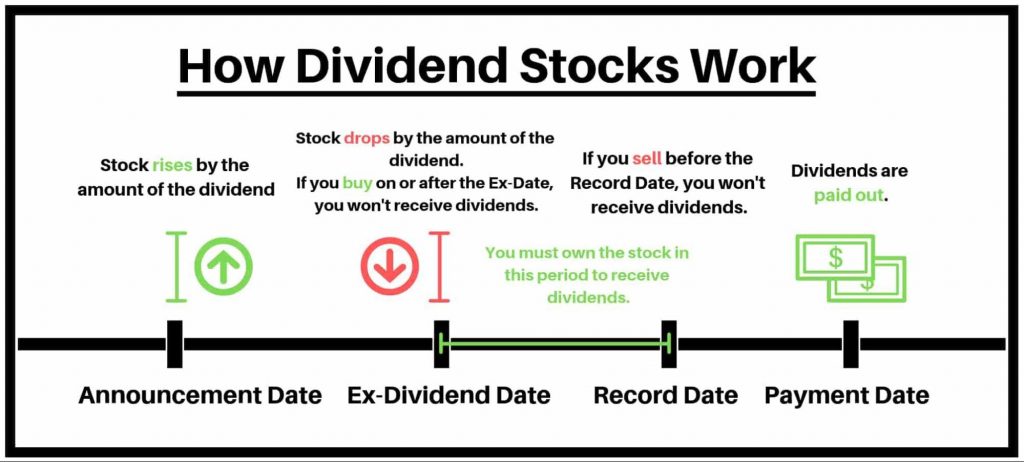

Before we go, it is good to know about another classification that can guide your investment decisions is dividend stocks. This investment approach is based on only those stocks that pay a high and growing dividend regularly. A passive investor can safely get returns consistently from most high dividend stocks.

Summary

As we have seen, stocks can be grouped, categorized, and classified based on different factors and investment styles. Whether you are a beginner investor or someone interested in high value or growth stocks, whether you want your share to have an impact on a company’s management or you are concerned only with regular returns – there are different ways in which you can invest in a stock, depending on what your needs and preferences are.