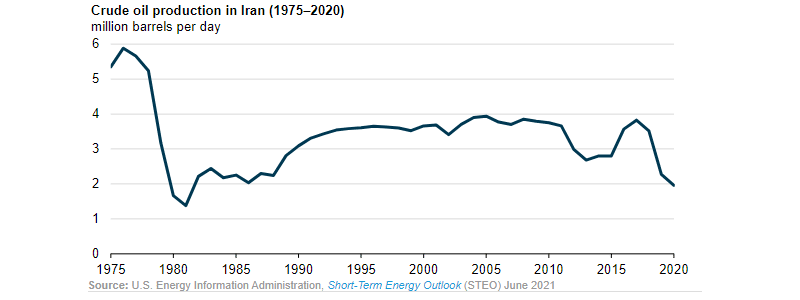

- Iran’s oil production neared its 40-year low, with an output of fewer than 2 million barrels per day in 2020.

- The US government reportedly sanctioned a businessman from Oman for helping to smuggle oil for Iran.

- China’s industrial production declined 6.4% (YoY) from the previous record of 8.3%.

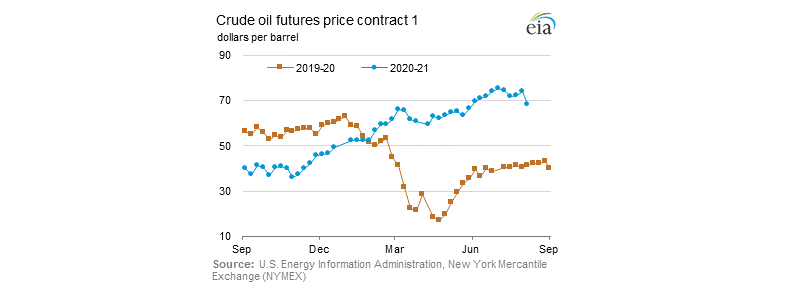

Crude oil prices extended their decline below $70, dropping more than 1.10% on August 16, 2021. Demand concerns led to the decrease, with official data indicating decreased oil production in Iran. As of 1:59 am GMT, crude oil futures (for the October 2021 contract) were down 1.28%, standing at $67.34, while Brent oil was trading at $69.73 per barrel.

The Iran factor

According to the Energy Information Association (EIA), Iran’s oil production neared its 40-year low with an output of fewer than 2 million barrels per day in 2020.

Among the factors that contributed to this decline was the increase in Covid-19 cases in the Middle East and sanctions on exports of crude oil from Iran. Oil production in Iran (alone) equaled 25% of the Middle East reserves and 12% of global reserves (by Q4 2020).

The US government reportedly sanctioned a businessman from Oman for helping to smuggle oil for Iran. The report indicated that revenue from petroleum sales in Iran was used by the IRGC-QF- the Quds Force to destabilize Iran and the Middle East region.

As of August 12, 2021, the daily (oil) basket price recognized by OPEC was $71.32 per barrel.

Industrial production

China, the world’s largest net importer of oil, reported a 14.4% decrease YTD in industrial production as of July 2021 (YoY) from 15.9%. On annual analysis, China’s industrial production reduced 6.4% from the previous record of 8.3%. It failed to beat analysts; expectations at 7.8%.

There was an 8.5% increase in retail sales (MoM) that was lower than June’s 12.1% record. It also fell short of Wall Street’s 11.5% forecast. Investors are still concerned about the recent crackdown on foreign investments and a fresh increase in Covid-19 infections. However, China is still on the verge of expansion despite new restrictions.

Tighter restrictions in China, especially on travel and hospitality, have derailed petroleum demand as the government rushes to control the surge in Covid-19. Steel output (in the factory sector) has decreased to its 3-month low.

Oil imports and OPEC production target

Canada’s oil imports from the US also declined 20.63% (YoY) in 2020: from 693,000 barrels per day (in 2019) to 550,000 b/d (in 2020). The total value of oil imports into Canada in 2020 was C$11.5 billion (US$ 9.2 billion) from C$18.9 billion (US$ 15.1 billion) in 2019.

OPEC revised downwards its August 2021 forecast for petroleum production, citing a decrease in demand and new OPEC+ agreements. In the weekly review, OPEC noted an increase in Covid-19 cases that pushed prices down.

The OPEC+ meeting had agreed to increase production in August 2021 to 400,000 b/d monthly. It also discussed the full reversal of Saudi Arabia’s voluntary cut in production that would have affected an extra 1 million b/d.

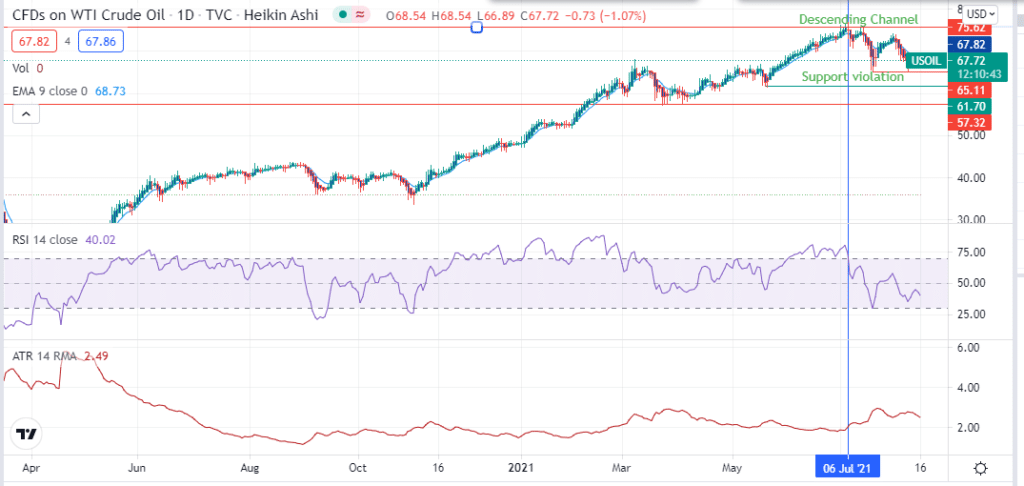

Technical Analysis

WTI futures formed a descending wedge after prices hit resistance at $75.62. The pullback put the uptrend on hold while setting a short-term barrier at $67.82.

The price decline on August 16, 2021, appears to violate support at $67.72, but it will need a downward breakout confirmation to consider a reversal of the long-term uptrend. A further decrease will push the price towards $65.11 and a deeper correction to $61.70 and $57.32.

Due to the increase in volatility, with the 14-day ATR at 2.49, the downward breakout is likely. In case of the breakout’s failure, the price may retest $75.62.