The crude oil price has struggled in the past few days as investors react to the ongoing Omicron pandemic and the supply and demand imbalances. Brent, the global benchmark, is trading at $72.88, which is about $12 below its highest level this year. West Texas Intermediate is trading at $69.8, which is about 20% below the highest level this year.

Demand challenges

The biggest challenge facing crude oil prices is the ongoing Omicron pandemic. In the past few weeks, more countries have reported a surge in cases even as vaccine hesitance remain. For example, on Wednesday, the UK published the highest daily increase of Covid cases since the pandemic started.

The US is also recording thousands of cases per day. China, the biggest oil consumer in the world, also recorded its first Omicron case this week.

This trend has led to a small decline in oil demand. For example, a number of companies in the US has asked their staff to work from home. In the UK, the government has requested most employers to allow people to work from home. At the same time, many airline companies have announced that demand for local and international demand has declined slightly in the past few weeks.

Therefore, there is a likelihood that crude oil demand will be subdued in the coming months. In most cases, crude oil prices tend to decline when there are higher supplies and low demand.

Supplies remain strong

While demand has declined slightly in the past few months, analysts believe that supply will remain intact as companies take advantage of higher prices.

A few weeks ago, the US announced that it was coordinating with other countries like China and the UK to release millions of barrels from the strategic oil reserves. This was an important measure to help reduce prices.

At the same time, the OPEC+ cartel has committed to maintaining supplies at elevated levels. In its most recent meeting, the cartel committed to continuing to add about 400k barrels of oil every month. Most importantly, the members said that the meeting would go on, meaning that they will be ready to intervene if the situation changes.

US producers are also increasing production, albeit at a slower pace than what analysts were expecting. Therefore, a combination of higher supplies and subdued demand has dragged prices.

Surplus?

The ongoing demand and supply dynamics have pushed some analysts to predict that oil prices are moving to a surplus situation. In a report published on Tuesday, Paris-based International Energy Agency (IEA) said that demand will be relatively lower in 2022. It expects that demand will decline by about 100k barrels per day.

It expects that demand will rise by 5.4 million barrels per day this year and by about 3.3 million barrels in 2022. It expects that the demand will hit pre-pandemic highs of 99.5 million in 2022.

Still, estimates by IEA and other agencies should be taken with a grain of salt since they have been inaccurate for years.

Crude oil price forecast

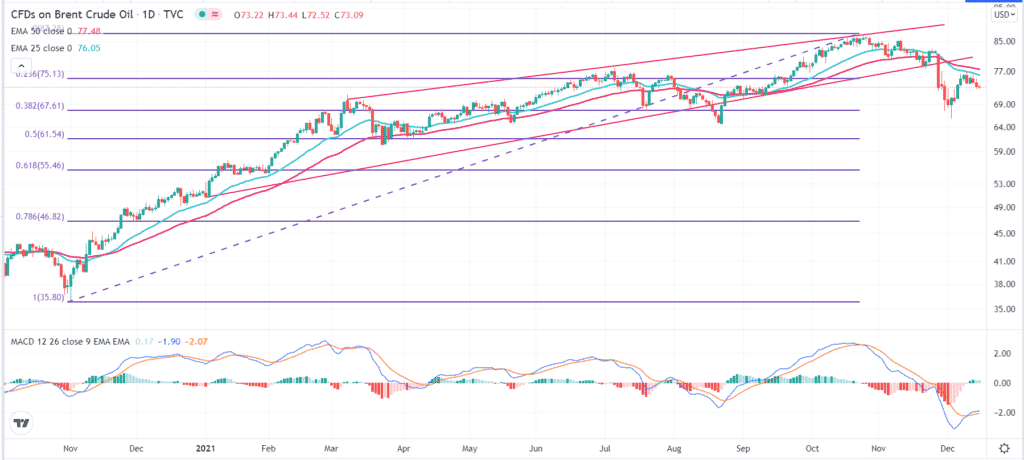

The daily chart shows that the Brent crude oil price has dropped by double digits in the past few weeks. The price is trading slightly below the 23.6% Fibonacci retracement level. It is also below the ascending channel that is shown in red. At the same time, the price has moved below the 25-day and 50-day moving averages, while the MACD has moved below the neutral level. Therefore, there is a likelihood that the price will decline and retest the key support at $65 in the coming weeks.