- Ethereum sell-off below $2,000 accelerates

- Continued dollar strength impact

- ETH 7 Block Reorg raises Beacon Chain concerns

The end is not in sight as the bloodbath in the cryptocurrency market shows no signs of slowing down. Leading the slide this week is Ethereum, which has come under immense pressure, plunging to 14-month lows as the pullback from all-time highs gathers steam.

The second-largest cryptocurrency by market slid by more than 10% as markets reacted to the 7-Block reorganization. In addition, the forking of Ethereum’s Beacon Chain has rattled the markets providing investors with concerns all but fuelling the sell-off.

ETHUSD technical analysis

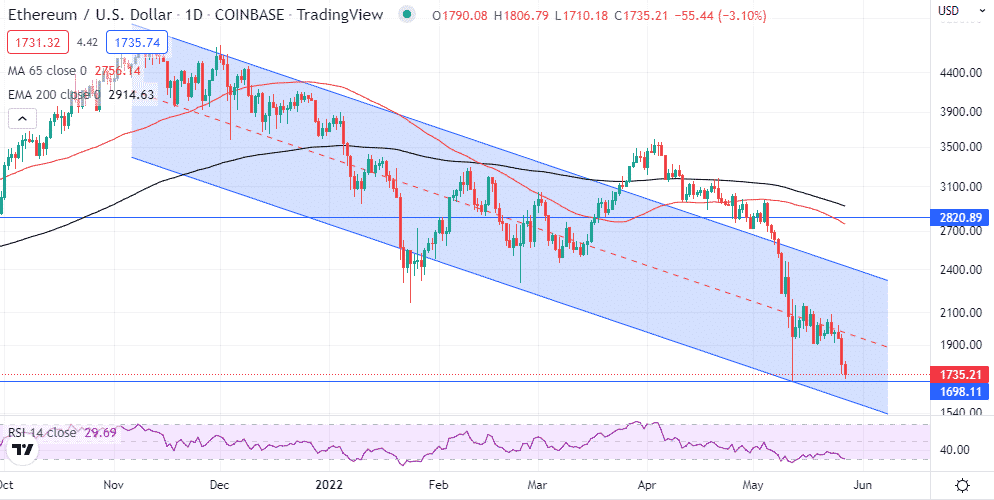

ETHUSD is headed for its worst week in recent months after failing to find support above the $2,000 handle. A plunge to the $1741 area leaves the coin vulnerable to renewed sell-offs in continuation of the long-term downtrend.

A daily close below the $1700 handle could give short sellers a reason to engineer a drop to the $1300 seen as the next substantial support level. With the Relative strength index pointing lower and below the 50 handle, the prospect of further losses is high.

On the flip side, bulls defending the $1700 support level could avert further losses. However, ETHUSD needs to rise and find support above the $2,000 level to curtail further losses. It’s been a rough few months for Ethereum on the broader cryptocurrency sector, turning bearish.

Rate hikes and dollar strength

The dollar strengthening to two-decade highs has not helped the course for a potential bounce back despite the ETH appearing oversold at current levels. However, continued dollar strength should continue to pile pressure which could see the coin sliding even further.

In addition, to the dollar strength, Ethereum, just like other cryptocurrencies, has been trading in tandem with stocks. So, as the broader stock market has edged lower, has the coin also tanked, shedding a significant market value?

Investors are shunning riskier investments due to the growing concerns about the global economy and inflationary pressures. Consequently most have opted to bet on safe havens such as bonds and treasuries. The Federal Reserve hiking interest rates to try and curb inflationary pressures has triggered fears in the capital markets going by the expected increase in borrowing costs.

Seven block reorg

Amid the rate hikes, inflationary pressure, and dollar strength, Ethereum sentiments have also taken a hit on the Beacon Chain, effectively forking in what is suspected to be the work of a malicious actor-network failure or bug.

The reorg is believed to be the result of some miners using outdated mining software. The reorganization occurs when miners try to add blocks of transactions simultaneously, resulting in duplicates on the blockchain, resulting in the fork. One of the possible outcomes is transactions being lost or duplicated.

The idea that the Ethereum network was comprised while it is supposed to be tamper-proof is a major concern. The fact that it arose from Beacon Chain, a solution expected to enhance scalability on the network, also continues to fuel concerns among developers and the investment community.

Final thoughts

Ethereum network being compromised comes at one of the worst times whereby any negative news gives short-sellers a reason to sell. The Seven-block reorg is one event that should continue to weigh on ETHUSD sentiments in the short term. As the coin remains subdued below the $2,000 level, it is at risk of edging lower, especially on tanking below the $1700 level.