- Euro is strengthening against the US dollar, which has retreated from 3-month highs.

- The Chinese yuan also continues to gain ground against the dollar, pushing USDCNH lower.

- Oil prices are edging higher amid an impasse over output between OPEC members.

- Bitcoin edged lower after failing to take out the $36,000 level.

The EURUSD pair is on the front foot at the start of the week advancing for the second day. The pair is rallying as the single currency remains well-supported amid US dollar weakness across the board. After hitting a speed bump the past week, the dollar is under immense pressure as mixed US labor data allayed fears about the tapering of the loose monetary policy.

EURUSD bounce back

June employment data came in at 850,000, well above analyst expectations even as the unemployment rate ticked higher and workforce participation failed to budge. The dollar index, which measures the greenback strength against the majors, has since retreated from three-month highs of 92.74 to lows of 92.14, affirming USD weakness.

Consequently, the EURUSD pair has bounced off session lows of 1.1850 and is trying to find support above the 1.1870 level.

Supporting the common currency strength at the start of the week is the Eurozone’s investor sentiment extending its uptrend in July. The gauge rose to 2.8 in July from 28.1 in June but slightly below the 30.0 thresholds expected.

The pair needs to rise and find support above the 1.1900 level to turn bullish. Below the psychological level, it remains susceptible to further losses. Some of the key events expected to sway trader’s sentiments on the pair are a speech by the European Central Bank president Christine Lagarde on Monday and ECB Accounts on Thursday.

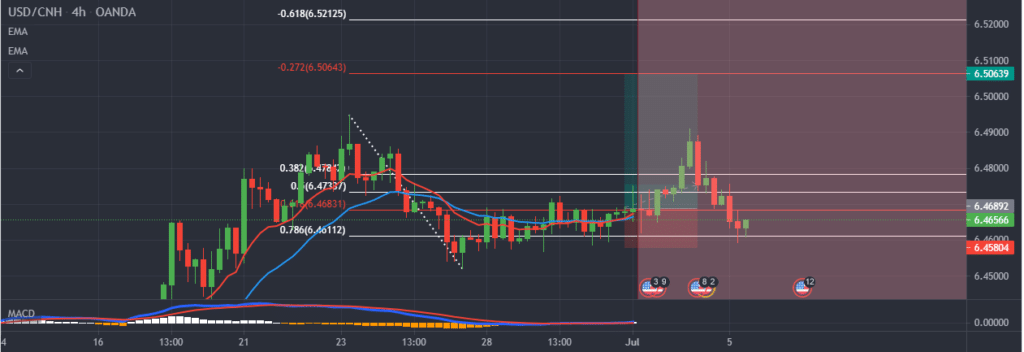

USDCNH retreats

The US dollar is also under pressure against the Chinese yuan at the start of the week. USDCNH has since retreated from last week’s highs of 6.4909 amid dollar weakness across the board. The mixed US employment data is the trigger behind the pair’s sell-off.

USDCNH is currently trading between the 6.4670 level and 6.4810, as the US markets remain closed for the independent day festivities.

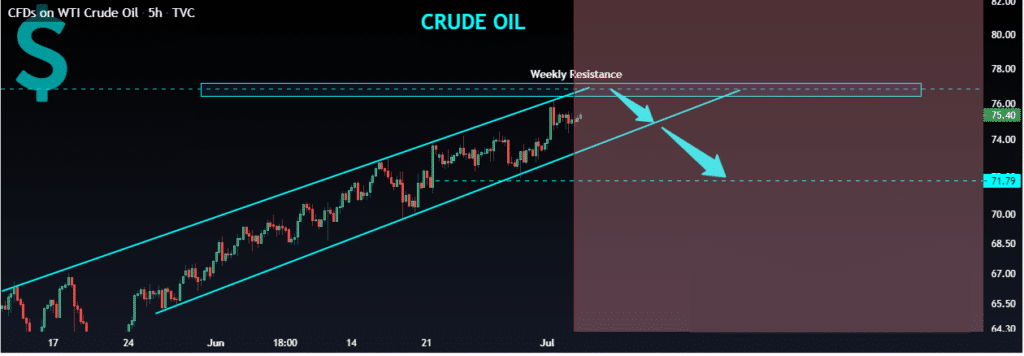

Oil rally on OPEC standoff

In the commodities market, oil prices were upbeat at the start of the week. Brent was up by 0.4% to $76.47 a barrel, as US oil rose 0.4% to $75.48. The catalyst behind the price surge is an impasse between OPEC members over a new output pact.

After failing to reach an agreement last week, OPEC members will resume talks on Monday. Last year the members agreed to cut production in response to a significant decline in demand owing to COVID-19 lockdowns.

Last week, they voted to lift output by about 2 million barrels per day from August to December and extend remaining cuts to the end of 2022. The United Arab Emirates blocked the new pact. The standoff between the OPEC members is good for the oil markets as it averts the risk of increased production that could lead to a glut in supply.

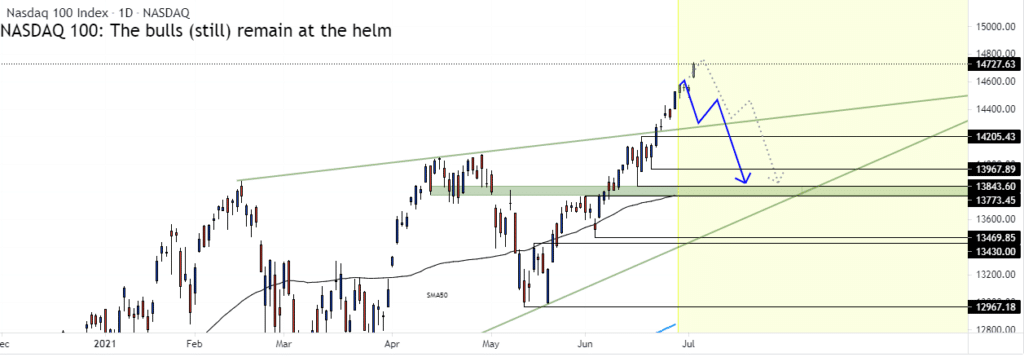

US futures retreat

US stock futures edged lower early Monday after closing at record highs last week in the equity markets. Index futures are struggling for direction in the aftermath of the June employment report indicating the economy is gaining steam which could sway the FED to start tapering.

The US markets remained closed for the Independence Day festivities, waiting to see how the markets will open on Tuesday after the long weekend.

The S&P 500 registered a seventh consecutive record after powering 0.8% to 4352.34. The tech-heavy NASDAQ index was up 0.8% to 14,639.33, and the Dow Jones Industrial Average recorded its first closing high of 34,786.35 after a 0.4% surge.

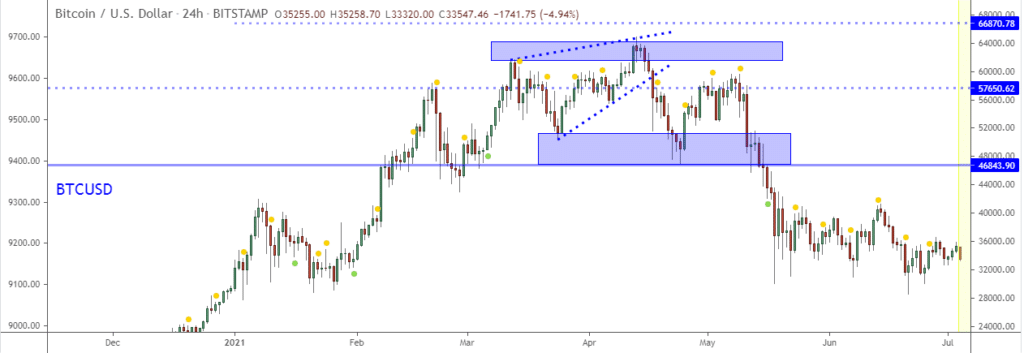

Bitcoin sell-off

Bitcoin is yet again under pressure in the cryptocurrency markets after failing to power through the 36,000 critical resistance levels. BTCUSD has since retreated from session highs of 35,934.15 to touching session lows of 33,998.23.

The pair continues to consolidate between the $33,000 and $36,000 level on the back of a lack of substantial catalyst to trigger a breakout.

Regulation pressure from China continues to weigh heavily on the flagship cryptocurrency. Environmental concern amid questions on the amount of energy used to mine Bitcoin also continues to affect its sentiments in the market.