Excelsior is an expert advisor that works on both daily and weekly charts. The system will always trade on 8 symbols using any timeframe despite the chart you are using. You may use other systems or indicators on the chart, and Excelsior won’t be affected. The vendor says that the EA can compensate for losing trades when volatility in the market increases. Furthermore, a dynamic trail is applied to obtain the highest profit amount possible from trending winning trades.

Is investing in Excelsior a good decision?

We have carefully studied the robot’s features, strategy, backtest report, live trading stats, and customer reviews, among other things, to determine its efficiency. Our findings have revealed that the system has a low profitability rate and can increase an account’s risk of ruin. Moreover, it has a poor rating among customers.

Company profile

Evgeniy Scherbina is the developer of the EA. He is based in Russia, and some of the trading systems that can be credited to him are TradeKeeper Pro, High Trend, Pipsovar, etc. However, it is not clear if Evgeniy works alone or is part of a bigger team.

Main features

The main features of the robot are:

- It is fully automated.

- The system trades on 8 different symbols; AUDUSD, EURUSD, GBPCHF, GBPUSD, NZDUSD, USDCAD, USDCHF, and USDJPY.

- It can work on a VPS.

- The minimum deposit is $250, but the recommended one is $1000.

- The robot supports the MT4/5 terminal.

- It works on any timeframe.

The robot executes a popular variant of the regular neural network and conducts trades on daily and weekly charts. What sets this EA apart according to the vendor is that it applies 2 of these networks to compute “buy” and “sell” signals. It opens daily and weekly trades any time during the day or week when the signals are still valid.

The calculation of the daily signal is done for vital crossings of indicators on daily bars. On the other hand, a weekly signal is computed as a consequence of the competition of “buy” and “sell” signals on similar weekly bars. The vendor adds that when the current trend changes, the system closes trades or sets a stop loss at the opening price based on its algorithm.

Price

Excelsior is currently priced at $385. The vendor does not include any renting options or a refund policy. Is the EA worth this money? Look at what we found out about its performance on historical data and in the live market in the next section to know if it’s worth the cost.

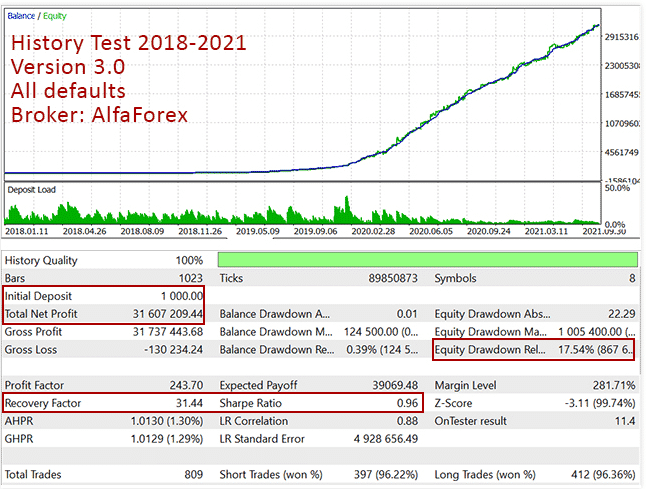

Trading results

The vendor has decided to share with us the backtest results posted above. The historical data period is 2018-2021. From 809 trades conducted, win rates of 96.22% were achieved for short positions and 96.36% for long positions. As a consequence, a large profit amount ($31607209.44) was realized. Low trading risks were applied based on the drawdown (17.54%) generated. A high profit factor of 243.70 was reported.

Let’s see in the next section if the above results can be produced in the live market.

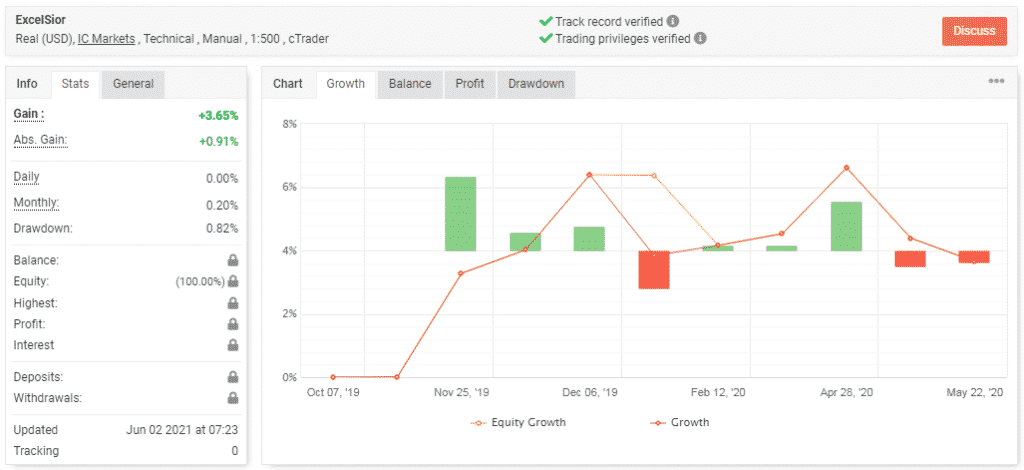

The profitability rate of this account is a far cry from what is recorded in the backtest report. From October 2019 to June 2021, the EA only managed to attain a small gain of 3.65%. The monthly profit was 0.20%, while the drawdown was 0.82%. However, other data values are locked.

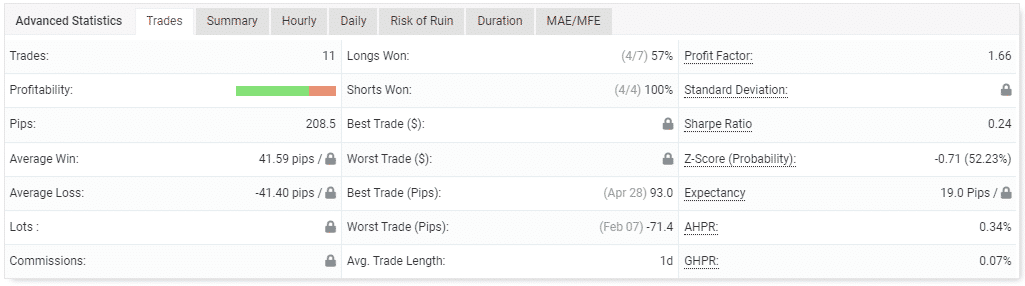

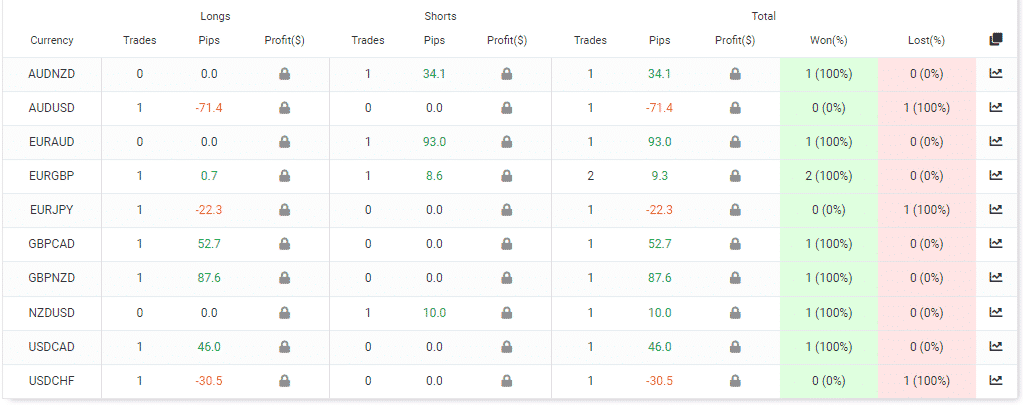

The 11 trades completed in almost a 2-year trading period tell us that the system was inactive most of the time. All short positions were successful, but the win rate for long positions was poor — 57%. There was a profit factor of 1.66, which is way lower than the value showcased in the backtest statement.

All the profit values for both long and short positions are locked. The system didn’t place any buy orders using the AUDNZD, EURAUD, and NZDUSD currency pairs. The EURAUD recorded the highest amount of pips — 93 pips.

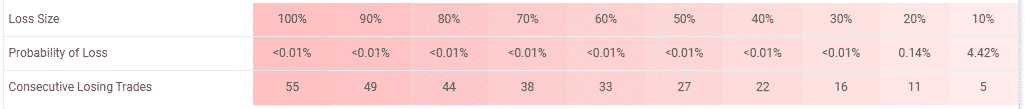

This account had a low survivability rate by the time the owner decided to close it.

Customer reviews

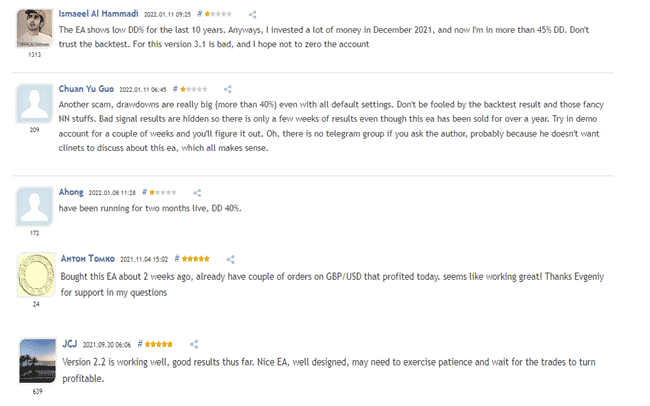

Based on the 2.25 rating the EA has received from 30 reviews, it is obvious that most traders have had bad experiences with it. There are those that say that the robot loses trades and generates a high drawdown. On the contrary, some clients say that Excelsior works great and produces good results.

Summing up

The vendor clearly explains how his algorithm functions and looks for trades. He even displays the results obtained from backtesting it. However, there are concerns among customers regarding the system’s high losing streak and large drawdowns. The live results also show that the EA trades riskily because it almost blew up an account on Myfxbook before it was deactivated.