How good FXStabilizer is in 2020?

FxStabilizer is a well-known and long-run robot. The EA is a fully-automated system that trades all day and provides stable profit on an every-day basis. The robot trades with little drawdowns and adapts well to Forex market changes. FXStabilizer trades every day since 2015. The system calculates very accurately the points to get in the trades and does its best to close trades with profit. EA has got its own money-management system with stop-loss and take-profit features. The robot has been designed to let people without knowledge get a stable profit. Everything the average investor should do it’s installing the robot, and applying some risk settings. FXStabilizer has got two modes of trading: Durable (very safe) and Turbo (riskier).

Strategy backtesting

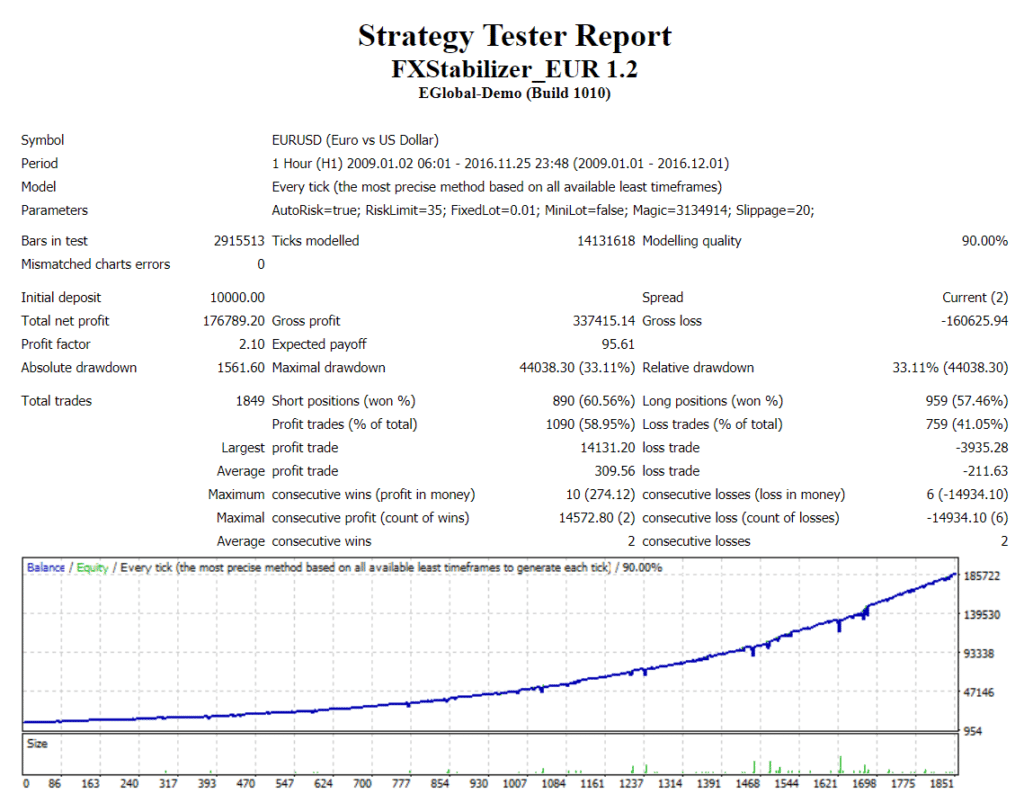

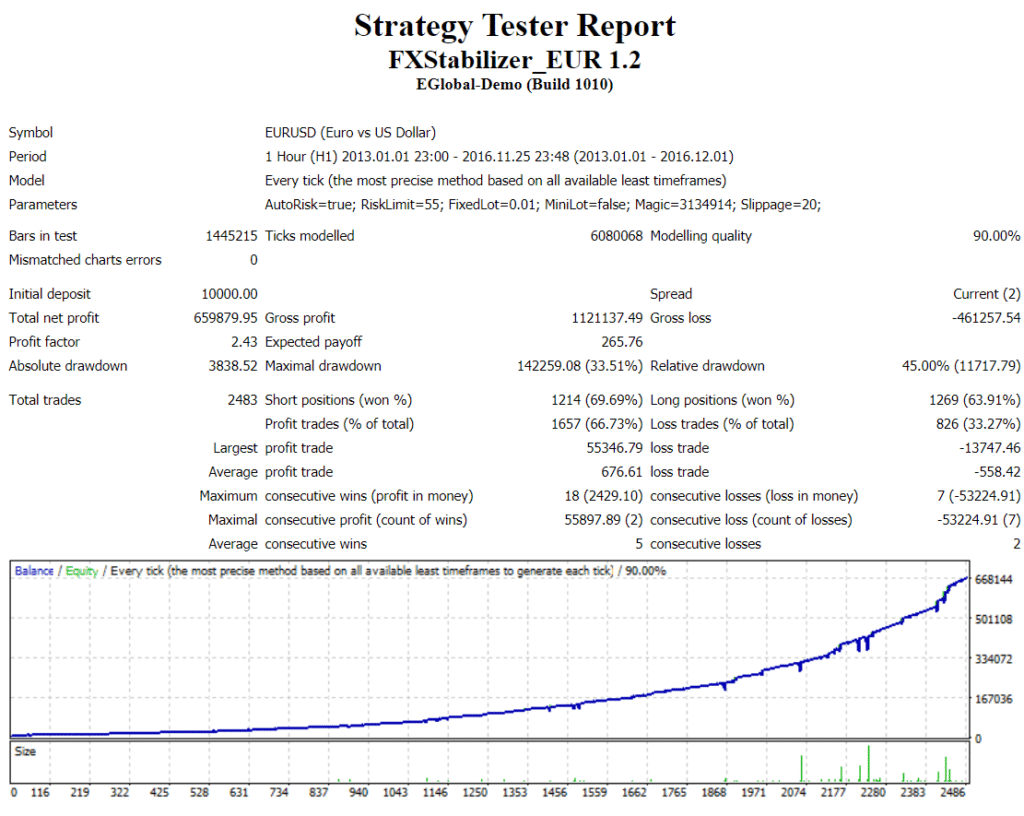

The devs provide us with 10 backtest results with various currency pairs and modes.

It’s a backtest of the EUR/USD currency pair in the save mode on the 1H time frame. The risk limit has been set 35. Fixed Lot was 0.01. The initial deposit has been $10000 and total net profit equaled $176789. The profit factor has been 2.1. The maximal drawdown has been 33.11%. The robot executed 1849 trades. The short positions win-rate equaled 60.56% and for longs one 57.46%.

As we can see, the Turbo mode provided 4 times more profit, having run with Risk limit 55 instead of 35.

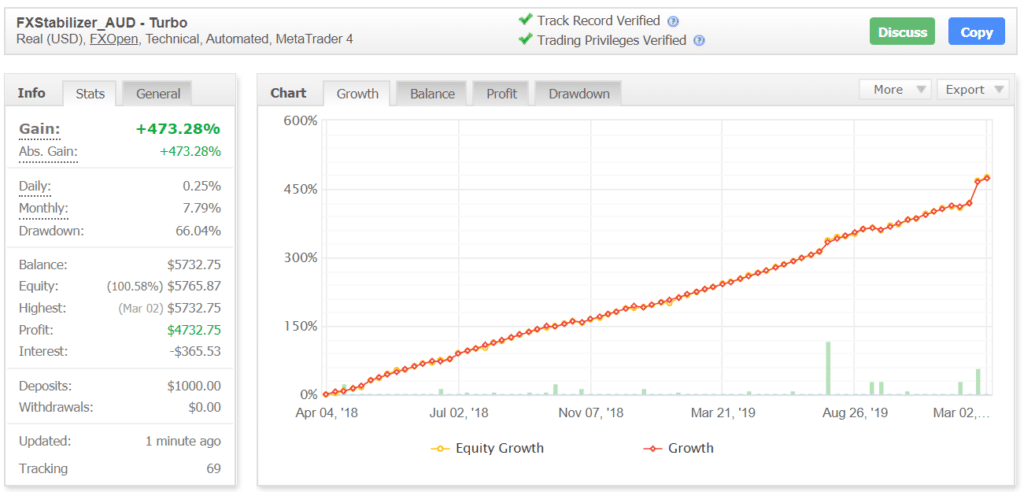

MyFxBook verified trading results

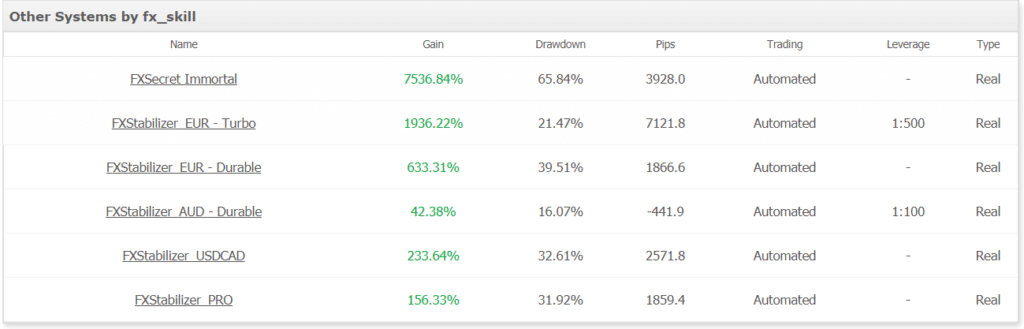

The devs showed us many real accounts with different settings applied. It’s a real USD account where the robot trades the AUD/USD currency pair. It uses FXOpen as a brokerage company and trades with no leverage on the MetaTrader 4 platform. The max drawdown has been 66%. The monthly gain equals 7.79%.

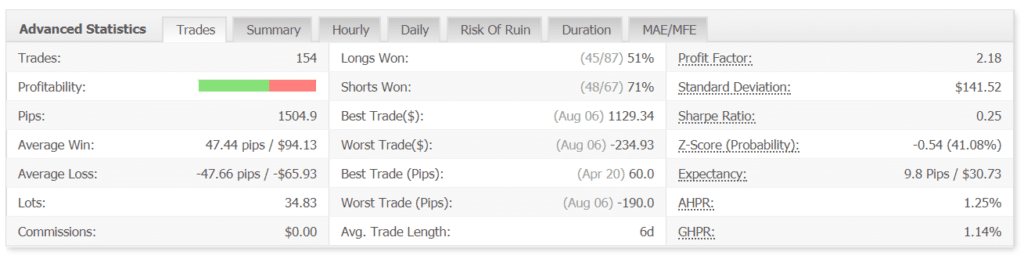

The EA has performed just 154 deals for almost two years but with 1504.9 pips. The average win is twice good ($94) than a loss (-$65) and the best trade ($1129) was 5 times better than the wort one (-$234). It can only mean that the money management system works quite well. The profit factor equals 2.18 like on backtests that rises our trust to the system in general. The longs win-rate is wise lower (51%) comparing to shorts one (71%).

The average trade length is 6 days.

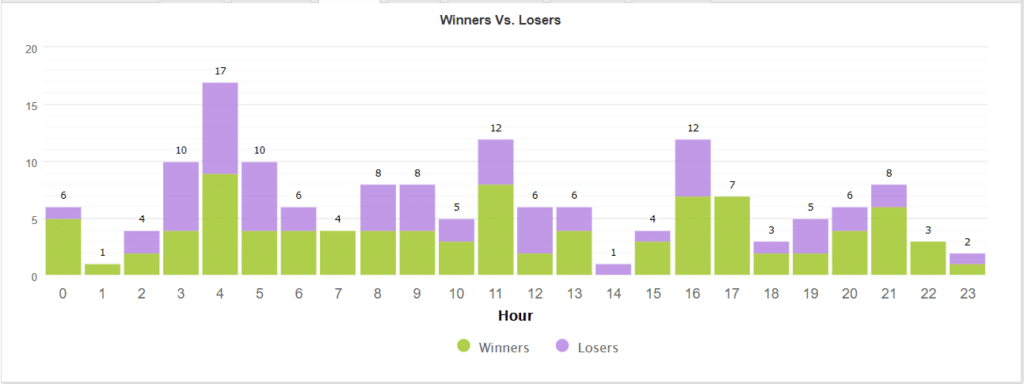

FXStabilizer trades all hours including even the scalping ones.

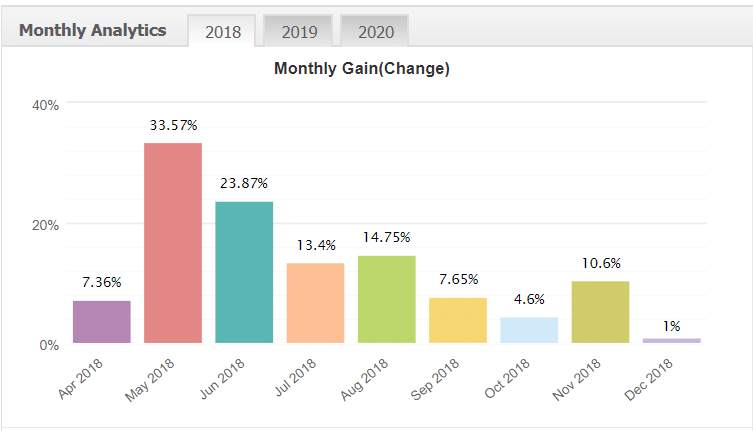

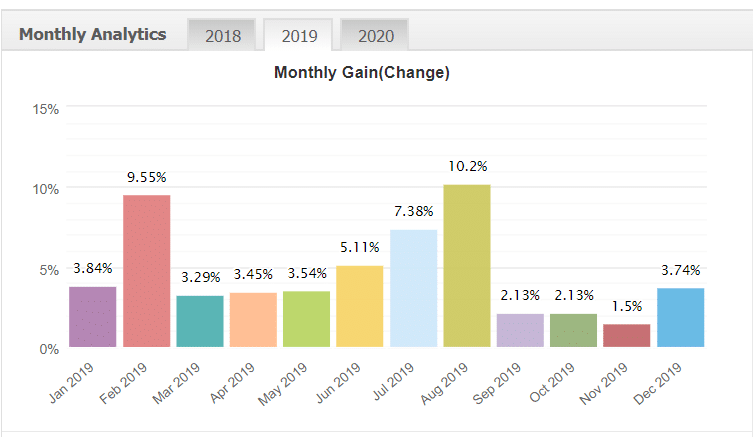

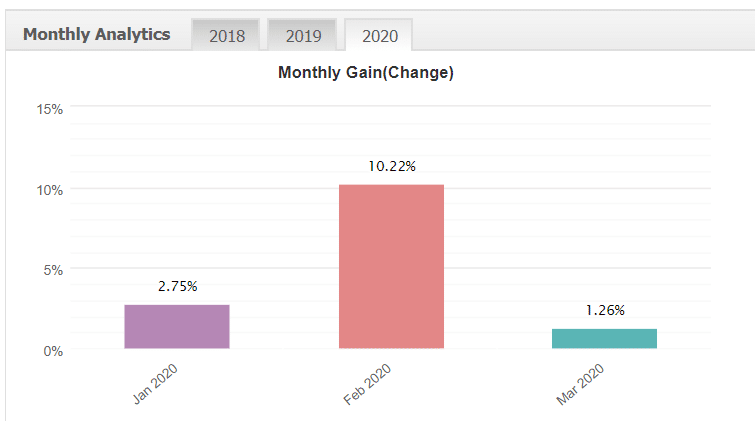

The robot trades vary, so, depends on the months it’s able to provide 2-10% of the monthly gain.

The sum up sheet proves us on the thought that devs entrust much money to trade vis their robot on their own.

The offer

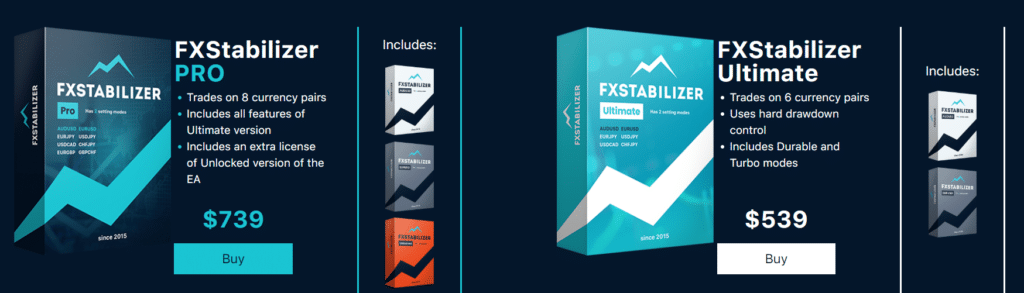

The robot sells in four packages. The main ones are Pro and Ultimate options.

Ultimate costs $540 and includes trading 6 currency pairs, drawdown control, Durable and Turbo modes included. The Pro version costs $740 and allows us to trade 8 currency pairs, and includes an extra license of the Unlocked version of the EA.

The common versions allow trading one currency pair (AUD/USD or EUR/USD). Both of them cost $300. As well, the packages include the drawdown control feature, Durable ad Turbo modes.

All the packages have got one unlimited license of the robot for the MetaTrader 4, user manual, 24/7 welcome support, free and lifetime updates guarantee. If we purchase the Pro version of the EA, we’ll get two separate licenses: FXStabilizer Pro and FXStabilizer Unlocked.

The seller provides the 30-day money-back guarantee.

Both of the packages have got high scores on the ForexStore site.

Wrapping up

Pros

- A lot of backtests to compare

- A lot of real accounts

- High monthly gain

- High-profit factor

- Well-designed money-management system

- Free updates

- 24/7 welcome support

- A lot of packages of a product available

- High rates on ForexStore

Cons

- High price for the extended packages of the robot

- Low the longs trades win-rate

FXStabilizer is a good robot to try. We’ve got every information about the robot to make a wise decision about applying EA on the real account. At the start of 2020, the robot is still a good option to work with.