- The Fed is likely to delay tapering following a favorable July CPI.

- GBP remains resilient against the USD amidst a spike in cases of Covid-19 delta variant in the UK.

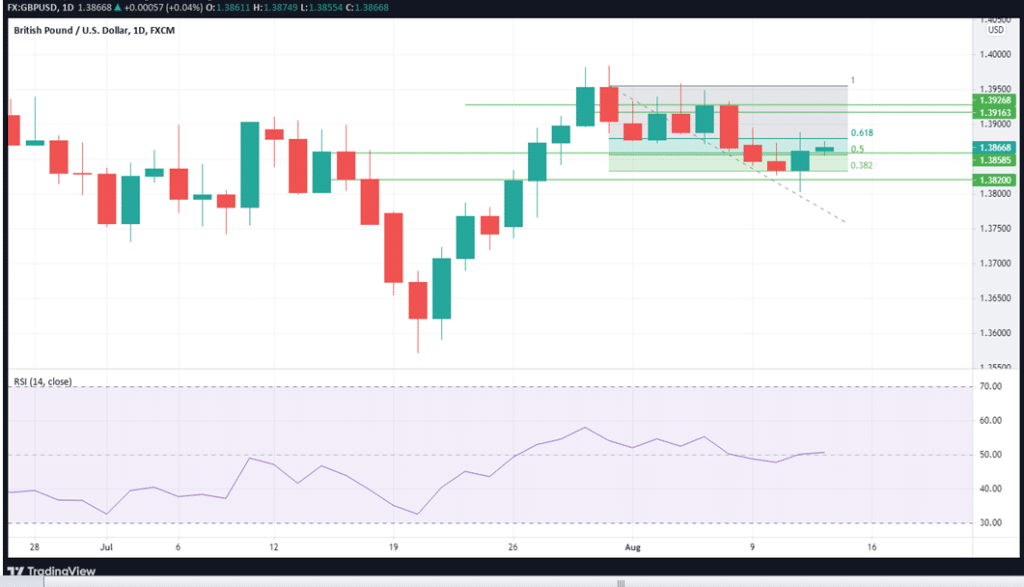

After four days of bearish trade, GBPUSD strengthened marginally against following the release of the July Consumer Price Index (CPI) for the US. At the time of writing, GBPUSD was at a 24-hour high of 1.38668, a marginal gain of 0.04%.

There were no surprises in the CPI as it met forecasts at 0.5%. Importantly for the forex market, it reduces chances of a Fed tapering in September, considering that this was a decline from the June inflation of 0.9%. The decline vindicates the Fed’s stance that the current inflation is transitory. Going forward, the market is likely to trade on the likelihood of a continuation of the Fed’s bonds purchases. This is likely to weaken the USD.

Inflation in the UK and the US economy

Today, the United States Dollar dropped after the data on inflation indicated an increase in consumer price. The dollar index decreased by about 0.12%. This has eased the pressure off the Federal Reserve regarding the schedule to taper the asset purchases to be used in supporting the recovery of the economy.

The Bank of England is also indicating no haste in tightening its monetary policy. In its last meeting held on August 4th, the bank retained interest rates at 0.01%.

The retention of the current monetary policies by the Federal Reserve and the Bank of England would nullify the effect of interest rates on the GBPUSD market. That would leave the US weekly jobs data and the infrastructure stimulus as the next market movers.

There is still no main material information on the economic data for the United Kingdom that is to be released. Therefore, this leaves the GBPUSD pair mainly dependent on the changes in the United States macroeconomic data.

Effects of the Covid-19 delta variant on GBP

A hike in the number of Covid-19 cases in the United Kingdom could challenge the resilience of the GBPUSD pair, causing it to collapse. The British Pound might get support from some factors. This includes the current trends in the declining cases of coronavirus in the United Kingdom and the Bank of England hinting about a moderate monetary policy.

Unfortunately, the number of deaths caused by Covid-19 has risen, testing the efforts of the British government to put the pandemic at bay. This has forced the government to use its Brexit rights to get more vaccines from France. This is also an indication that for the UK government to caution itself, it would be using cross-channel distribution.

In the United States, cautious optimism is still the main theme amidst a $1 Trillion bill on infrastructure being passed and the outbreak of the Covid-19 delta variant.

Technical outlook

The Fibonacci retracement level for the GBPUSD pair is currently below 50%, and the downward trend might reverse temporarily at 38.2%. The RSI on the daily chart is showing neutral momentum at 49.

In the short term, an upward correction is likely to go as high as $1.3916, where it will meet the first resistance. A move beyond that point is likely to meet the second resistance at $1.3926. Downward action is likely to be marginal, with support established at $1.3820.