- The British pound is under pressure, with GBPUSD tanking below 1.3800.

- Oil prices have retreated from multi-year highs amid a standoff on production and supply among OPEC members.

- US indices are struggling to hold on to gains at record highs amid tapering concerns.

- Bitcoin is in consolidation mode after a recent bounce back but struggling to breakout.

The British pound is under immense pressure amid growing bid bias around the US dollar, even on yields edging lower. The GBPUSD pair has slid below the 1.3800 psychological levels and looks increasingly vulnerable amid dollar strength.

A close below the 1.3800 level would leave the pair susceptible to further losses, probably to the 1.3720, the next substantial support level.

A sell-off followed by a close below the 1.3720 would leave the pair vulnerable to further sell-offs, probably to 1.3670, the next support level. On the flipside, GBPUSD needs to bounce back and find support above the 1.3800 level to have any chance of turning bullish.

The British pound is being weighed heavily by growing concerns about the Delta variant, fuelling fears about lockdowns that could lead to a slowdown in economic recovery. On the other hand, the dollar continues to strengthen across the board after an impressive June employment data that continues to affirm chatter about the Federal Reserve tapering. The dollar is also the subject of increased bids as a safe haven.

The focus is on the FOMC minutes for June, whose outcome could sway trader’s sentiments on the dollar consequently influence GBPUSD’s direction of trade.

USDTRY pullback

The Turkish lira is another currency under immense pressure amid renewed buying interest on the dollar. USDTRY is looking increasingly bullish, having experienced strong support near the 8.600 level, resulting in a bounce back to highs of 8.6914 levels.

USDTRY has turned bearish amid increased inflows in safe-havens such as the dollar amid growing concerns about the Delta variant. The markets also remain cautious ahead of the all-important FED meeting, which is expected to provide hints on the next course of action on the monetary front.

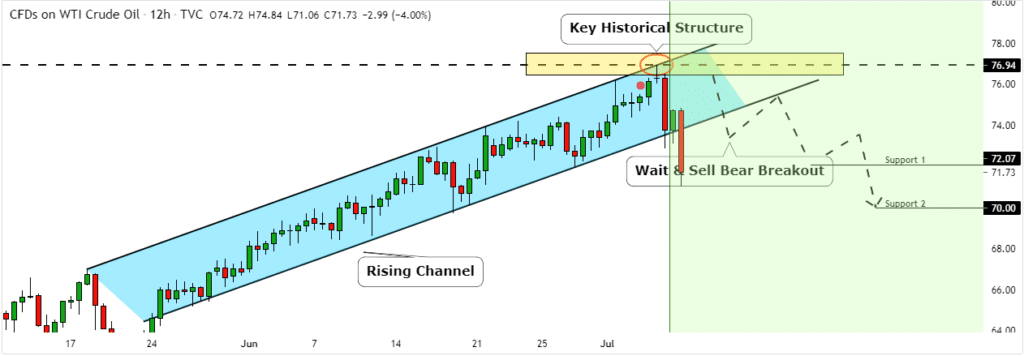

Oil sell-off

A slide in oil prices from multi-year highs persisted on Wednesday after a 3.3% sell-off on Tuesday in the commodity markets. After reaching six-year highs of $76.95 a barrel, oil prices have turned bearish and are now looking to take out the $70 a barrel level.

The sharp decline in oil prices stems from growing concerns over OPEC’s inability to reach a supply agreement. The group reaching an agreement to increase supply, amid growing fears of the Delta variant weighing on oil demand, should continue to take a toll on oil prices.

Additionally, oil prices continue to be weighed heavily by growing concerns about a recent spat between Saudi Arabia and the United Arab Emirates. There are fears that the standoff could ignite a price war should the current production cut agreement break down.

At above $70 a barrel, oil prices are far above the estimated breakeven price of $46 a barrel needed to sustain shale drilling. Consequently, there are fears that the high oil prices could be the incentive to fuel aggressive drilling in the US, which could lead to an oversupply.

US indices retreat

After ending flat on Tuesday, US major indices are under immense pressure on Wednesday, struggling to hold on to gains above multi-year highs. The Dow Jones Industrial Average, the S&P 500, and the tech-heavy NASDAQ are retreating from record highs.

Indices are under immense pressure even on the US 10 year yield tanking to four and half months lows. FED minutes for the June meeting are the major catalyst likely to influence sentiment in the equity market this week. The minutes providing clarity on when the FED is likely to start tapering should significantly impact the equity markets.

Cryptocurrency consolidation

In the cryptocurrency market, Bitcoin is struggling for direction after recently failed breakouts. BTCUSD continues to trade in a tight trading range of between $35,500 and $34,400 amid a lack of catalyst to trigger a breakout.

A sell-off followed by a close below the $34,400 level would accelerate the sell-off wave back to the $33,400 level. On the flipside, BTCUSD needs to rally and close above the $35,100 to have any chance of turning bullish.