Are you looking to make profits in a volatile market? A grid strategy is a good approach for making gains as it helps make profits in whatever direction the price movement occurs. However, the approach is a complicated one that requires good knowledge and trading experience or you can use an automated trading system that uses the grid strategy. But not all systems are the same and the risks involved are high. We have reviewed the Grid Master Pro expert advisor here. As the professional version of the free BF Grid Master EA, this system comes with several additional features aimed at improving its overall performance.

Is Investing in Grid Master Pro a Good Decision?

As part of the Forex robot systems by FXautomater, this system claims to have a profitable strategy focused mainly on the GBPUSD pair. The vendor however maintains that the system can be customized to work on any trading instrument. We have analyzed all the crucial aspects of this automated system including its strategy, trading results, company profile, and price. Our initial view on the system is that it needs to improve in a few aspects to make it a reliable system. Here is a more detailed evaluation of the system

Company Profile

FXautomater is the company behind Grid Master Pro and several other Forex robots and indicators. The company has more than 15 years of experience in the field and owns over 30 Forex robots. Despite being in the industry for over 15 years, the company does not reveal any info about its location or the developers behind the system. Furthermore, we could not find any phone contact or live chat feature, all of which make it difficult to get the needed support.

Main Features

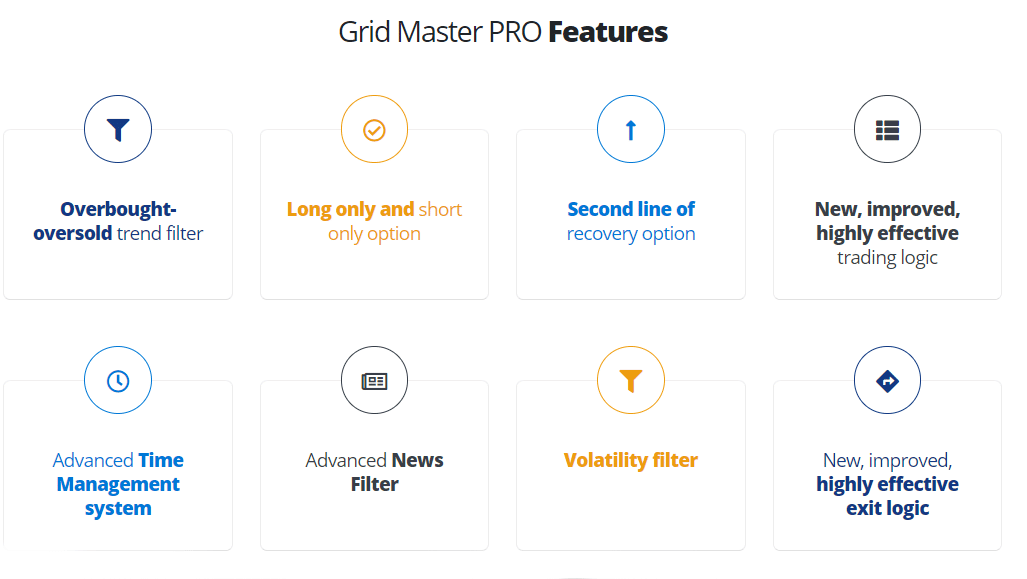

According to the vendor info, the professional version can make double the profit as the free version. Designed to make entries at the appropriate moment, this system uses a second safety move of extra trades as its key trading approach. The approach enables high-frequency scalping and low drawdown.

Some of the main features of this system include overbought and oversold trend filters, long-only and short-only options, advanced filters for news, time management and volatility, and more. Manual and automated trading methods are possible with this system and it offers broker, slippage, and high spread protection. A timeframe of M15 is used by this system which is focused on the GBPUSD pair. The minimum balance for trading is $1000 and the recommended balance is $3000.

Price

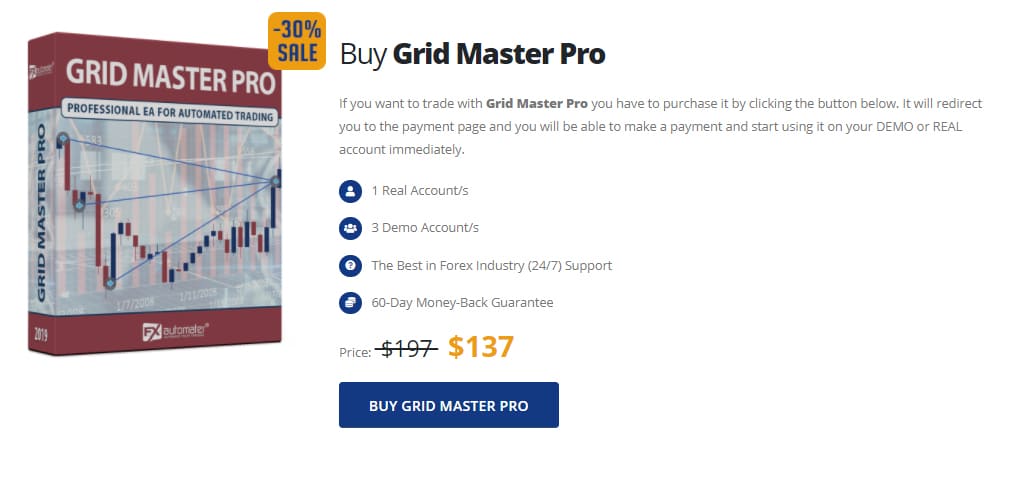

This automated trading system costs $137, which is a discounted price, with the original amount being $197. Some of the main features provided with the package include one real and three demo accounts, 24/7 support, and a money-back guarantee of 60 days. Compared to the prices of other similar systems based on the grid approach, the price is nominal. And the money-back assurance further increases the reliability of the system.

Trading Results

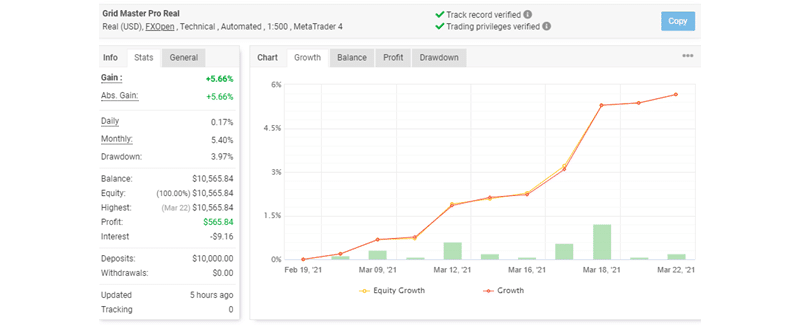

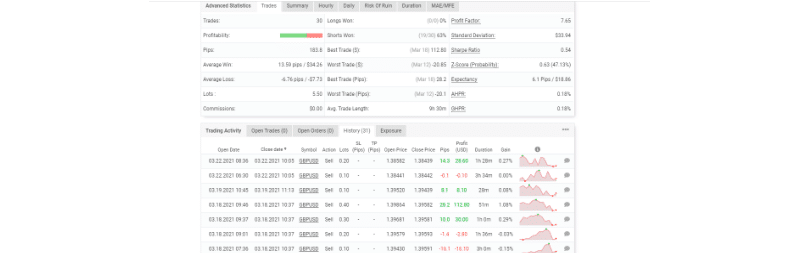

We found verified trading results on the official site. Here is a screenshot of the real USD account of the system traded with FXOpen using the leverage of 1:500.

From the trading stats, on a deposit amount of $10,000 the profit percentage is 5.66% and the absolute gain is also the same at 5.66%. A daily return of 0.17% and a monthly gain of 5.40% are shown. The drawdown is 3.97% for this account that started trading in February 2021. A total of 30 trades have been done in a span of fewer than four weeks and a profit factor of 7. 65 is presented. From the trading history, we could see the lot sizes ranging from 0.10 up to 0.40, which indicates the high risk taken by the system.

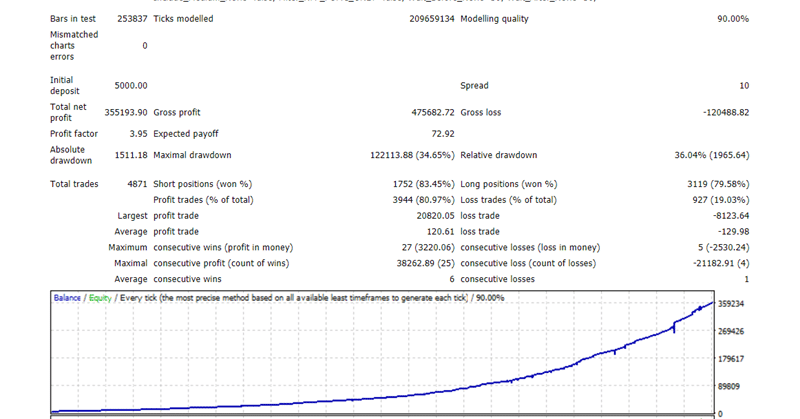

We found backtests provided by the vendor on the official site. A screenshot of the strategy tester report for the GBPUSD pair is shown below

Modeling quality of 90% is used for the backtesting. We prefer 99.9% modeling quality as it provides more relevant and crucial info on the spreads, commissions, slippage, and more. A drawdown of 34.65% and a profit factor of 3.95 are shown for this system. Compared to the live real account trading results, there is a big difference in the drawdown value and the profit factor. This may be due to the low lot sizes used for the backtesting.

Customer reviews

We could not find user reviews for this system on reliable third-party sites such as Forexpeacearmy, Trustpilot, etc. The absence of reviews raises suspicion about the reliability of the system.

Grid Master Pro Review Summary

Summing up our review of Grid Master Pro EA, we find that the system has several positive points in its favor such as the good trading results, backtests, and affordable price. But there are a few downsides such as the high lot sizes, small sample size, and variations in the backtest and real account results. Grid systems carry a particular risk level that not all traders would be comfortable with. Hence, we would like to wait for the vendor to post a bigger sample size to fully assess the system before we can recommend it.