Growth, value, and income are three main approaches to investing in the stocks and exchange-traded fund market. The three strategies are relatively different, and their outcome is usually different. In this report, we will look at the differences between these approaches and how you can create a good and diversified portfolio.

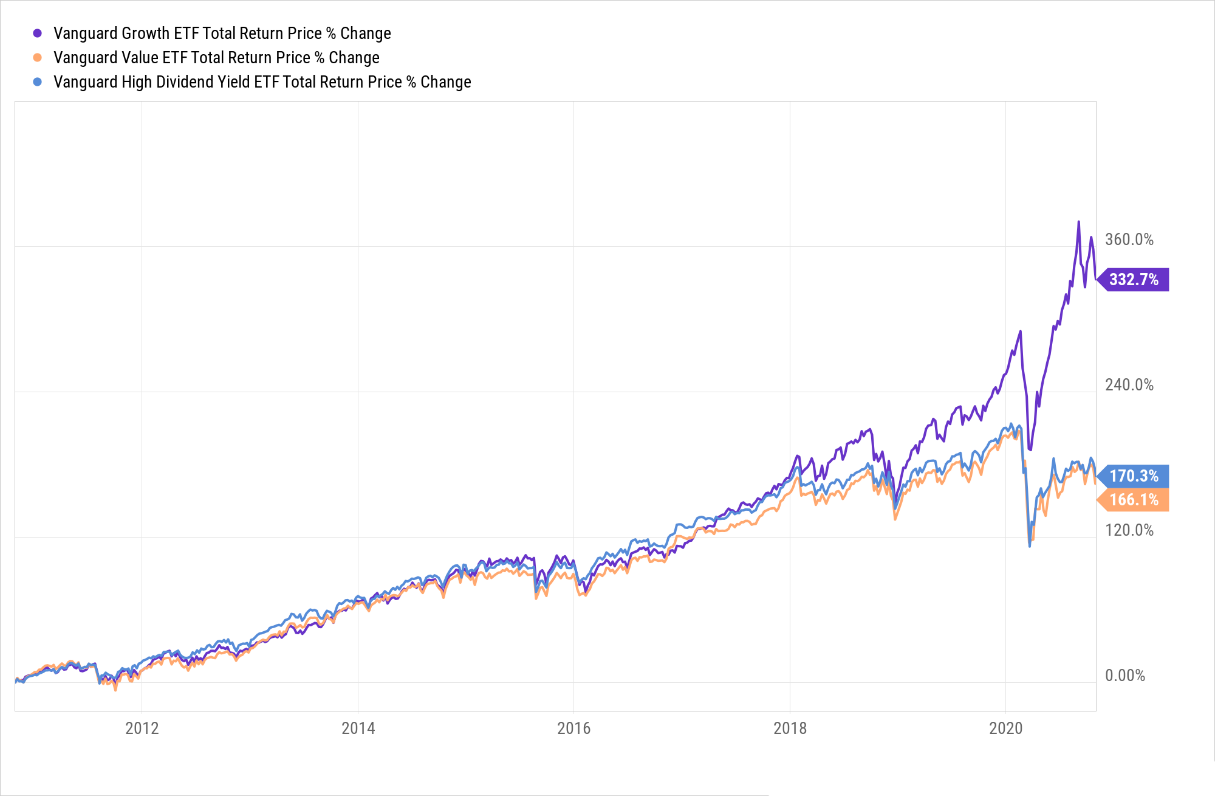

As shown in this chart above, the total return of the Vanguard growth ETF has outperformed, by far, that of the value and high dividend ETF.

What is growth investing?

Growth investing is the approach of selecting companies that are in their early stages. The goal is usually to select companies that you believe will have a substantial market share and high earnings in the future.

Growth companies significantly differ from value and dividend or income firms. First, they are typically young. Indeed, some of these firms were established in the past five years. Second, they tend to be highly unprofitable. That is simply because the management usually focuses on investing for growth instead of profitability.

Third, these firms rarely pay dividends or even buy back their shares. Finally, growth stocks are usually highly overvalued when you look at traditional metrics like price-to-earnings ratio.

Shopify (SHOP) is one of the popular growth stocks of our time. The company provides e-commerce software services that help people build quality stores with a few clicks. Investors love the company because of its strong market share in the industry and its strong revenue growth. As such, they expect that the company will become a highly successful and cash earning value stock in the future.

Shopify has a market cap of more than $119 billion. This is relatively pricey for a company that has had revenue of more than $2.3 billion in the past 12 months. In this period, it has made a profit of just $196.4 million, giving it a price to earnings ratio of 607. That’s pricey.

Snowflake, a company that has recently gone public, is yet another example of a growth stock. The company, which offers cloud data warehousing services, is valued at more than $70 billion. That is expensive, considering that the company had revenue of just $411 million in the past 12 months and a loss of more than $342 million.

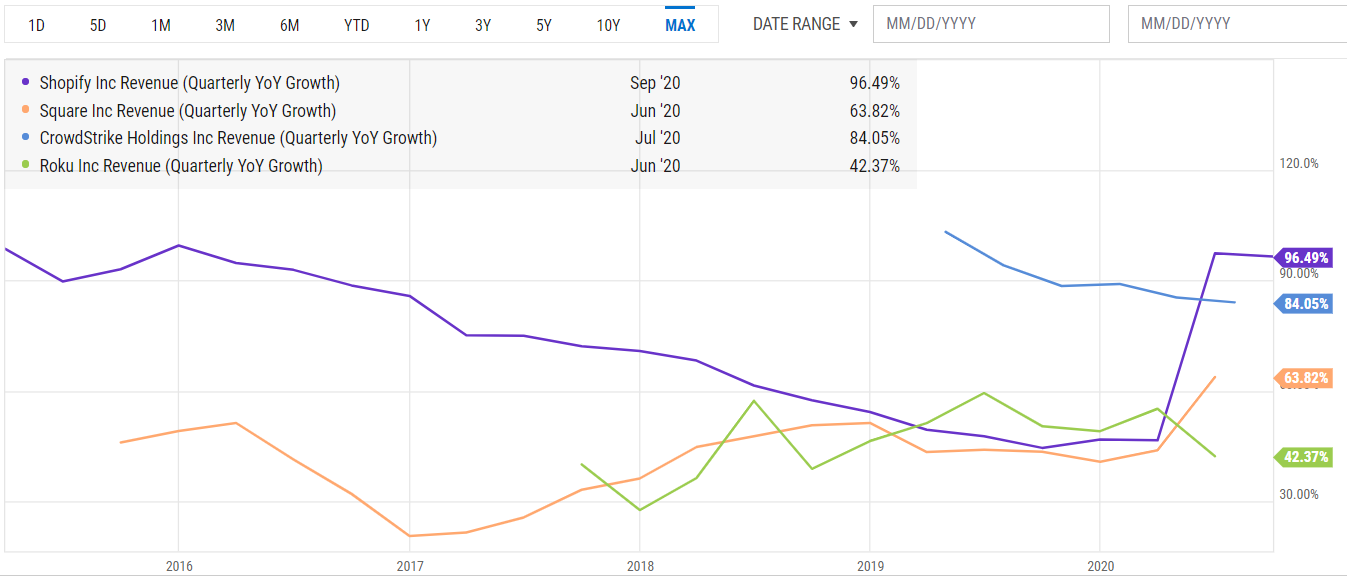

Other popular growth stocks are Square, CrowdStrike, and Roku. And as you can see below, their quarterly revenue growth has been relatively strong.

Shopify, Square, CrowdStrike, and Roku revenue growth

What is value investing?

Value investing is an investment approach that has been advocated by investors like Bill Ackman and Warren Buffett. Ideally, it seeks to maximize returns by investing in cheap companies that they believe will achieve their real intrinsic value in the future.

The idea behind value investing is relatively simple. Just scan the entire market and screen quality companies that have no interest from investors. Invest in it and then hope that interest will return in due time.

A good example of this is Procter & Gamble (PG), a leading company in the fast-moving consumer goods industry. A few years ago, investors sold shares in the company because they believed that its products would be disrupted by new upstarts and e-commerce. They argued that with e-commerce, the firm would not have the edge it had in brick and mortar retail.

As a result, the company’s price-to-earnings ratio dropped, which pushed value investors to accumulate. These investors believed that the shares were cheap and that the company would be able to beat the upstarts. As shown below, the stock has recently recovered and pushed its PE multiple higher.

Procter & Gamble PE and price

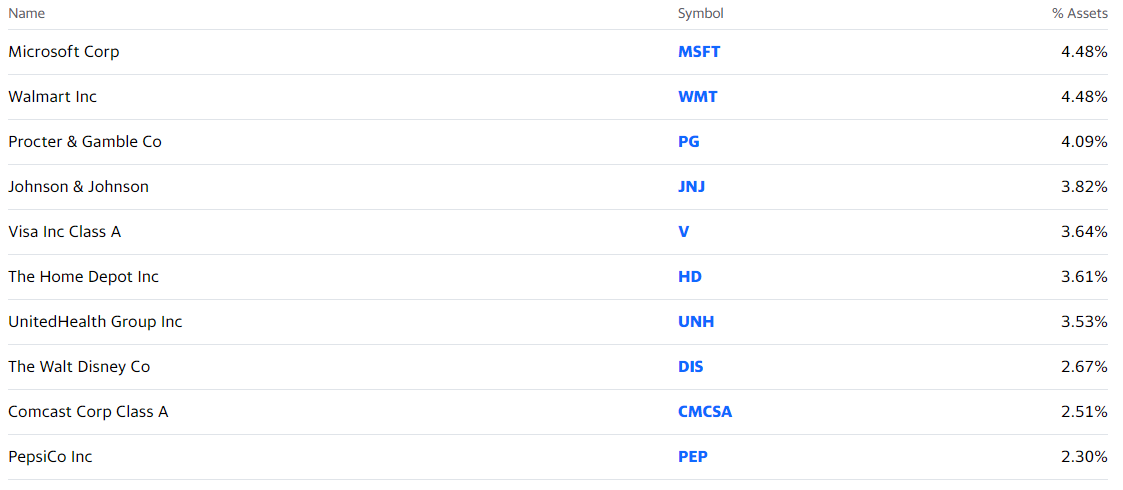

Here are the top holdings in the Vanguard value investing ETF.

Vanguard value investing ETF

Value investors use several approaches to find stocks to invest in:

- Revenue – They look for companies with stable revenue in the past few years.

- Market share – They prefer companies with a strong moat in their industries.

- Profitability – Unlike in growth companies, investors look for companies with high profits.

- Valuation – They look for firms that are reasonably valued. On this, they use various approaches like multiple comparisons and discounted cash flow method (DCF) method.

- Balance sheet and cash flow – They prefer firms with a solid balance sheet and free cash flow.

What is income or dividend investing?

Income or dividend investing is an approach that focuses primarily on dividends. It is relatively similar to value investing since most income stocks pay higher dividends.

In most cases, high dividend stocks are companies that have been in the industry for decades. These companies, which were once growth stocks, usually have little or no growth. However, they compensate for this weakness by having strong free cash flow (FCF) and higher dividend returns.

In dividend investing, investors look for:

- Dividend yield – This refers to the dividend paid compared to the share price. They prefer firms with a higher yield.

- Dividend payout ratio – This term refers to the total dividend paid compared to a company’s income. On this, they prefer companies with a lower ratio.

- Market share and valuation – They look at firms with a substantial market share and a reasonable valuation.

Examples of high-dividend firms are AT&T that has a yield of 7.7%, IBM (5.85%), and Boston Properties. Here are other examples of dividend appreciation stocks.

Vanguard dividend appreciation ETF

Choosing between growth, value vs. income investing

So, which is a better approach to investing: should you give your preference to growth, value, or income stocks? As shown in the first chart, in the past few years, growth investing has outperformed value and income investing by far. That is because of low-interest rates and the fact that some growth companies like Amazon and Facebook have become highly-profitable juggernauts. Therefore, investors believe that smaller growth stocks will become strong in their industries.

Therefore, we recommend that you create three baskets of investments. In the first basket, allocate 60% of your funds to growth stocks either individually or through growth ETFs. In the second basket, allocate about 25% of your funds to value stocks. And in the final basket, invest in dividend stocks.

The advantage of doing this is that you will benefit from the strong share appreciation of the growth stock and dividends paid by income stocks. In times of high volatility, value and dividend stocks can also help to cushion your portfolio performance. That is because growth stocks tend to underperform in periods of high volatility.

Final thoughts

Growth, value, and income investing are the three popular approaches to investing in the stock market. In the long-term, the three approaches tend to do well, as evidenced by the performance of the three main averages – Dow Jones, S&P 500, and Nasdaq. As an investor, you will benefit from creating a blended portfolio that has the three classes of stocks.